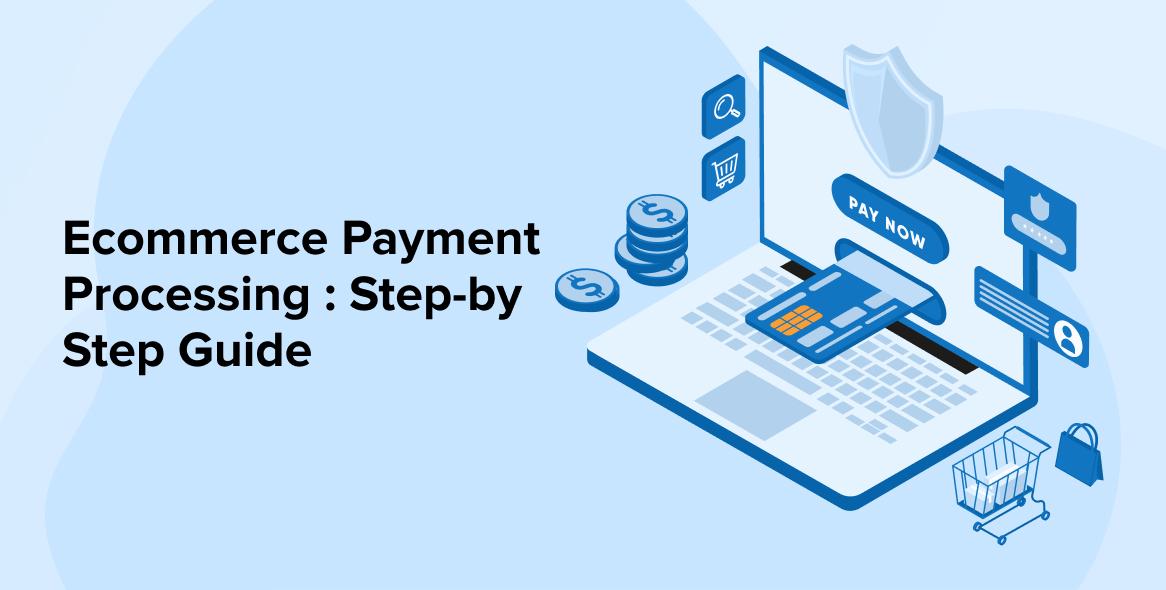

Looking to streamline your online sales? Our Ecommerce Payment Processing Guide unveils the top 7 services that can elevate your business. From secure transactions to seamless integration, discover how the right choice can boost your sales and customer satisfaction!

Ecommerce Payment Processing Guide: Top 7 Services and More

Are you ready to unlock the true potential of your online business? If you’re diving into the world of eCommerce, one of the most crucial decisions you’ll make is how to process payments. Trust us—choosing the right payment processing service can be the difference between a smooth, seamless transaction and a frustrating roadblock that sends potential customers packing. In this guide, we’ll walk you through the top seven payment processing services that can elevate your eCommerce game. Whether you’re a seasoned seller or just starting out, we’ll cover everything you need to know to make informed decisions, streamline your checkout process, and boost your sales. Let’s get started on making your online store as efficient and customer-friendly as possible!

Understanding the Basics of Ecommerce Payment Processing

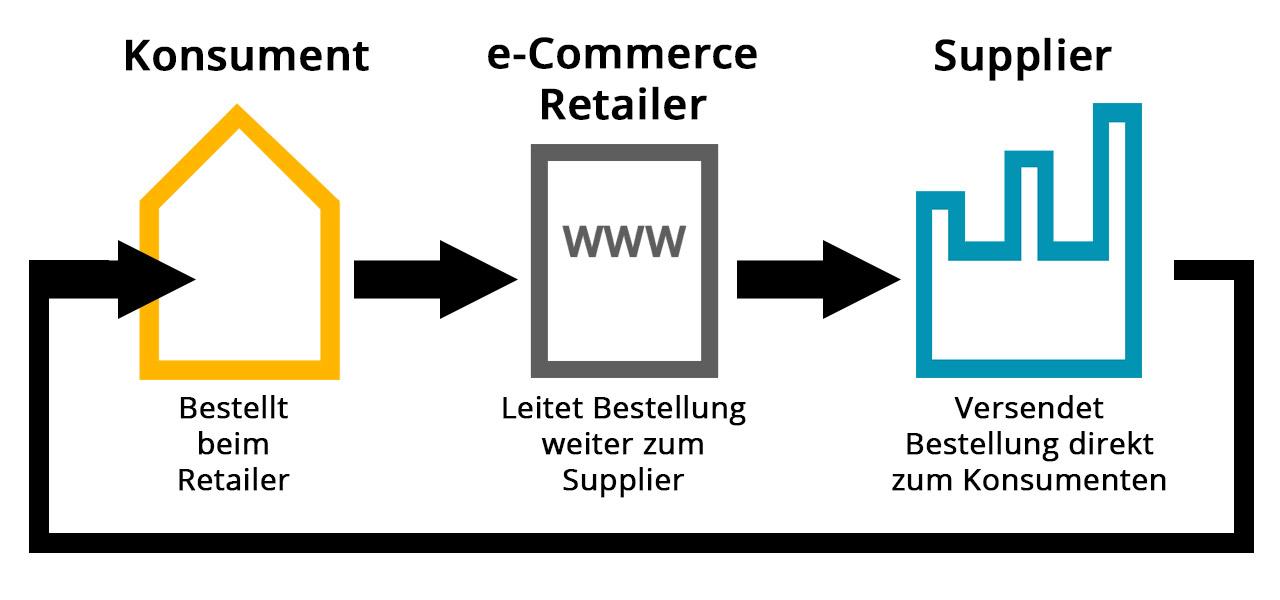

When it comes to running an online store, understanding how payment processing works is crucial. This system is the backbone of any ecommerce business, allowing you to securely receive payments from customers while providing them with a hassle-free shopping experience. Essentially, payment processing involves a series of steps that facilitate a transaction between a buyer and a seller.

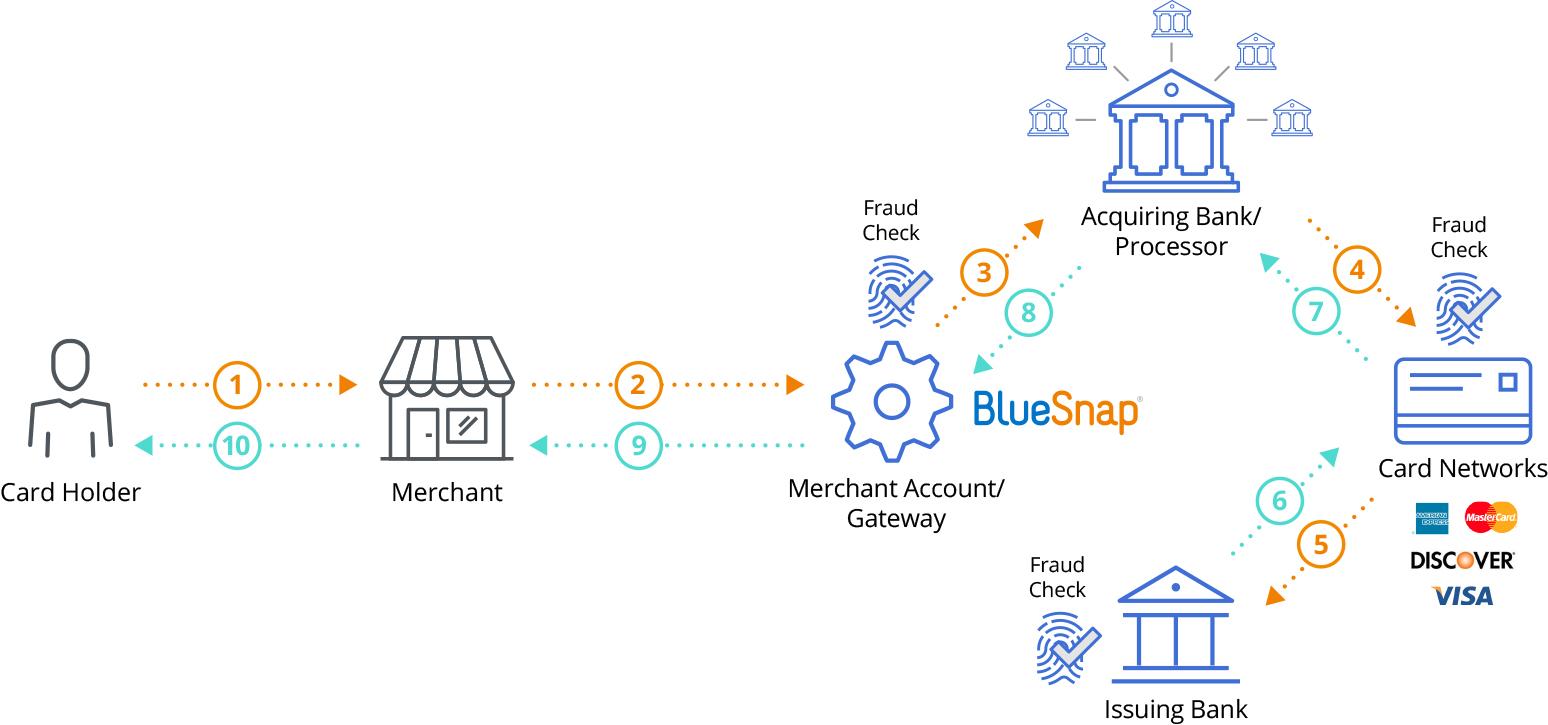

At its core, payment processing can be broken down into a few key components:

- Payment Gateway: This is the technology that captures and transfers payment data from the customer to the merchant’s bank. Think of it as a virtual point-of-sale terminal.

- Merchant Account: This is a special bank account that allows businesses to accept payments via credit and debit cards. It acts as an intermediary between the bank and your ecommerce platform.

- Payment Processor: This entity handles the transaction processes, including the verification of funds and transferring money from the customer’s account to the merchant account.

Each of these components plays a significant role in ensuring that transactions are smooth and secure. When a customer decides to make a purchase, they enter their payment information, which is then encrypted and sent to the payment gateway. From there, the gateway communicates with the payment processor, which verifies the transaction with the bank. Once approved, the funds are transferred to the merchant account, completing the process.

Security is a paramount concern in any ecommerce transaction. To safeguard sensitive information, businesses must comply with industry standards such as the Payment Card Industry Data Security Standard (PCI DSS). This ensures that all payment data is handled securely, reducing the risk of fraud and identity theft.

Choosing the right payment processing service is vital for your ecommerce success. Consider factors such as:

- Transaction fees

- Types of payment accepted (credit cards, PayPal, etc.)

- Integration capabilities with your ecommerce platform

- Customer support and service reliability

As you explore your options, you may want to compare different services. The table below provides a quick overview of some popular payment processing services to consider:

| Service | Transaction Fees | Payment Methods | Best For |

|---|---|---|---|

| PayPal | 2.9% + $0.30 | Credit/Debit Cards, PayPal | Small to Medium Businesses |

| Stripe | 2.9% + $0.30 | Credit/Debit Cards, ACH Transfers | Developers and Tech-Savvy Stores |

| Square | 2.6% + $0.10 | Credit/Debit Cards, Cash App | Retail and Local Businesses |

By understanding these components and considerations, you’ll be well-equipped to choose the best payment processing solution for your ecommerce business. The right choice can enhance customer trust, streamline transactions, and ultimately boost your sales.

Choosing the Right Payment Gateway for Your Business

When it comes to selecting a payment gateway for your eCommerce business, the options can seem overwhelming. However, making the right choice is crucial to your success. A payment gateway is not just a tool for processing transactions; it plays a vital role in shaping your customers’ shopping experience and influencing their decision to complete a purchase.

Here are some key factors to consider when choosing a payment gateway:

- Transaction Fees: Every payment gateway charges a fee for processing transactions, often a percentage of the sale plus a fixed amount. Compare different services to find one that fits your budget while ensuring it offers the features you need.

- Payment Methods: Make sure the payment gateway supports a variety of payment methods, including credit cards, debit cards, and mobile wallets. This flexibility can increase your conversion rates.

- Security Features: Look for gateways that are PCI compliant and offer fraud detection measures. Your customers need to trust that their sensitive information is safe when they shop with you.

- Integration Ease: Choose a gateway that seamlessly integrates with your existing eCommerce platform. A complicated setup can lead to delays and frustration.

- Customer Support: Reliable customer service is a must. Ensure your chosen gateway offers 24/7 support to help you navigate any issues that may arise.

Additionally, consider the following attributes that can enhance your eCommerce operations:

- Multi-Currency Support: If you plan to sell internationally, a gateway that can handle multiple currencies will make the transaction process much smoother for your customers.

- Mobile Optimization: With the rise of mobile shopping, ensure that your payment gateway is optimized for mobile devices, providing a seamless experience for users on smartphones and tablets.

- Recurring Billing: If you offer subscription services, look for a gateway that can handle recurring payments without hassle.

To give you a clearer picture of what different payment gateways offer, here’s a comparison table of some popular options:

| Payment Gateway | Transaction Fees | Best For |

|---|---|---|

| PayPal | 2.9% + $0.30 | Small to medium businesses |

| Stripe | 2.9% + $0.30 | Tech-savvy startups and developers |

| Square | 2.6% + $0.10 | Retail businesses with in-person sales |

| Authorize.Net | 2.9% + $0.30 + monthly fee | Established businesses needing additional features |

Each gateway has its strengths and weaknesses, so it’s essential to evaluate your business needs thoroughly. By considering transaction fees, payment options, security measures, and customer support, you can make an informed decision that will enhance both your operations and your customers’ shopping experience.

Exploring the Top Seven Payment Processing Services

When it comes to selecting a payment processing service, the choices can seem overwhelming. However, finding the right one is crucial for ensuring a seamless customer experience and maximizing your sales potential. Here’s a closer look at seven of the top payment processing services available today, each with its unique advantages.

1. PayPal

PayPal is a household name in online payments, known for its user-friendly interface and widespread acceptance. It allows customers to pay with credit cards, debit cards, or their PayPal balance. Key features include:

- Instant setup with minimal fees.

- Integration with most ecommerce platforms.

- Robust buyer and seller protection policies.

2. Stripe

If you’re looking for customization and flexibility, Stripe is an excellent choice. It’s favored by developers for its API and extensive documentation. Here’s what sets Stripe apart:

- A wide range of payment options, including ACH transfers and international payments.

- Advanced features like subscription billing and fraud protection.

- Real-time analytics to track your sales performance.

3. Square

Square is not just a point-of-sale solution; it’s also a robust online payment processor. Ideal for small businesses, Square offers:

- No monthly fees; you only pay per transaction.

- Integrated tools for inventory management and sales tracking.

- Easy setup for both online and offline sales.

4. Authorize.Net

This service has been around for over twenty years and has earned a strong reputation for reliability. Here’s what you can expect from Authorize.Net:

- Support for multiple payment methods, including e-checks and digital wallets.

- Advanced fraud detection tools to protect your business.

- Easy integration with a variety of shopping carts.

5. Braintree

Owned by PayPal, Braintree offers a seamless payment experience, especially for mobile apps. Its features include:

- Support for a variety of currencies and payment types.

- In-depth analytics for performance tracking.

- Recurring billing for subscription services.

6. 2Checkout (now Verifone)

2Checkout is a global payment processor widely used for its flexibility and ability to handle multiple currencies and payment methods. Consider its benefits:

- Support for international sales, enabling you to reach a global audience.

- Customizable checkout pages to match your brand.

- Comprehensive fraud protection mechanisms.

7. Adyen

Adyen is a favorite among larger businesses due to its all-in-one payment platform that supports online, mobile, and in-store transactions. Key highlights include:

- Global payment options to cater to a diverse customer base.

- Real-time data and analytics for better business insights.

- Flexible payment methods tailored to regional preferences.

Comparison Table

| Service | Transaction Fee | Best For |

|---|---|---|

| PayPal | 2.9% + $0.30 | Ease of use |

| Stripe | 2.9% + $0.30 | Customization |

| Square | 2.6% + $0.10 | Small businesses |

| Authorize.Net | 2.9% + $0.30 | Reliability |

| Braintree | 2.9% + $0.30 | Mobile apps |

| 2Checkout | 3.5% + $0.35 | International sales |

| Adyen | Varies | Large businesses |

Choosing the right payment processing service is essential for success in ecommerce. By evaluating your specific needs and considering the unique features and benefits of each option, you can find a service that not only meets your requirements but also enhances your customers’ shopping experience. Dive deep into these services, and you will surely find the perfect fit for your online store.

Comparing Fees and Features of Popular Payment Processors

When it comes to choosing a payment processor for your ecommerce business, understanding the fees and features is crucial. Not all payment processors are created equal, and the right choice can significantly impact your bottom line. Here’s a deep dive into the key aspects that differentiate the top services in the market.

1. Transaction Fees: Most payment processors charge a fee for each transaction. These fees can vary widely based on the provider and the payment method. Here’s a quick overview:

| Payment Processor | Transaction Fee | Monthly Fee |

|---|---|---|

| PayPal | 2.9% + $0.30 | None |

| Stripe | 2.9% + $0.30 | None |

| Square | 2.6% + $0.10 | None |

| Authorize.Net | 2.9% + $0.30 | $25 |

2. Features: Beyond fees, consider what each payment processor offers. Here are some common features that can greatly enhance your ecommerce operations:

- Multi-Currency Support: Ideal for businesses selling internationally.

- Recurring Billing: Great for subscription services.

- Fraud Protection: Essential for securing transactions and customer data.

- Integration Options: Compatibility with popular ecommerce platforms like WooCommerce, Shopify, and Magento.

3. Customer Support: Consider the level of customer support each processor provides. Having reliable support can be a game changer in critical situations. Look for processors that offer:

- 24/7 availability

- Live chat support

- Extensive documentation and resources

Ultimately, the choice of a payment processor should reflect your business’s unique needs. Take the time to evaluate not just the fees, but also the features and support systems that each provider offers. A well-informed decision can streamline your payment processing and enhance the overall shopping experience for your customers.

Enhancing Security with PCI Compliance and Encryption

In the ever-evolving landscape of ecommerce, prioritizing security is not just a good practice; it’s a necessity. With the increase in online transactions, the risk of data breaches and fraud has also surged. By adhering to PCI compliance standards and implementing robust encryption methods, businesses can significantly enhance their security posture and build customer trust.

Understanding PCI Compliance

PCI DSS (Payment Card Industry Data Security Standard) sets forth a framework of requirements designed to secure credit and debit card transactions. Embracing these standards ensures that your ecommerce platform is properly handling sensitive payments. Here are some key benefits of PCI compliance:

- Protects Customer Data: Ensures sensitive information is safeguarded against unauthorized access.

- Reduces Risk of Fraud: Mitigates the chances of data breaches that can lead to fraud.

- Enhances Brand Reputation: Builds trust with customers who are increasingly concerned about their data security.

- Avoids Fines and Penalties: Non-compliance can lead to hefty fines and legal issues.

The Role of Encryption

While PCI compliance lays the groundwork for secure transactions, encryption adds an additional layer of protection. By encrypting sensitive data, such as credit card information and personal details, businesses can ensure that even if data is intercepted, it remains unreadable and unusable to malicious actors. Here’s why encryption is crucial:

- Data Protection: Keeps customer information safe during transmission, making it difficult for hackers to access.

- Compliance Assistance: Many compliance frameworks require encryption, simplifying adherence to regulations.

- Trust and Confidence: Customers are more likely to complete transactions on sites that visibly use encryption technologies.

Best Practices for Implementing PCI Compliance and Encryption

To effectively implement PCI compliance and encryption, consider the following best practices:

- Regular Security Audits: Schedule audits to assess your compliance status and identify vulnerabilities.

- Use Strong Encryption Protocols: Utilize up-to-date encryption standards, such as AES (Advanced Encryption Standard).

- Educate Staff: Provide training to employees on security protocols and the importance of compliance.

- Monitor Transactions: Implement continuous monitoring to detect any suspicious activities in real time.

| Security Measure | Description |

|---|---|

| Encryption | Transforms readable data into an encoded format to prevent unauthorized access. |

| Firewalls | Establishes barriers between secure internal networks and untrusted external networks. |

| Two-Factor Authentication | Requires two forms of identification before granting access, enhancing security. |

| Regular Software Updates | Ensures that all systems are updated to protect against known vulnerabilities. |

Integrating PCI compliance and encryption into your ecommerce strategy is not just about meeting regulatory requirements—it’s about creating a secure environment for your customers. By taking these proactive steps, you not only protect your business but also foster lasting relationships with consumers who value security just as much as great products and services.

Maximizing Customer Satisfaction with Smooth Checkout Experiences

In the fast-paced world of ecommerce, ensuring that your customers have a seamless checkout experience is essential for maximizing satisfaction and driving conversions. A complicated or frustrating payment process can lead to abandoned carts and lost sales, making it crucial to identify and implement the best payment processing solutions.

One of the key elements that contribute to a smooth checkout experience is the variety of payment options available. Customers today have diverse preferences, and offering multiple methods can significantly enhance their comfort level. Consider incorporating:

- Credit and Debit Cards

- Digital Wallets (e.g., PayPal, Apple Pay)

- Bank Transfers

- Buy Now, Pay Later options

Another factor that cannot be overlooked is mobile optimization. With an increasing number of customers shopping via their smartphones, ensuring that your payment gateway is fully optimized for mobile devices is paramount. A responsive design that simplifies navigation and input fields can help reduce friction during checkout, ultimately leading to higher satisfaction rates.

Moreover, consider the significance of security features in your payment processing system. Customers need to feel secure when entering their financial information. Implementing SSL certificates, two-factor authentication, and PCI compliance not only protects your customers but also builds trust in your brand. Displaying security badges prominently during checkout can further reassure users.

Lastly, don’t underestimate the power of a streamlined checkout process. Reducing the number of steps required to complete a purchase can drastically improve user experience. A guest checkout option, combined with an auto-fill feature for returning customers, can make a world of difference. Here’s a quick comparison of various payment processing services to help you choose the right fit:

| Service | Transaction Fees | Key Features |

|---|---|---|

| PayPal | 2.9% + $0.30 | Easy integration, mobile-friendly |

| Stripe | 2.9% + $0.30 | Customizable, recurring payments |

| Square | 2.6% + $0.10 | POS integration, analytics |

| Authorize.Net | 2.9% + $0.30 | Advanced fraud detection, customer profiles |

By prioritizing these aspects, you can create an engaging and satisfying checkout experience that not only meets but exceeds customer expectations. An investment in the right payment processing solutions will yield dividends in customer loyalty and retention.

Integrating Payment Solutions with Your Ecommerce Platform

To truly enhance your ecommerce platform, integrating seamless payment solutions is a game-changer. With a multitude of payment service providers available today, choosing the right one can significantly impact your customer’s shopping experience and your bottom line. The key is to find a solution that not only meets your business needs but also aligns well with your customer preferences.

One of the first steps in the integration process is understanding the types of payment methods that your audience uses most frequently. Consider incorporating:

- Credit and Debit Cards: The most common payment method used globally.

- Digital Wallets: Options like PayPal, Apple Pay, and Google Pay are increasingly popular.

- Cryptocurrencies: Accepting Bitcoin or Ethereum can attract a niche market.

- Buy Now, Pay Later: Services like Afterpay and Klarna enhance affordability for customers.

When choosing a payment gateway, look for features that enhance security and customer trust. Key aspects to consider include:

- SSL Certification: Ensures secure transactions.

- PCI Compliance: Essential for protecting sensitive customer data.

- Fraud Detection Tools: Helps minimize risks and chargebacks.

Integration should be as straightforward as possible. Most popular ecommerce platforms offer plugins or built-in features that facilitate the integration of various payment solutions. Here’s a quick comparison of some top services:

| Payment Service | Fees | Ease of Integration | Supported Currencies |

|---|---|---|---|

| Stripe | 2.9% + 30¢ per transaction | Easy with plugins | 135+ |

| PayPal | 2.9% + 30¢ per transaction | Very Easy | 25+ |

| Square | 2.6% + 10¢ per transaction | Simple API | 1 (USD) |

Don’t overlook the importance of mobile optimization. With the rise in mobile shopping, ensure your payment solution is fully responsive and user-friendly on mobile devices. Features like one-click payments can drastically reduce cart abandonment rates.

Lastly, continually monitor and analyze your payment processing performance. Look for trends in customer behavior and preferences. This not only helps in refining your integration but also in enhancing customer satisfaction and loyalty. Remember, a smooth payment experience can turn a potential sale into a loyal customer relationship.

Looking Ahead: Future Trends in Ecommerce Payment Processing

The landscape of ecommerce payment processing is continuously evolving, driven by technological advancements and changing consumer expectations. As businesses seek to stay competitive, understanding the upcoming trends is essential for optimizing payment strategies.

One of the most significant trends is the rise of contactless payments. With the acceleration of digital wallets and NFC technology, consumers are looking for quick, hassle-free payment options. This shift not only enhances user experience but also boosts conversion rates. Adopting contactless solutions can provide a competitive edge in attracting tech-savvy customers.

Another trend to watch is the increasing importance of subscription-based models. Many businesses are shifting towards this recurring revenue model, which requires robust payment processing systems to manage ongoing transactions seamlessly. Offering flexible payment plans can enhance customer loyalty and create a more predictable revenue stream.

Additionally, the integration of artificial intelligence (AI) in payment processing is set to revolutionize the industry. AI can analyze transaction data to identify fraud patterns, streamline processes, and personalize customer experiences. This not only increases security but also fosters a sense of trust among consumers, encouraging them to complete purchases.

Moreover, the push for cryptocurrency payments is gaining momentum. As digital currencies become more mainstream, ecommerce platforms that accommodate crypto transactions can appeal to a broader audience. This could also reduce transaction fees, benefiting both businesses and consumers.

As we look to the future, it’s clear that omnichannel payment solutions will play a pivotal role. Customers expect to engage with brands across multiple platforms, and seamless payment integration across these channels is vital. Businesses should consider adopting solutions that unify online and offline payment methods to deliver a cohesive shopping experience.

the focus on sustainability is reshaping consumer behavior. Payment processors are increasingly expected to support eco-friendly initiatives through features like carbon offset programs or charity donations tied to transactions. Aligning payment options with ethical practices can resonate with conscientious consumers, further driving brand loyalty.

| Trend | Impact on Ecommerce |

|---|---|

| Contactless Payments | Enhances user experience and increases conversion rates. |

| Subscription Models | Boosts customer loyalty and offers predictable revenue. |

| AI Integration | Improves security and personalizes customer experiences. |

| Cryptocurrency | Appeals to a broader audience and reduces fees. |

| Omnichannel Solutions | Delivers a cohesive shopping experience across platforms. |

| Sustainability Focus | Resonates with eco-conscious consumers and boosts loyalty. |

Tips for Troubleshooting Common Payment Issues

Addressing Payment Issues: Practical Tips

When managing an online store, dealing with payment issues can be a frustrating experience. However, with a few strategies up your sleeve, you can resolve these challenges efficiently. Here are some practical tips to help you navigate common payment hurdles:

- Verify Customer Information: Ensure that customers enter their billing address, credit card number, and CVV correctly. Simple typos can lead to failed transactions.

- Check Payment Processor Status: Sometimes, the issue lies with the payment processor itself. Regularly check their status page for any outages or maintenance notifications that could affect transaction processing.

- Test Your Checkout Process: Conduct regular tests of your checkout process to identify any potential roadblocks. This will help you spot issues before your customers do and keep your sales flowing smoothly.

Additionally, having a solid understanding of error codes can save you a lot of time. Here are a few common error codes and their meanings:

| Error Code | Meaning |

|---|---|

| Declined | The payment was declined by the issuing bank. |

| Expired Card | The card used has expired. |

| Insufficient Funds | The account does not have enough funds to complete the transaction. |

Besides troubleshooting the direct issues, consider enhancing your payment system’s user experience. A smooth, intuitive checkout can reduce payment-related problems:

- Optimize for Mobile: Ensure that your payment interface is mobile-friendly. Many customers shop on their phones, and a complicated payment process can lead to cart abandonment.

- Offer Multiple Payment Methods: Cater to customer preferences by accepting various payment methods. This not only helps in reducing payment issues but also increases customer satisfaction.

- Clear Error Messages: Provide specific error messages that guide customers on how to correct their issues. This simple step can prevent frustration and improve conversion rates.

maintaining a seamless payment experience is critical for your ecommerce success. By being proactive and addressing potential issues before they escalate, you can ensure a smoother transaction process for your customers.

Final Thoughts on Optimizing Your Payment Processing Strategy

As you navigate the complexities of ecommerce, fine-tuning your payment processing strategy can significantly enhance both your operational efficiency and customer satisfaction. The right approach to payment processing not only streamlines transactions but also builds trust with your customers, which is essential in today’s competitive landscape.

Consider the following factors when optimizing your payment processing:

- Variety of Payment Options: Offering multiple payment methods can cater to a broader audience. Popular choices include credit cards, digital wallets, and even cryptocurrency.

- Mobile Optimization: With the rise of mobile shopping, ensure your payment system is fully optimized for mobile devices, providing a seamless experience for customers on the go.

- Security Measures: Implement robust security protocols to protect customer data. This not only safeguards your business but also fosters customer loyalty.

- Transaction Fees: Keep an eye on transaction costs associated with different payment processors. Opt for solutions that balance affordability with the features you need.

Another vital aspect to consider is the user experience during checkout. A lengthy or complicated checkout process can lead to abandoned carts and lost sales. To mitigate this, aim for a streamlined approach:

- One-Page Checkout: Minimize the steps required to complete a purchase. A one-page checkout can reduce friction and enhance conversion rates.

- Guest Checkout Options: Allow customers to check out without creating an account. This can lead to higher completion rates, as many users prefer a quick checkout process.

It’s also wise to monitor and analyze your payment processing performance regularly. Use analytics tools to track metrics such as conversion rates, payment failures, and customer feedback. This data can reveal areas for improvement and help you make informed decisions about your payment processing strategy.

| Payment Processor | Key Features | Transaction Fees |

|---|---|---|

| PayPal | Widely recognized, easy setup, buyer protection | 2.9% + $0.30 per transaction |

| Stripe | Flexible API, subscription billing, fraud prevention | 2.9% + $0.30 per transaction |

| Square | Integrated POS, invoicing, online store | 2.6% + $0.10 per transaction |

Incorporating these elements into your payment processing strategy not only improves efficiency but also enhances the overall shopping experience for your customers. By staying proactive and responsive to changes in consumer behavior and technology, you can position your ecommerce business for sustained success in a rapidly evolving market.

Frequently Asked Questions (FAQ)

Q&A for “Ecommerce Payment Processing Guide: Top 7 Services and More”

Q1: Why is choosing the right payment processing service important for my ecommerce business?

A1: Choosing the right payment processing service is crucial for your ecommerce business because it directly affects your sales, customer experience, and even your bottom line. A seamless payment process can boost conversion rates, while a clunky one may turn potential customers away. Plus, different services offer various fees, security features, and integrations that can align better with your business needs. It’s like laying the foundation of your online store—get it right, and everything else falls into place!

Q2: What should I look for in a payment processing service?

A2: Great question! When evaluating payment processing services, consider factors like transaction fees, payment method acceptance (credit cards, digital wallets, etc.), ease of integration with your ecommerce platform, security features, customer support availability, and reporting capabilities. Also, think about scalability. You want a service that can grow with you as your business expands. It’s all about finding the perfect fit for your unique needs!

Q3: Can you give me a brief overview of the top 7 payment processing services?

A3: Absolutely! Here’s a quick rundown:

- PayPal: A household name that’s trusted by millions. It’s easy to set up and offers a variety of payment options.

- Stripe: Known for its powerful API, Stripe is great for tech-savvy businesses looking for customization and advanced features.

- Square: Perfect for small businesses, Square offers a simple fee structure and great point-of-sale solutions.

- Authorize.Net: A reliable option for established businesses, it provides robust security features and excellent customer support.

- Braintree: Owned by PayPal, Braintree is ideal for mobile and web-based businesses, offering seamless integration with different payment methods.

- Adyen: Excellent for global companies, Adyen supports multiple currencies and payment methods, streamlining international transactions.

- 2Checkout (now Verifone): Great for businesses selling internationally, it offers flexible payment options and comprehensive reporting tools.

Explore each one to see which aligns best with your business goals!

Q4: What are some common pitfalls to avoid when selecting a payment processor?

A4: One common pitfall is not thoroughly reviewing the fee structure. Different processors have various fees for transactions, chargebacks, and monthly services. Make sure you understand all potential costs to avoid surprises later! Another mistake is underestimating the importance of security features. Your customers need to trust that their payment information is safe. Lastly, don’t overlook customer support—when issues arise, you’ll want a provider that’s responsive and helpful.

Q5: How can I ensure a smooth payment experience for my customers?

A5: To ensure a smooth payment experience, keep the checkout process simple and intuitive. Limit the number of steps required to complete a purchase, and offer multiple payment options to cater to different customer preferences. Make sure your payment page is mobile-friendly, as many shoppers use their phones. Also, consider adding trust signals like security badges to reassure customers. It’s all about making your customers feel comfortable and valued during the transaction!

Q6: Is it easy to switch payment processing services if I’m not happy later?

A6: Switching payment processing services can be straightforward, but it depends on the specific platforms involved. Most ecommerce platforms allow you to change your payment processor easily, but it might require some technical work, like updating API keys. It’s always a good idea to review the terms of your current service for any cancellation fees or notice periods. And remember, if you’re considering a switch, take the time to evaluate your new options thoroughly to ensure you make the best choice this time!

Q7: Where can I find more information on these payment processing services?

A7: You’re in luck! Our article “Ecommerce Payment Processing Guide: Top 7 Services and More” dives deep into each service, comparing features, pricing, and ideal use cases. It’s packed with tips and insights to help you make an informed decision. Plus, don’t hesitate to check out user reviews and testimonials—real-world experiences are invaluable in guiding your choice!

Feel free to reach out if you have more questions or need further assistance. Happy selling!

To Wrap It Up

As we wrap up our journey through the world of ecommerce payment processing, it’s clear that choosing the right service is not just a technical decision—it’s a pivotal step in shaping your business’s success. Each of the top seven services we explored offers unique features and benefits that can cater to different needs, whether you’re a small startup or an established enterprise.

Remember, the right payment processor can enhance your customer’s shopping experience, increase your conversion rates, and ultimately boost your bottom line. So, take the time to evaluate your options carefully. Consider factors like transaction fees, ease of integration, and customer support.

The ecommerce landscape is ever-evolving, and staying ahead means making informed choices. So why wait? Dive into the world of payment processing today, and empower your ecommerce venture to thrive. Your customers are ready to shop—are you ready to serve? Happy selling!