Looking for the best payment gateway for your business in 2025? With so many options out there, it can feel overwhelming. Our comparison breaks down the top providers, helping you choose the perfect fit to boost your sales and streamline transactions. Don’t miss out!

Payment Gateway Comparison: Top Providers Analyzed for 2025

Introduction:

In today’s digital landscape, where every click can lead to a sale, choosing the right payment gateway isn’t just a necessity—it’s a game changer. As we step into 2025, businesses of all sizes are faced with a myriad of options, each promising seamless transactions and enhanced security. But with so many providers vying for your attention, how do you know which one truly fits your needs?

Whether you’re a budding entrepreneur launching your first online store or a seasoned business owner looking to upgrade your payment processing solutions, this article is here to guide you through the maze of choices. We’ve taken a close look at the top payment gateways on the market, analyzing their features, fees, and user experiences to help you make an informed decision. Join us as we sift through the noise and discover which providers stand out in 2025, ensuring that your checkout process not only meets expectations but exceeds them. Your journey to smarter payments starts now!

Understanding the Importance of Choosing the Right Payment Gateway

When it comes to online businesses, selecting the right payment gateway is a decision that can significantly impact your bottom line. It’s not just about processing payments; it’s about creating a seamless experience for your customers while ensuring their data remains secure. Here are a few key factors to consider:

- Security Features: A reliable payment gateway should prioritize security. Look for options that include features such as PCI compliance, SSL encryption, and fraud detection tools to protect sensitive information.

- Transaction Fees: Understanding the fee structure of a payment gateway is crucial. Some providers charge per transaction, while others may have monthly fees or setup costs. Evaluating these fees against your expected sales volume can help you choose a cost-effective solution.

- Integration Capabilities: Your payment gateway should work seamlessly with your existing e-commerce platform or website. Consider whether the gateway offers easy integration with your tools, such as shopping carts and inventory management systems.

- Payment Options: In today’s market, consumers expect flexibility. A good payment gateway should support various payment methods, including credit cards, digital wallets, and even cryptocurrencies, to cater to diverse customer preferences.

- Customer Support: When issues arise, responsive customer support can make all the difference. Choose a gateway that offers reliable support through multiple channels, ensuring you can get help whenever you need it.

Furthermore, it’s essential to consider the gateway’s reputation and user reviews. Businesses thrive on trust, and a payment gateway with a solid track record can enhance your brand’s credibility. Researching other users’ experiences can provide valuable insights into the reliability and performance of different providers.

To help you visualize the choices available, here’s a quick comparison of popular payment gateways in 2025:

| Provider | Transaction Fees | Payment Methods | Customer Support |

|---|---|---|---|

| Stripe | 2.9% + 30¢ | Credit/Debit, Wallets | 24/7 Support |

| PayPal | 2.9% + 30¢ | Credit/Debit, Wallets | Live Chat & Email |

| Square | 2.6% + 10¢ | Credit/Debit, Invoices | Phone & Email |

| Authorize.Net | 2.9% + 30¢ | Credit/Debit, E-checks | 24/7 Support |

Ultimately, the right payment gateway should not only meet your current needs but also be adaptable as your business grows. Whether you are a startup or an established enterprise, investing the time to make an informed choice will help set the stage for success in the ever-evolving online marketplace.

Key Features to Consider When Comparing Payment Gateways

When evaluating payment gateways, several key features can significantly impact your decision-making process. Understanding these features will help you select a provider that aligns perfectly with your business needs.

Transaction Fees: One of the first aspects to consider is the fee structure. Payment gateways typically charge a combination of per-transaction fees and monthly costs. These rates can vary widely, so it’s essential to assess:

- Flat-rate vs. percentage-based fees

- Monthly subscription fees

- Hidden costs, such as chargeback fees

Payment Methods Supported: The versatility of a payment gateway is crucial. A good provider should support a range of payment options to accommodate your customers’ preferences. Look for gateways that offer:

- Credit and debit card processing

- Mobile payment options (like Apple Pay and Google Pay)

- Integration with digital wallets (like PayPal and Venmo)

| Payment Method | Availability |

|---|---|

| Credit Cards | Yes |

| Mobile Payments | Yes |

| Digital Wallets | Yes |

| Cryptocurrency | No |

Security Features: Security is paramount when handling transactions. Choose a payment gateway that employs robust security measures to protect sensitive customer information. Key features to look out for include:

- End-to-end encryption

- Two-factor authentication

- Compliance with PCI DSS standards

Integration and Compatibility: How well the payment gateway integrates with your existing systems can make or break your operations. Look for gateways that offer:

- Easy integration with your eCommerce platform

- APIs for custom solutions

- Support for multiple programming languages

Customer Support: Last but certainly not least, consider the level of customer support provided by the payment gateway. Accessible, knowledgeable support can save you from headaches down the line. Evaluate options that provide:

- 24/7 customer service

- Multiple contact methods (email, phone, live chat)

- Comprehensive documentation and resources

By prioritizing these features in your comparison, you can confidently select a payment gateway that not only meets your business’s current needs but also scales as you grow.

A Deep Dive into the Top Payment Gateway Providers of 2025

As we venture into 2025, the landscape of digital payments continues to evolve at a rapid pace. Businesses today are not just looking for a way to accept payments; they seek solutions that enhance customer experience, streamline operations, and adapt to the latest technologies. Let’s examine the leading payment gateway providers that stand out in this competitive market.

Stripe has solidified its place as a frontrunner by offering a comprehensive suite of features that cater to developers and businesses alike. Its user-friendly API allows for seamless integration, while its robust fraud prevention tools provide peace of mind. Key features include:

- Customizable payment forms that enhance user experience.

- Global acceptance of various payment methods and currencies.

- Advanced analytics for real-time insights into transaction performance.

PayPal, a household name in the payment processing world, continues to innovate with features like PayPal One Touch™ and integration with various e-commerce platforms. With its brand recognition, it builds trust among consumers, which can lead to increased conversion rates. Some of its standout features include:

- Instant payment notifications to keep merchants informed.

- Mobile optimization for smooth transactions on mobile devices.

- Multiple currency support for international sales.

Another notable player is Square, which has expanded its offerings beyond the traditional point-of-sale systems. Square’s intuitive interface and all-in-one solution make it a favorite among small to medium-sized businesses. Highlights include:

- E-commerce tools that allow businesses to set up online stores easily.

- Comprehensive reporting to track sales and inventory.

- Affordable flat-rate pricing for easier budgeting.

| Provider | Key Strengths | Ideal For |

|---|---|---|

| Stripe | Developer-friendly API, global payments | Tech-savvy businesses |

| PayPal | Brand trust, ease of use | Small to large retailers |

| Square | All-in-one solution, pricing transparency | Small businesses and startups |

Adyen has made significant strides in catering to large enterprises with its unified commerce approach. It allows businesses to manage payments across various channels (in-store, online, and mobile) through a single platform. Noteworthy features include:

- Real-time data analytics for optimizing sales strategies.

- Support for new payment methods as they emerge.

- Global reach with local payment methods.

as we look at the top payment gateway providers in 2025, it’s clear that each offers unique strengths tailored to different business needs. Whether you’re a small startup or a large enterprise, understanding these options can empower you to choose the right payment partner that aligns with your business goals.

How Transaction Fees Impact Your Bottom Line

When it comes to managing your business finances, transaction fees can act as a hidden drain on your profits. These fees, often overlooked in the grand scheme of budgeting, can accumulate quickly and significantly impact your overall revenue. Understanding how these fees work is crucial for any business looking to maximize its bottom line.

Transaction fees generally encompass a variety of charges, including:

- Credit card processing fees: Typically a percentage of the transaction plus a fixed fee.

- Monthly fees: Charged by payment processors for account maintenance.

- Chargeback fees: Incurred when a customer disputes a transaction.

- Cross-border fees: Applied for transactions involving international payments.

Each payment gateway provider has its own fee structure, which can lead to significant variances in costs. For instance, some providers may offer lower processing fees but charge higher monthly fees, while others might have flat-rate pricing with minimal extras. It’s essential to conduct a thorough comparison before committing to a provider.

Consider this example:

| Provider | Processing Fee | Monthly Fee | Chargeback Fee |

|---|---|---|---|

| Provider A | 2.9% + $0.30 | $25 | $15 |

| Provider B | 2.5% + $0.20 | $10 | $20 |

| Provider C | 3.5% flat | $0 | $10 |

From the table, it’s evident that while Provider B has the lowest processing fee, its chargeback fee could eat into savings if you frequently face disputes. Similarly, while Provider C offers a no-monthly fee option, its higher processing fee might not be advantageous for businesses with higher sales volumes. Understanding these nuances allows you to forecast your expenses accurately.

Ultimately, the cumulative effect of transaction fees can determine whether your business thrives or merely survives. To mitigate these costs, consider negotiating rates with your provider or exploring different payment gateways that align better with your sales model. The more informed you are about these fees, the better equipped you’ll be to make strategic decisions that enhance your profitability.

Evaluating Security Measures: Keeping Your Customers Safe

When it comes to selecting a payment gateway, security is paramount. With cyber threats evolving rapidly, ensuring that your chosen provider has robust security measures in place is essential for maintaining trust with your customers. Here are some vital aspects to consider when evaluating the security features of different payment gateways:

- PCI-DSS Compliance: Ensure that the payment gateway complies with the Payment Card Industry Data Security Standard. This is a must-have for any provider handling credit card transactions.

- Two-Factor Authentication: Look for gateways that offer two-factor authentication (2FA) as an extra layer of security, ensuring that only authorized users can access sensitive information.

- Fraud Detection Tools: Advanced fraud detection tools can identify and mitigate fraudulent transactions before they occur. Providers that utilize machine learning algorithms for this purpose can offer a more secure environment.

- Data Encryption: Verify that the gateway uses end-to-end encryption to protect sensitive customer data during transmission.

- Dispute Management: A transparent and efficient dispute management process can protect you from chargebacks and fraud claims.

Let’s take a look at how some of the top payment gateways stack up in terms of their security features:

| Payment Gateway | PCI-DSS Compliant | Two-Factor Authentication | Fraud Detection | Data Encryption |

|---|---|---|---|---|

| Provider A | Yes | Yes | Advanced | Yes |

| Provider B | Yes | No | Basic | Yes |

| Provider C | Yes | Yes | Advanced | Yes |

| Provider D | No | No | Basic | No |

While examining these features, it’s also essential to consider the provider’s track record. Research their history regarding data breaches or security incidents. A reputable gateway should have a transparent response plan in the event of a security breach, demonstrating their commitment to safeguarding your business and your customers.

Another critical factor is customer support. In the event of a security issue, having accessible and knowledgeable support can make a significant difference. Check if the payment gateway offers 24/7 support, as timely assistance can help mitigate potential damages.

Ultimately, choosing a payment gateway is not just about transaction fees or ease of integration; it’s about the peace of mind that comes from knowing your customers’ data is secure. Building a trustworthy relationship with your customers starts with selecting the right partner for processing payments.

User Experience Matters: The Interface and Customer Journey

In today’s fast-paced digital landscape, the interface and overall customer journey are more crucial than ever. A seamless payment process is not just a luxury; it’s a necessity for retaining customers and optimizing conversions. When evaluating payment gateways, it’s vital to consider how well these platforms integrate with your existing systems and enhance the user experience.

Intuitive Design is key. Users are more likely to complete transactions when they encounter interfaces that are straightforward and easy to navigate. Look for payment gateways that offer:

- Clear call-to-action buttons

- Simple checkout processes

- Responsive design for mobile devices

Another critical component is speed and efficiency. Research shows that even a few seconds of delay during checkout can lead to cart abandonment. High-performing payment gateways should offer:

- Fast loading times

- Minimal redirects

- One-click payment options

| Provider | User Experience Rating | Mobile Optimization |

|---|---|---|

| Provider A | 9/10 | Excellent |

| Provider B | 8/10 | Good |

| Provider C | 7/10 | Average |

Security and Trust are paramount for users, especially when it comes to online payments. Customers need to feel confident that their personal and financial information is secure. The best payment gateways should highlight:

- Encryption protocols

- Compliance with regulations (like PCI DSS)

- Visible trust signals (like security badges)

Lastly, consider the customer support aspect of your chosen gateway. Issues can arise at any time, and having accessible support can make or break a user’s experience. Look for providers that offer:

- 24/7 customer service

- Multiple contact methods (chat, email, phone)

- Thorough knowledge bases and FAQs

Integration Capabilities: Seamless Connections with Your Platform

In today’s fast-paced digital landscape, integration capabilities are more crucial than ever for businesses looking to streamline their operations and enhance customer experiences. With the right payment gateway, seamless connections with your existing platforms can drive efficiency and boost conversion rates. Here’s what to consider when evaluating the integration capabilities of top payment gateway providers.

Flexibility Across Platforms

When selecting a payment gateway, it’s essential to ensure it can easily integrate with your existing systems. Look for providers that offer:

- API Access: Robust APIs allow for custom integrations tailored to your business needs.

- Pre-Built Plugins: Many gateways provide plugins for popular e-commerce platforms like WooCommerce, Shopify, and Magento, enabling quick setups.

- Middleware Solutions: Some gateways come with middleware options that facilitate integration with legacy systems.

Compatibility with Payment Methods

Ensure the payment gateway supports a wide array of payment methods. This includes traditional credit and debit cards, digital wallets like PayPal and Apple Pay, and alternative payment options such as cryptocurrencies. A diverse range of supported payment methods can significantly enhance the user experience and increase the likelihood of completed transactions.

Data Security and Compliance

Security should always be a top priority when integrating a payment gateway. Choose providers that offer:

- PCI Compliance: Ensures that the payment gateway adheres to industry standards for data protection.

- Tokenization: This process converts sensitive information into a unique identifier, reducing the risk of fraud.

- Fraud Detection Tools: Advanced security features help protect transactions and monitor suspicious activities.

User-Friendly Interface

While powerful integrations are essential, a user-friendly interface can make a significant difference in how your team interacts with the payment system. Seek out gateways that feature:

- Intuitive Dashboards: Easy navigation allows for quick access to transaction data and reporting tools.

- Customizable Settings: Personalization options help tailor the gateway experience to match your business needs.

Cost-Effectiveness

| Provider | Setup Fee | Transaction Fee | Monthly Fee |

|---|---|---|---|

| Provider A | $0 | 2.9% + $0.30 | $19.99 |

| Provider B | $50 | 2.5% + $0.25 | $29.99 |

| Provider C | $0 | 3.2% + $0.35 | $9.99 |

Cost can be a deciding factor in your payment gateway selection. Consider not only the transaction fees but also any monthly or setup fees associated with the service. A transparent fee structure ensures you won’t be faced with unexpected costs down the line.

the right payment gateway will not only simplify your transaction processes but also enhance customer satisfaction. As you evaluate your options, prioritize those that can connect effortlessly with your existing systems, offering the flexibility and security that modern businesses demand.

Customer Support: Why It Should Be a Top Priority

In today’s fast-paced digital economy, exceptional customer support has transitioned from a mere bonus to a critical necessity. As businesses compete on multiple fronts, the quality of support offered can significantly influence customer loyalty and retention. When it comes to payment gateways, customers expect not just reliable transactions but also prompt and effective assistance when issues arise. This is why a robust customer support system should be at the forefront of your payment gateway considerations.

Imagine a scenario where a transaction fails at a crucial point, perhaps during a holiday sale or a major campaign launch. Customers experiencing such issues need immediate help. A payment gateway with 24/7 customer support can be a game-changer. Here are some key aspects to consider:

- Responsiveness: Quick reply times can make or break customer satisfaction. Look for providers that offer live chat options, as these enable instant communication.

- Multi-channel Support: Ensure that the provider offers support through various channels such as phone, email, and social media. This flexibility allows customers to reach out in the way they find most comfortable.

- Comprehensive Knowledge Base: A well-organized online resource center can empower customers to troubleshoot basic issues on their own, reducing dependency on customer service.

Moreover, consider the technical expertise of the support team. Payment gateways can be complex, and having knowledgeable staff who can handle issues efficiently is crucial. Providers that invest in training their support team will not only resolve issues faster but also build trust with their users.

To help you visualize the importance of customer support across different payment gateways, here’s a simple comparison table:

| Provider | Support Availability | Response Time | Support Channels |

|---|---|---|---|

| Gateway A | 24/7 | Immediate | Phone, Email, Live Chat |

| Gateway B | Weekdays Only | Up to 1 Hour | Email, Knowledge Base |

| Gateway C | 24/7 | 15 Minutes | Phone, Live Chat, Social Media |

Ultimately, great customer support can differentiate a payment gateway in a crowded market. As you evaluate providers for 2025, remember that a positive support experience can lead to repeat business and glowing referrals. Investing in a provider that prioritizes customer support is investing in your own business success.

Real-World Success Stories: Businesses Thriving with the Right Gateway

Final Thoughts and Recommendations for Your Payment Gateway Selection

When it comes to selecting the right payment gateway for your business, understanding the unique needs of your operation is crucial. Every business is different, and so are the requirements for processing payments. Here are some key factors to consider in your decision-making process:

- Transaction Fees: Look for gateways that offer transparent pricing structures. Be wary of hidden fees that could cut into your profit margins.

- Integration: Ensure the payment gateway easily integrates with your existing e-commerce platform. This can save you time and headaches in implementation.

- Customer Support: A solid support system can make all the difference. Choose a provider that offers 24/7 assistance to address any issues that may arise.

- Security Features: Opt for gateways that provide advanced security measures, such as PCI compliance and fraud detection tools, to protect your customers’ information.

Additionally, think about the payment methods you want to support. Modern consumers appreciate flexibility, so having options beyond credit and debit cards—like digital wallets and cryptocurrencies—can enhance customer satisfaction and conversion rates. Don’t forget to consider the user experience as well; a smooth checkout process can significantly reduce cart abandonment rates.

| Provider | Transaction Fee | Integration | Security Features |

|---|---|---|---|

| PayPal | 2.9% + $0.30 | Easy | PCI compliant, fraud protection |

| Stripe | 2.9% + $0.30 | Flexible | Advanced fraud detection |

| Square | 2.6% + $0.10 | Simple | End-to-end encryption |

| Authorize.Net | 2.9% + $0.30 | Moderate | Fraud detection suite |

consider the scalability of your chosen gateway. As your business grows, your payment processing needs will likely evolve. Selecting a provider that can grow with you will not only save you time but also avoid the hassles of transitioning to a new system down the road.

By taking the time to carefully evaluate your options and aligning them with your specific business goals, you can make a well-informed decision that positions your business for success in the competitive landscape of 2025. Remember, the right payment gateway is not just a tool, but a strategic partner in your growth journey.

Frequently Asked Questions (FAQ)

Q&A: Payment Gateway Comparison – Top Providers Analyzed for 2025

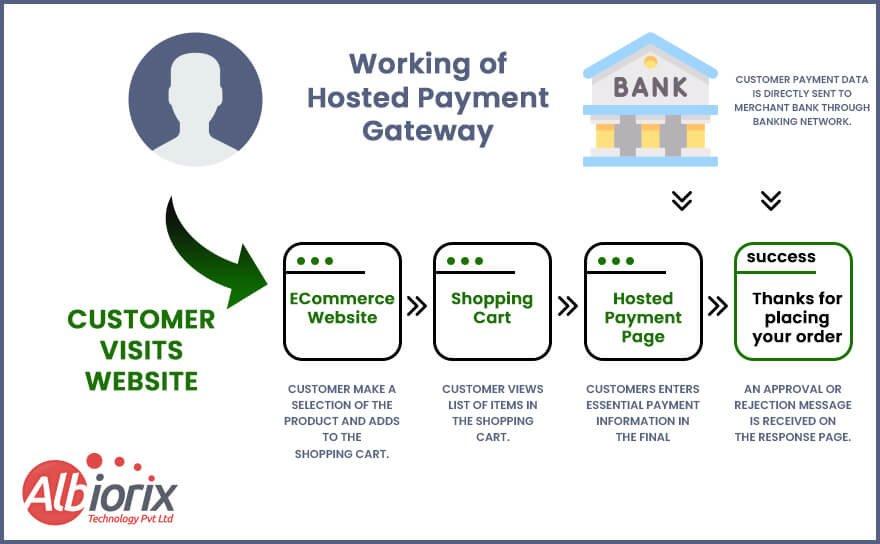

Q: What is a payment gateway, and why do I need one for my business?

A: Great question! A payment gateway is essentially the technology that allows your customers to make online payments securely. It acts as a bridge between your e-commerce site and the payment processor. If you’re selling products or services online, you absolutely need a reliable payment gateway to ensure secure transactions and a smooth checkout experience for your customers.

Q: With so many options available, how do I choose the right payment gateway for my business?

A: Choosing the right payment gateway can feel overwhelming, but it boils down to a few key factors. Consider transaction fees, compatibility with your e-commerce platform, customer support, and security features. In our 2025 comparison, we break down the top providers to help you evaluate which one aligns best with your business needs.

Q: What are some of the top payment gateway providers for 2025?

A: We’ve analyzed several top contenders, including PayPal, Stripe, Square, and Authorize.Net. Each provider has its unique strengths. For example, Stripe is known for its developer-friendly features, while Square offers an all-in-one solution that’s perfect for small businesses. We highlight the pros and cons of each, so you can make an informed decision.

Q: What should I look for in terms of security features?

A: Security is paramount when it comes to online payments. Look for features like PCI compliance, encryption technologies, and fraud detection tools. In our article, we specifically evaluate how each provider safeguards sensitive customer information to give you peace of mind.

Q: How do transaction fees work, and why do they matter?

A: Transaction fees are the charges that payment gateways apply each time a customer makes a purchase. These fees can vary significantly between providers and can eat into your profits if you’re not careful. We break down the fee structures of each top provider in our comparison, helping you understand which gateway will offer you the best value based on your sales volume.

Q: What about customer support? Is it really that important?

A: Absolutely! Fast and effective customer support can make or break your experience with a payment gateway. If something goes wrong—like a payment processing error during peak sales hours—you want to know you can get help quickly. We’ve analyzed the support options available for each provider, including live chat, phone support, and the availability of resources.

Q: Can I integrate multiple payment gateways into my website?

A: Yes, you can! Many businesses choose to integrate multiple payment gateways to offer customers more options and to ensure a backup payment method if one gateway experiences issues. Our article discusses how to seamlessly integrate these options and the potential benefits of doing so.

Q: What’s the takeaway from your payment gateway comparison for 2025?

A: The takeaway is that there’s no one-size-fits-all solution. Each business has unique needs, and understanding the features, costs, and customer support of each provider is key. Our comparison helps you navigate through these choices, empowering you to select a payment gateway that not only fits your budget but also enhances your customer experience. Don’t leave money on the table—make an informed decision for your business today!

Feel free to dive into the article for a detailed analysis and find the perfect payment gateway tailored just for you!

In Retrospect

As we wrap up our deep dive into the world of payment gateways, it’s clear that choosing the right provider isn’t just a technical decision; it’s a strategic move that can elevate your business in 2025 and beyond. Whether you’re a small startup or an established enterprise, the right payment gateway can streamline your transactions, enhance customer experience, and ultimately boost your bottom line.

We’ve explored the top providers, dissecting their features, fees, and overall performance. Now, it’s time for you to take the next step. Consider what’s most important for your business—be it low transaction fees, robust security, or seamless integration. Don’t hesitate to weigh your options carefully; the right payment gateway is out there waiting for you.

So, what are you waiting for? Dive in, compare the options, and make an informed choice that aligns with your business goals. Your customers deserve a seamless checkout experience, and with the right payment gateway, you can deliver just that. Here’s to your success in navigating the digital payment landscape of 2025!