In the world of digital transactions, understanding the distinction between a payment gateway and a payment processor is crucial for business success. Unlock your potential by choosing the right tools that streamline payments and enhance customer experiences!

Payment Gateway vs Payment Processor: What Are the Differences?

In today’s digital landscape, where e-commerce is flourishing and online transactions are part of our daily lives, understanding the nuances of how money changes hands has never been more crucial. For businesses venturing into the world of online sales, the terms “payment gateway” and “payment processor” often surface, yet their distinct roles can be confusing. This article will illuminate the vital differences between these two essential components of the payment ecosystem, empowering you to make informed decisions that can enhance your business operations and customer experience. By grasping the functionalities and benefits of each, you’ll not only streamline transactions but also unlock new opportunities for growth and innovation. Join us on this journey to demystify payment solutions and discover how mastering these elements can lead to a more prosperous financial future for your enterprise.

Understanding the Core Concepts of Payment Gateways and Processors

In the world of online transactions, understanding the distinction between payment gateways and payment processors is vital for any business owner or entrepreneur. Both play critical roles in facilitating payments, yet they serve different functions that can significantly impact the user experience and overall efficiency of your payment system.

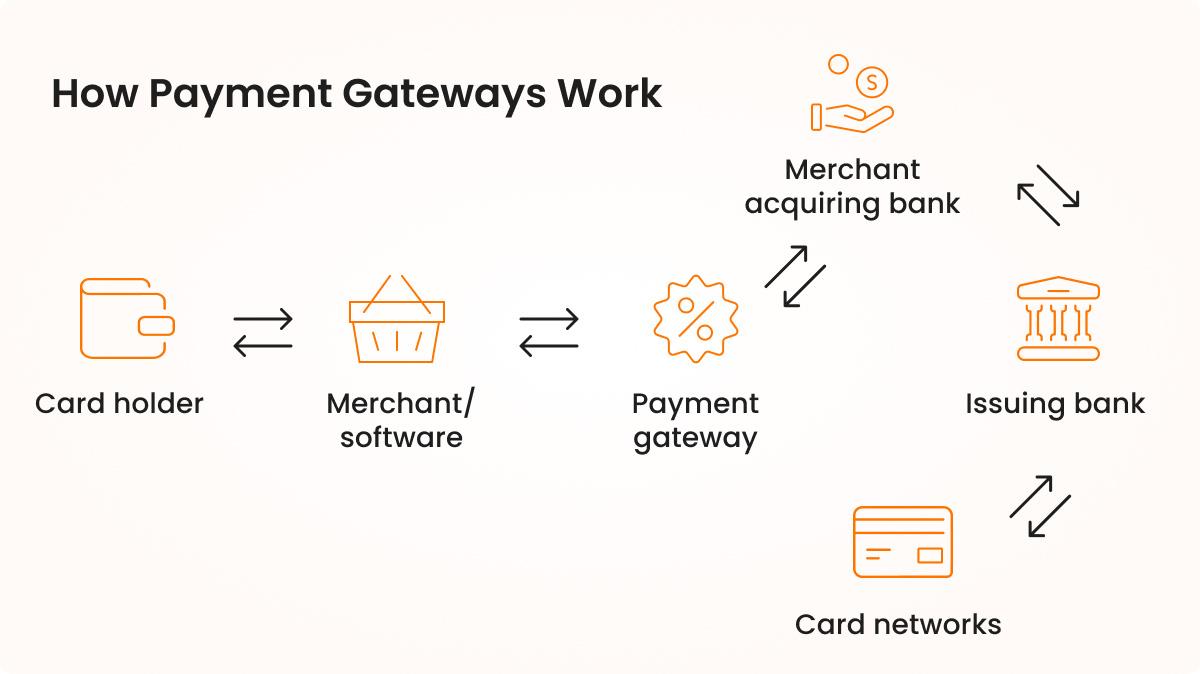

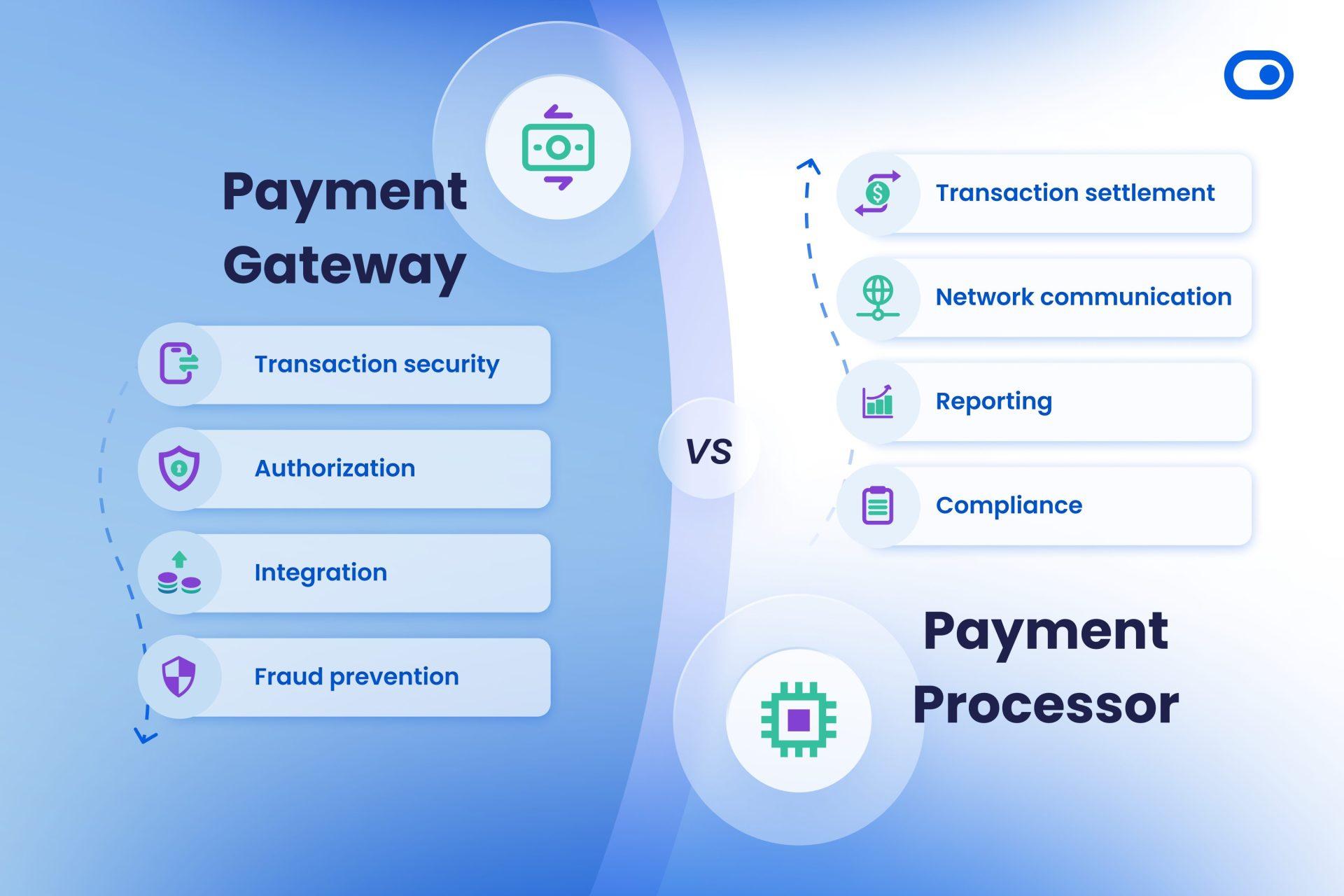

Payment Gateway: A payment gateway acts as the digital equivalent of a point-of-sale terminal in a physical store. It securely transmits customer transactions from the merchant to the payment processor. Here are some of its key features:

- Security: Ensures sensitive information, such as credit card numbers, is encrypted during transmission.

- User Interface: Provides a seamless checkout experience for customers, often customizable to match your brand.

- Support for Multiple Payment Methods: Accepts various payment forms, including credit cards, digital wallets, and more.

Payment Processor: On the flip side, the payment processor is responsible for handling the transaction after it has been authorized by the payment gateway. It manages the flow of money between the customer’s bank and the merchant’s account. Here’s what to consider:

- Transaction Management: Processes the transaction details, facilitating the actual funds transfer.

- Reporting Tools: Often provides analytics and reporting features to help merchants track sales and manage finances.

- Merchant Account: Usually requires a merchant account, which is necessary for processing payments.

To illustrate the differences clearly, consider the following comparison table:

| Feature | Payment Gateway | Payment Processor |

|---|---|---|

| Function | Authorizes transactions | Processes transactions |

| Security | Encrypts customer data | Manages fund transfer |

| User Interaction | Customer-facing | Backend operations |

while both a payment gateway and a payment processor are essential for online transactions, they serve distinct roles within the payment ecosystem. By understanding these differences, businesses can make informed decisions about which services best suit their needs, ensuring a smooth and secure transaction experience for their customers.

Unveiling the Key Differences Between Payment Gateways and Processors

When navigating the world of online transactions, understanding the distinct roles that payment gateways and payment processors play is essential for any business owner. While they often work hand-in-hand to facilitate smooth transactions, their functions are uniquely different and cater to various aspects of the payment process.

Payment Gateways: These are essentially the digital equivalents of point-of-sale terminals found in physical stores. They serve as the interface between the customer and the merchant, securely transmitting transaction data. Here are some key features:

- Security: Payment gateways encrypt sensitive customer information, ensuring data safety during payment processing.

- User Experience: They offer a seamless checkout experience, allowing customers to complete transactions with ease.

- Integration: Payment gateways can easily integrate with various e-commerce platforms and shopping carts, enhancing online store functionality.

Payment Processors: In contrast, payment processors act as the behind-the-scenes facilitators that handle the transaction once a payment is initiated. They communicate with banks and financial institutions to authorize and settle payments. Here’s what sets them apart:

- Transaction Handling: Payment processors manage the technical aspects of payment authorization and settlement.

- Variety of Payment Methods: They allow merchants to accept multiple payment options, from credit cards to digital wallets.

- Fee Structures: Payment processors typically charge fees based on transaction volume, making it crucial for businesses to choose wisely.

To illustrate the differences further, consider the following comparison:

| Feature | Payment Gateway | Payment Processor |

|---|---|---|

| Primary Function | Customer interface for payment submission | Transaction execution and settlement |

| Security | Encrypts customer data | Handles secure transaction transfers |

| Integration | Works with e-commerce platforms | Connects with banks and financial institutions |

| Fees | Typically a flat rate per transaction | Varies based on volume and method |

Ultimately, recognizing these differences empowers business owners to choose the right combination of services that best suit their operational needs. Opting for a reliable payment gateway and an efficient payment processor can lead to enhanced customer satisfaction and improved transaction success rates. As the digital marketplace continues to evolve, staying informed about these critical components will keep your business ahead of the curve.

The Role of Payment Gateways in Securing Online Transactions

In the world of e-commerce, where digital transactions have become the norm, the importance of secure payment gateways cannot be overstated. A payment gateway acts as a bridge between the customer and the merchant, facilitating the transfer of payment information while ensuring that sensitive data remains protected. By encrypting transaction details, these gateways safeguard against potential fraud, making them a vital component for any online business.

Key functions of payment gateways include:

- Data Encryption: Payment gateways utilize advanced encryption protocols to protect customer data during online transactions, ensuring that sensitive information is not intercepted by malicious actors.

- Authorization: They verify the legitimacy of transactions by checking with the issuing bank, confirming whether the customer has sufficient funds or credit to complete the purchase.

- Fraud Detection: Many payment gateways come equipped with fraud prevention tools, using algorithms to identify unusual patterns and flag potentially fraudulent transactions before they are processed.

- Seamless Integration: These gateways can easily integrate with various e-commerce platforms, allowing businesses to provide a smooth checkout experience for their customers.

Security is paramount in the digital age, and a reliable payment gateway not only provides peace of mind but also builds trust with customers. When users feel confident that their payment information is secure, they are more likely to complete a purchase. This trust can significantly impact conversion rates and overall sales volume, making the choice of payment gateway a critical business decision.

The benefits extend beyond just security. Payment gateways also facilitate a variety of payment methods, accommodating customer preferences whether they prefer credit cards, debit cards, or digital wallets. This flexibility can enhance customer satisfaction and loyalty, as consumers appreciate having options that fit their payment habits.

When selecting a payment gateway, businesses should consider several factors, including transaction fees, compatibility with existing systems, and the level of customer support provided. The right gateway can not only secure transactions but also streamline operations and enhance the user experience.

| Feature | Payment Gateway | Payment Processor |

|---|---|---|

| Data Security | Yes, encrypts data | No, focuses on transaction processing |

| Transaction Authorization | Yes, verifies funds | Yes, processes payments |

| Fraud Prevention | Includes fraud detection tools | No, primarily transactional |

| Integration Ease | High, with various platforms | Moderate, linked to specific gateways |

choosing the right payment gateway is essential for securing online transactions and fostering a trustworthy relationship with customers. Not only do these gateways protect sensitive information, but they also enhance the overall shopping experience, encouraging customers to return time and again.

How Payment Processors Streamline Your Payment Operations

In today’s fast-paced digital environment, managing payment operations can be a complex endeavor. Payment processors play a crucial role in simplifying this complexity by providing a seamless bridge between merchants and financial institutions. By utilizing advanced technology and infrastructure, these processors facilitate transactions efficiently and securely.

Enhanced Efficiency

Payment processors automate various steps in the transaction process, reducing manual input and minimizing errors. This automation not only speeds up operations but also ensures that merchants can focus more on their core business activities without being bogged down by payment logistics. As a result, businesses can process payments quickly, enhancing the overall customer experience.

Secure Transactions

Another vital feature of payment processors is their commitment to security. They employ state-of-the-art encryption and fraud detection systems to protect sensitive payment information. This layer of security not only builds trust with customers but also protects businesses from potential financial losses due to fraudulent transactions.

Comprehensive Reporting Tools

Most payment processors offer robust reporting tools that provide insights into transaction trends, customer behavior, and sales performance. These tools enable businesses to make data-driven decisions, optimize their marketing strategies, and ultimately boost revenue. By having access to real-time data, merchants can identify opportunities for growth and innovation.

Flexible Payment Options

Payment processors support a variety of payment methods, allowing businesses to cater to diverse customer preferences. Whether it’s credit cards, debit cards, e-wallets, or even cryptocurrencies, the flexibility in payment options ensures that customers can transact in a way that’s most convenient for them. This variety not only enhances customer satisfaction but also helps businesses capture a broader audience.

Integration with Other Platforms

Payment processors often come equipped with the ability to integrate with various e-commerce platforms, accounting software, and customer relationship management (CRM) systems. This integration simplifies workflows and creates a cohesive ecosystem, enabling businesses to manage their operations more effectively. With everything interconnected, data flows seamlessly across platforms, providing a more organized approach to managing finances.

Global Reach

For businesses looking to expand their reach, payment processors offer solutions that facilitate international transactions. They handle currency conversions and ensure compliance with regional regulations, allowing merchants to tap into global markets without the headaches of navigating complicated payment systems. This global capability opens new avenues for revenue and growth.

Choosing the Right Payment Gateway for Your Business Needs

When it comes to selecting a payment gateway that aligns with your business goals, several factors demand your attention. First and foremost, you need to understand the specific needs of your business. Are you a small startup looking for basic functionalities, or a large enterprise requiring advanced features? Identifying your requirements can help narrow down your options.

Next, consider the transaction fees and pricing structures associated with different gateways. Some providers charge a flat rate per transaction, while others may implement a tiered pricing model. It’s essential to calculate the projected costs based on your sales volume to avoid any surprises down the road.

Another crucial aspect is the security measures offered by the payment gateway. Look for features such as PCI compliance, fraud detection, and encryption technologies. With the increasing prevalence of cyber threats, ensuring the safety of your customers’ data should be a top priority.

Additionally, examine the supported payment methods. A comprehensive gateway should enable various payment options, including credit cards, digital wallets, and even cryptocurrencies. The more payment methods you offer, the easier it is for customers to complete their purchases, enhancing their overall shopping experience.

Don’t overlook the importance of integration capabilities. Your chosen gateway should seamlessly integrate with your existing e-commerce platform, accounting software, and other business tools. This ensures a smooth workflow and minimizes the chances of errors in transaction processing.

Lastly, consider the level of customer support provided. Having reliable support can make a significant difference, especially when you encounter technical issues or require assistance with setup. Look for gateways that offer 24/7 support through various channels, such as phone, email, or live chat.

| Key Features | Considerations |

|---|---|

| Transaction Fees | Understand pricing models and calculate costs. |

| Security Features | Ensure protection against data breaches. |

| Payment Methods | Offer diverse options to enhance customer convenience. |

| Integration | Smooth integration with existing systems is crucial. |

| Customer Support | Reliable support is essential for resolving issues. |

The Importance of Integration: Payment Gateways and Processors Working Together

In the world of e-commerce, the seamless flow of transactions is paramount to success. While both payment gateways and processors play critical roles in this ecosystem, their true potential is unlocked when they work in harmony. Integration between these two components ensures that the payment experience is not only smooth but also secure, providing customers with confidence in their transactions.

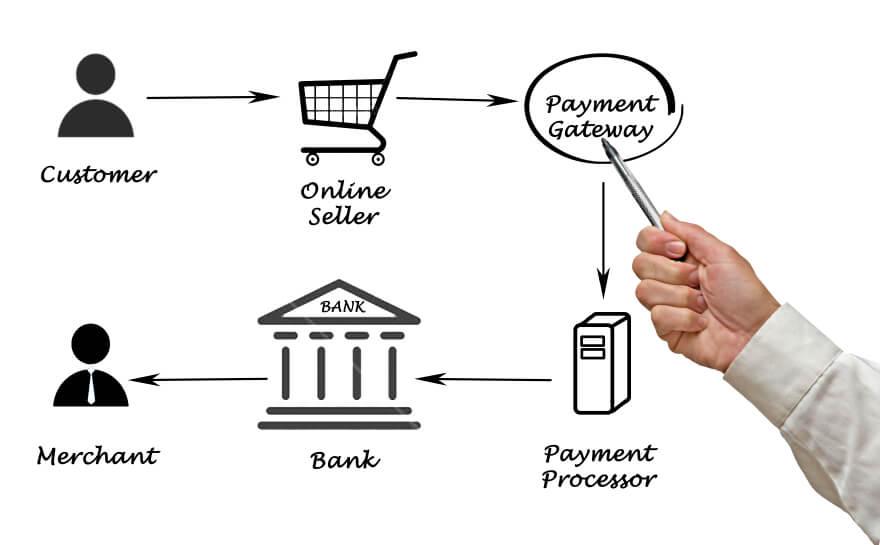

When a customer makes a purchase online, the journey begins with the payment gateway. This is the first point of contact, acting as the bridge between the merchant’s website and the payment processor. The gateway encrypts sensitive information such as credit card details, creating a secure channel for data to travel. Without this layer of protection, businesses would expose themselves to significant risks, including data breaches and fraud.

Once the payment information has been securely transmitted, the payment processor takes over, handling the intricate details of authorizations, settlements, and fund transfers. A well-integrated payment processor ensures that transactions are processed quickly and efficiently, minimizing delays that could lead to abandoned carts. Key benefits of effective integration between payment gateways and processors include:

- Enhanced Security: By working together, they create a multi-layered security framework that keeps customer data safe.

- Faster Transactions: Streamlined processes reduce the time taken from payment initiation to completion.

- Improved User Experience: Customers enjoy a hassle-free checkout process, leading to higher conversion rates.

- Comprehensive Reporting: Integrated systems provide detailed insights into sales, refunds, and customer behavior, enabling smarter business decisions.

Moreover, the integration of payment gateways and processors can also facilitate a variety of payment methods. Today’s consumers demand flexibility, from credit cards to digital wallets. By leveraging the strengths of both components, businesses can cater to diverse preferences, thereby expanding their customer base. This adaptability can be a game-changer in a competitive landscape.

To visualize the collaboration between payment gateways and processors, consider the following table that simplifies their functions and the integration benefits:

| Component | Function | Integration Benefits |

|---|---|---|

| Payment Gateway | Encrypts and forwards payment information | Enhanced security and trust |

| Payment Processor | Handles transaction authorization and settlement | Faster transactions and improved user experience |

the synergy between payment gateways and processors is not just beneficial but essential for any business aiming to thrive in the digital marketplace. By investing in robust integration, companies can create a powerful payment infrastructure that enhances security, improves efficiency, and ultimately drives sales. Embracing this integrated approach positions businesses for sustainable growth in a rapidly evolving financial landscape.

Enhancing Customer Experience Through Effective Payment Solutions

In today’s fast-paced digital landscape, providing a seamless customer experience is paramount, and choosing the right payment solution plays a crucial role in that journey. Understanding the difference between a payment gateway and a payment processor can significantly impact how smoothly transactions flow, ultimately enhancing customer satisfaction.

Payment Gateways serve as the bridge between the customer and the merchant’s account. They ensure that sensitive information, such as credit card details, is securely transmitted for authorization. A robust payment gateway provides:

- Security: Advanced encryption methods protect customer data, fostering trust.

- Speed: Quick transaction approvals lead to faster checkouts, reducing cart abandonment.

- Integration: Compatibility with various eCommerce platforms enhances operational efficiency.

On the other hand, Payment Processors handle the transactions behind the scenes. They are responsible for the actual movement of funds between the customer’s bank and the merchant’s account. Their features include:

- Transaction Management: Easy tracking and reporting of sales data help merchants make informed decisions.

- Support for Multiple Payment Methods: Accepting various payment types caters to diverse customer preferences.

- Fee Transparency: Clear pricing structures help businesses budget effectively without hidden costs.

| Feature | Payment Gateway | Payment Processor |

|---|---|---|

| Function | Facilitates secure transactions | Moves money between accounts |

| Customer Interaction | Visible during checkout | Behind the scenes |

| Security | Encrypts data | Ensures compliance |

By integrating both a payment gateway and a payment processor, businesses can streamline their operations and provide an experience that resonates with their customers. The synergy between these two components not only enhances security and efficiency but also builds a foundation of trust, encouraging repeat purchases and customer loyalty.

Ultimately, investing time in understanding these services can lead to a more pleasant shopping experience for customers, setting your business apart in a competitive market. In an era where convenience is king, having the right payment solutions can make all the difference.

The Cost Factor: Comparing Fees and Charges of Gateways and Processors

When it comes to selecting the right payment solution for your business, understanding the cost implications is crucial. Both payment gateways and processors come with their own set of fees, which can vary significantly based on the provider and the services included. By digging deeper into these costs, you can make an informed choice that aligns with your business goals.

Payment gateways typically charge a variety of fees, including:

- Setup Fees: One-time fees for initial account creation.

- Monthly Fees: Recurring charges for maintaining the service.

- Transaction Fees: Costs incurred per transaction processed.

- Chargeback Fees: Penalties applied when a customer disputes a charge.

On the other hand, payment processors often have their own unique fee structures that can include:

- Per-Transaction Fees: Charges for each transaction completed.

- Batch Fees: Costs associated with settling transactions at the end of the day.

- Monthly Gateway Fees: Sometimes bundled with payment processing services.

- Interchange Fees: Fees set by card networks that processors pass on to merchants.

| Fee Type | Payment Gateway | Payment Processor |

|---|---|---|

| Setup Fees | Often charged | Rarely applicable |

| Monthly Fees | Common | Usually minimal |

| Transaction Fees | Varies widely | Typically lower |

| Chargeback Fees | Yes | Yes |

As you weigh your options, keep in mind that while lower transaction fees might seem appealing, they can sometimes come with hidden costs like monthly fees or chargeback penalties. Therefore, it’s essential to consider the total cost of ownership. A payment gateway with a slightly higher transaction fee might provide better support, enhanced security features, or more integrations, ultimately saving you money and effort in the long run.

Investing time to understand these fees and charges will empower you to choose the right payment solution that not only fits your budget but also supports your growth aspirations. The right choice can significantly impact your bottom line, enhancing customer satisfaction and boosting your revenue potential.

Security Matters: Ensuring Safe Transactions with the Right Tools

In today’s digital landscape, ensuring the security of financial transactions is not just an option; it’s a necessity. Businesses and consumers alike need to be aware of the tools available to protect their sensitive information. Understanding the distinctions between a payment gateway and a payment processor is crucial for anyone looking to enhance their transaction security.

A payment gateway serves as the first line of defense in online transactions. It acts as a bridge between the customer and the merchant, securely capturing and transmitting payment data. Here are some key functions of a payment gateway:

- Encryption: Protects sensitive data by converting it into a secure format.

- Authorization: Ensures that the funds are available in the customer’s account before proceeding with the transaction.

- Fraud Detection: Monitors transactions for suspicious activity, reducing the risk of fraud.

On the other hand, a payment processor is responsible for handling the transaction once it has been authorized. This includes forwarding the transaction details to the bank for approval and processing the payment. Here are some essential roles played by a payment processor:

- Settlement: Manages the transfer of funds from the customer’s account to the merchant.

- Reporting: Provides insights into transaction history and analytics for better financial management.

- Chargeback Management: Handles disputes and returns, ensuring that both customers and merchants are protected.

When selecting the right tools, businesses should consider integrating both a payment gateway and a payment processor into their operations. This combination not only streamlines transactions but also fortifies the security of customer data. To illustrate the differences further, here’s a quick comparison:

| Feature | Payment Gateway | Payment Processor |

|---|---|---|

| Primary Function | Securely captures transaction data | Processes and settles transactions |

| Security Role | Encryption and fraud detection | Transaction management and reporting |

| Integration | Works with e-commerce platforms | Connects with banks and financial institutions |

Choosing the right combination of a payment gateway and processor is essential for fostering trust with your customers. A secure transaction process not only protects sensitive data but also enhances the overall user experience. By investing in these tools, businesses can demonstrate their commitment to safeguarding customer information, ultimately leading to increased customer satisfaction and loyalty.

Scalability and Flexibility: Adapting Your Payment Solutions as You Grow

As businesses evolve, their payment needs inevitably change. Choosing the right payment solution from the start can significantly impact your ability to scale. A robust payment gateway paired with a reliable payment processor allows you to adapt seamlessly as your operations grow.

Scalability is crucial for any business model. When your customer base expands, so does the volume of transactions. A flexible payment solution ensures that you can handle increased traffic without hiccups. Here are some key factors to consider:

- Transaction Volume: Ensure your payment processor can handle high volumes without delays.

- Multi-Currency Support: As you reach international markets, supporting various currencies becomes vital.

- API Integration: Look for solutions that can integrate with existing systems or third-party applications to enhance functionality.

Another essential aspect is flexibility. Your business may pivot or explore new revenue streams, and your payment solutions should be able to pivot with you. Consider the following:

- Customization Options: Choose a solution that allows for personalized payment pages or checkout experiences.

- Payment Method Variety: Support for multiple payment methods (credit cards, digital wallets, etc.) caters to diverse customer preferences.

- Recurring Payments: If you’re moving towards subscriptions or memberships, ensure your processor can handle automated billing.

| Feature | Payment Gateway | Payment Processor |

|---|---|---|

| Transaction Security | High | Moderate |

| Speed of Transactions | Fast | Variable |

| Integration Capability | Extensive | Limited |

Ultimately, a well-chosen payment gateway and processor not only enhance customer experiences but also position your business for future growth. The right tools empower you to focus on scaling your operations rather than worrying about payment logistics. Embrace technology that adapts, and watch your business thrive in an ever-changing marketplace.

Navigating Compliance: Understanding Regulations for Payment Solutions

The landscape of payment solutions is continually evolving, making it essential for businesses to stay informed about the regulatory requirements surrounding payment gateways and payment processors. Understanding these regulations is crucial not only for compliance but also for maintaining customer trust and ensuring secure transactions. The differences between a payment gateway and a payment processor can further complicate compliance, but a clear comprehension of these roles can guide businesses toward effective solutions.

Payment Gateways: These are the digital interfaces that facilitate online transactions. They act as the intermediary between a customer’s bank and the merchant’s account, securely transmitting transaction data. Compliance regulations for payment gateways often include:

- PCI DSS Compliance: Payment gateways must adhere to the Payment Card Industry Data Security Standard, which mandates strict guidelines for handling cardholder data.

- Data Encryption: Regulations require that sensitive information, such as credit card numbers, is encrypted during transmission to prevent fraud.

- Fraud Monitoring: Gateways are often required to implement systems to detect and prevent fraudulent transactions.

Payment Processors: Unlike gateways, payment processors are responsible for handling the transaction itself, communicating with the bank to authorize and complete payments. Compliance for processors includes:

- Regulatory Oversight: Payment processors must comply with local and international laws regulating financial transactions.

- Transaction Reporting: Many jurisdictions require processors to report transaction data to help combat money laundering and other illicit activities.

- Consumer Protection Laws: Processors are often subject to laws that protect consumers, ensuring that they are treated fairly during transactions.

To illustrate the differences more clearly, consider the following table:

| Aspect | Payment Gateway | Payment Processor |

|---|---|---|

| Function | Facilitates transaction initiation | Handles transaction completion |

| Compliance Focus | Data security & encryption | Regulatory laws & consumer protection |

| Role in Transaction | Connects merchant & customer | Processes payment through financial institutions |

Being aware of these compliance requirements enables businesses to choose the right partners for their operations. Selecting compliant payment solutions not only safeguards your business but also builds lasting relationships with your customers by prioritizing their security and privacy. In this rapidly changing digital world, staying compliant and informed is not just a necessity; it’s an opportunity to differentiate your business as a trusted provider of payment solutions.

Future Trends in Payment Technology: What to Watch For

As we navigate through the ever-evolving landscape of financial technology, several trends are poised to reshape the way businesses and consumers approach payments. Staying ahead in this realm requires understanding these innovations and their potential impact on everyday transactions.

Contactless Payments have gained immense popularity, especially in the wake of the pandemic. Consumers are increasingly drawn to the convenience and speed of tap-and-go transactions. Businesses should consider implementing NFC (Near Field Communication) technologies to enhance customer experience. With the rise of digital wallets like Apple Pay and Google Wallet, the shift towards contactless methods is undeniable and will continue to gain traction.

Cryptocurrency Integration is another trend to watch. As digital currencies become more mainstream, businesses that adapt by integrating cryptocurrency payment options can attract a new demographic of tech-savvy consumers. Implementing a payment processor that supports cryptocurrencies can open doors to international markets and provide a competitive edge. The volatility of cryptocurrencies remains a concern, but their potential for low transaction fees and fast processing times makes them appealing.

Artificial Intelligence (AI) is transforming payment security. AI algorithms can analyze transaction patterns in real-time, significantly reducing the risk of fraud. Businesses that leverage AI-driven payment processors can not only enhance security but also streamline the checkout process through personalized customer experiences. By predicting consumer behaviors, businesses can tailor their offerings effectively, driving higher sales and customer loyalty.

Subscription-based Models are becoming increasingly favorable as customers seek flexibility. Payment gateways that facilitate recurring billing enable businesses to offer subscription services with ease. This trend reflects a shift towards a more predictable revenue model, providing stability for businesses and convenience for consumers.

| Payment Technology Trend | Impact on Businesses | Consumer Benefits |

|---|---|---|

| Contactless Payments | Increased sales with faster checkouts | Convenience and safety |

| Cryptocurrency | Access to global markets | Lower transaction fees |

| AI in Security | Reduced fraud loss | Enhanced transaction safety |

| Subscription Models | Predictable revenue stream | Flexible payment options |

the future of payment technology is bright and filled with opportunities. By aligning with these trends and embracing innovative solutions, businesses can not only enhance their operational efficiency but also create lasting relationships with their customers. The journey toward a more seamless and secure payment ecosystem is just beginning, and those who adapt early will undoubtedly lead the way.

Making the Right Choice: A Comprehensive Guide to Selecting Your Payment Partner

Choosing the right payment partner is crucial for the success of your business. It’s not just about processing transactions; it involves ensuring a seamless customer experience and maintaining security. Understanding the distinction between a payment gateway and a payment processor is essential, as both play different roles in the transaction process.

Understanding the Roles

A payment gateway acts as the interface between your customer’s bank and your business. It is responsible for securely capturing and transmitting transaction details to the processor. Think of it as the electronic equivalent of a point-of-sale terminal. On the other hand, a payment processor handles the transactions after they are initiated. It communicates with the customer’s bank to authorize and settle payments. This separation of roles is vital in streamlining operations and ensuring efficiency.

Key Features to Consider

When evaluating your options, focus on the following features:

- Security: Look for partners that offer robust encryption and comply with PCI DSS standards.

- Integration: Ensure the gateway and processor can integrate seamlessly with your existing systems.

- Fees: Compare transaction fees, monthly fees, and any hidden charges.

- Customer Support: Opt for providers that offer 24/7 support to assist during potential issues.

Comparative Analysis

| Feature | Payment Gateway | Payment Processor |

|---|---|---|

| Function | Captures payment information | Handles transaction authorization |

| Security Level | High (encryption) | High (bank-level security) |

| Speed | Instant (for customer) | Varies (based on bank) |

| Typical Users | Online retailers | All businesses |

Making the Right Choice

Ultimately, the right payment partner depends on your specific business needs. Assess your transaction volume, preferred payment methods, and growth plans. A well-suited payment gateway and processor can propel your business forward, ensuring that every transaction is smooth, secure, and efficient.

Empowering Your Business with Smart Payment Solutions for Success

In the dynamic landscape of digital commerce, understanding the tools that facilitate transactions is crucial for your business’s success. At the heart of every online payment lies two essential components: the payment gateway and the payment processor. While they often intertwine, distinguishing between the two can empower you to make informed decisions that align with your business goals.

Payment Gateway: Think of this as your online cashier, a digital interface that securely authorizes and processes payments by capturing customer details and transaction information. It serves as a bridge between your website and the financial institutions involved in the transaction, ensuring sensitive data is encrypted and transmitted safely.

Payment Processor: This entity handles the actual transaction approval, working behind the scenes to communicate with the banks and moving money from the customer’s account to your merchant account. The processor is responsible for validating the payment details and ensuring that funds are available, playing a critical role in the transaction lifecycle.

| Aspect | Payment Gateway | Payment Processor |

|---|---|---|

| Function | Authorizes payments | Moves funds |

| Security | Encrypts data | Manages transaction risk |

| Integration | Website integration | Merchant account integration |

When choosing a payment solution, consider the following key factors:

- Transaction Costs: Understanding the fees associated with each component can help you budget effectively and select solutions that maximize your profit margins.

- Compatibility: Ensure that your chosen gateway and processor work seamlessly together to enhance your customer experience.

- Support and Reliability: Opt for providers that offer robust support and have a reputation for reliability, as any downtime can directly impact your revenue.

By grasping the distinct roles of payment gateways and processors, you position your business to select solutions that not only streamline transactions but also enhance customer trust and satisfaction. Investing in the right combination of these tools can pave the way for a successful e-commerce presence and empower your business to thrive in a competitive market.

Frequently Asked Questions (FAQ)

Q&A: Payment Gateway vs Payment Processor: What Are the Differences?

Q1: What is a payment gateway, and why is it essential for my business?

A1: A payment gateway is a technology that facilitates the transfer of payment information between your customer and the payment processor. It acts as the bridge that ensures secure and smooth transactions. Think of it as a digital vault where sensitive payment information is encrypted and safely transmitted. For your business, having a reliable payment gateway is crucial because it enhances customer trust, reduces cart abandonment, and ultimately drives sales. In today’s digital landscape, investing in a robust payment gateway is not just an option; it’s a necessity for growth and security.

Q2: What role does a payment processor play in the transaction journey?

A2: A payment processor is the financial institution or service that handles the transaction once the payment information has been captured by the payment gateway. It communicates with the customer’s bank (or card issuer) to authorize the transaction, ensuring that funds are transferred securely and efficiently. The payment processor is the backbone of your payment system, making it possible for you to receive funds from your customers. Without it, your business wouldn’t be able to accept credit or debit card payments, limiting your sales potential.

Q3: Can you explain the key differences between a payment gateway and a payment processor?

A3: Certainly! The key difference lies in their functions: the payment gateway is all about capturing and transmitting payment data securely, while the payment processor manages the actual transaction and the movement of funds. To visualize it, you might think of the payment gateway as a digital cashier that collects the money and the payment processor as the bank that handles the deposit. Both are essential for a seamless transaction experience, but they serve different, equally important roles in the payment ecosystem.

Q4: How do I choose the right payment gateway and processor for my business?

A4: Choosing the right payment gateway and processor is pivotal for your business success. Start by assessing your business needs: consider the types of payments you want to accept, your customer demographics, and the volume of transactions. Look for solutions that offer competitive fees, robust security features, and excellent customer support. Integration capabilities with your existing systems should also be a priority. Remember, the right combination can streamline your operations, enhance customer satisfaction, and position your business for future growth.

Q5: Is it possible to use the same provider for both payment gateway and processor?

A5: Absolutely! Many businesses opt for a single provider that offers both services, simplifying the transaction process and reducing integration headaches. This can lead to smoother operations, better pricing packages, and unified customer support. However, it’s essential to evaluate each provider’s strengths in both areas. A one-stop-shop could be beneficial, but the ultimate goal is to ensure that you’re getting the best service and security for your unique business needs.

Q6: What should I consider regarding security in payment gateways and processors?

A6: Security is paramount in handling financial transactions. Look for gateways and processors that are PCI DSS compliant, as this ensures they meet the highest security standards for processing card payments. Features such as encryption, tokenization, and fraud detection tools are critical in safeguarding your customers’ sensitive information. Prioritizing security not only protects your business from potential data breaches but also builds trust with your customers, making them feel safe and valued.

Q7: How can understanding these differences empower my business?

A7: Understanding the differences between a payment gateway and a payment processor empowers you to make informed decisions that can significantly impact your business operations. With this knowledge, you can select the right tools to enhance customer experience, improve transaction efficiency, and reduce costs. Ultimately, equipping your business with the right payment solutions sets the stage for growth, innovation, and a rewarding journey in the ever-evolving digital marketplace. Embrace this knowledge, and watch your business thrive!

To Wrap It Up

In the ever-evolving landscape of digital transactions, understanding the nuances between a payment gateway and a payment processor is not just important—it’s essential for anyone looking to thrive in the world of online commerce. As you embark on your journey to elevate your business, remember that making informed choices about your payment infrastructure can significantly impact your customer experience, operational efficiency, and ultimately, your bottom line.

Embrace the power of knowledge to navigate these critical components of financial technology. By recognizing the distinct roles they play, you can tailor your approach to meet the unique needs of your business and your customers. Whether you’re a small startup or an established enterprise, investing time in understanding these differences will empower you to select the best solutions that drive growth and innovation.

So, take the next step with confidence! Equip yourself with the insights you’ve gained and transform your payment processes into a seamless, secure, and customer-friendly experience. As you move forward, remember that the right payment strategy is not just a choice; it’s a cornerstone of your success in the digital age. Let your journey begin today, and watch as the possibilities unfold!