Unlock the secrets of financially successful small business owners by embracing a mindset of resilience, continuous learning, and strategic networking. Invest in your growth and watch your dreams flourish; success is just an idea away!

Secrets of Financially Successful Small Business Owner

Unlocking Success: The Secrets of Financially Successful Small Business Owners

In a world where dreams of entrepreneurship flourish amidst the challenges of economic uncertainty, the journey of a small business owner is as exhilarating as it is daunting. Many aspire to join the ranks of those who not only survive but thrive in the competitive marketplace. So, what separates the financially successful from the rest? The answer lies in a treasure trove of strategies, insights, and unwavering determination that can transform a fledgling venture into a flourishing empire.

In this article, we will delve into the secrets of financially successful small business owners—those unsung heroes who have mastered the art of navigating financial landscapes, seizing opportunities, and building resilient businesses. Whether you’re just starting out or looking to elevate your existing enterprise, the wisdom shared by seasoned entrepreneurs can illuminate your path to financial freedom. Prepare to be inspired, motivated, and equipped with actionable tips that can propel your business to new heights. The journey to success begins here—let us unlock the secrets together!

Unleashing the Power of a Clear Vision for Your Business

In the competitive landscape of small business, a well-defined vision is not just a luxury; it’s a necessity. A clear vision serves as a guiding star, directing your efforts and shaping your decisions. It provides a sense of purpose that not only motivates you but also inspires your team and resonates with your customers.

Here’s how a compelling vision can transform your business:

- Alignment of Goals: A clear vision aligns your business objectives with your everyday actions. When every team member understands the ultimate goal, their individual tasks become part of a larger, cohesive strategy.

- Decision-Making Framework: With a solid vision, making decisions becomes simpler. You can evaluate options based on whether they support your vision, ensuring consistency and clarity in your business direction.

- Attracting the Right Talent: A powerful vision attracts employees who share your values and aspirations. This alignment can enhance job satisfaction and reduce turnover, creating a more dedicated workforce.

- Building Customer Loyalty: Customers are drawn to brands that stand for something. A clear vision allows your business to communicate its mission and values effectively, fostering stronger relationships with your customer base.

To harness the power of your vision, consider the following steps:

| Step | Description |

|---|---|

| Define Your Vision | Craft a clear, concise statement that encapsulates your business’s aspirations and core values. |

| Communicate Regularly | Ensure your vision is shared throughout your organization. Use meetings, newsletters, and social media. |

| Incorporate Feedback | Engage your team and customers in discussions about your vision to keep it relevant and inspiring. |

| Review and Revise | Periodically revisit your vision to ensure it evolves with your business and market conditions. |

Every financially successful small business owner understands that a vision is more than just words; it’s the lifeblood of their enterprise. By articulating a clear vision, you can not only navigate challenges but also capitalize on opportunities that align with your long-term goals. Embrace the power of your vision and watch as it elevates your business to new heights.

Mastering the Art of Budgeting for Sustainable Growth

Effective budgeting is the cornerstone of sustainable growth for any small business. By mastering this skill, entrepreneurs can not only enhance their financial health but also create a roadmap for future opportunities. Here are some vital strategies to consider:

- Set Clear Goals: Define both short-term and long-term objectives. This clarity will guide your budgeting decisions and ensure every dollar spent aligns with your vision.

- Track Every Expense: Utilize budgeting software or spreadsheets to keep a detailed record of all expenditures. This practice will help identify unnecessary costs and highlight areas for improvement.

- Forecast Revenue Wisely: Analyze historical data and market trends to make informed predictions about your income. Be conservative in your estimates to avoid overextending your resources.

- Review and Adjust Regularly: Your budget should be a living document. Schedule monthly reviews to assess performance against your goals and make necessary adjustments.

Another vital aspect of effective budgeting is prioritizing your investments. Allocating funds toward growth initiatives can yield significant dividends. Consider establishing a tiered investment strategy, where you prioritize spending based on potential return:

| Investment Type | Potential ROI | Priority Level |

|---|---|---|

| Marketing Campaigns | High | 1 |

| Technology Upgrades | Medium | 2 |

| Staff Training | High | 1 |

| Office Supplies | Low | 3 |

Moreover, building a cash reserve is essential for weathering unexpected challenges. Aim to save at least three to six months’ worth of expenses. This safety net allows your business to remain agile and responsive to market changes without jeopardizing your growth trajectory.

Lastly, consider seeking advice from financial experts or joining a mentorship program. Learning from the experiences of others can provide invaluable insights and strategies for successful budgeting. Remember, every financial decision you make should reflect your commitment to sustainable growth.

Harnessing the Impact of Smart Financial Planning

In the fast-paced world of small business, having a well-structured financial plan is paramount. This not only provides a roadmap for growth but also equips owners to navigate unforeseen challenges with confidence. By leveraging smart financial planning techniques, small business owners can unlock their potential for success and sustainability.

Key Components of Smart Financial Planning:

- Budgeting: Establishing a realistic budget allows owners to track income and expenses effectively. This practice not only highlights areas for improvement but also reinforces accountability.

- Cash Flow Management: Regular monitoring of cash flow helps prevent shortages and enables timely investment opportunities. Understanding cash flow cycles is crucial for maintaining liquidity.

- Financial Forecasting: Predicting future financial trends based on historical data empowers owners to make informed decisions. This foresight is essential for scaling operations and planning for market changes.

- Debt Management: Keeping debts under control is vital for long-term sustainability. Smart business owners prioritize paying off high-interest debts and strategically manage any necessary borrowing.

Utilizing the right tools can amplify the effectiveness of financial planning. Business intelligence software, accounting applications, and financial modeling tools can provide invaluable insights. By integrating technology into financial strategies, owners can automate processes, reduce errors, and focus on strategic growth.

Furthermore, financial literacy is a game-changer. Owners who invest time in understanding financial statements and metrics are better equipped to make sound decisions. Knowing how to interpret profit and loss statements or balance sheets can illuminate the path to profitability and efficiency.

| Financial Metric | Importance |

|---|---|

| Net Profit Margin | Indicates profitability and operational efficiency. |

| Current Ratio | Measures liquidity and short-term financial health. |

| Debt-to-Equity Ratio | Assesses financial leverage and risk. |

Lastly, fostering a culture of financial discipline within the business can drive collective success. Engaging employees in financial goals and providing them with training enhances overall performance. When everyone is aligned with the financial vision, it cultivates a proactive environment that embraces growth and innovation.

Building a Strong Network: The Key to Financial Success

In the realm of small business, success is rarely a solo endeavor. Cultivating a robust network can significantly increase your chances of financial success. Your connections can offer invaluable resources, such as mentorship, partnership opportunities, and new clients. The more diverse your network, the wider your access to fresh ideas and perspectives. Here are some strategies to enhance your networking efforts:

- Attend Local Events: Participate in workshops, seminars, and networking events in your community. These gatherings are prime opportunities to meet fellow entrepreneurs and potential collaborators.

- Utilize Social Media: Platforms like LinkedIn, Facebook, and Twitter can help you connect with industry leaders and engage with your target audience. Share your expertise and insights to attract like-minded individuals.

- Join Professional Associations: Becoming a member of industry-specific organizations can open doors to exclusive resources, events, and connections that can propel your business forward.

Building a strong network is not just about accumulating contacts; it’s about fostering meaningful relationships. Consider the following attributes when nurturing these connections:

- Reciprocity: Offer your support and expertise to others. A network thrives on mutual benefit, so be willing to give as much as you receive.

- Consistency: Stay connected with your network regularly. A simple check-in can maintain relationships and keep you top-of-mind for referrals and collaborations.

- Authenticity: Be genuine in your interactions. People are drawn to authenticity, which can lead to stronger bonds and trust among your network.

To further illustrate the potential of a well-developed network, consider the following table showcasing successful outcomes from networking efforts:

| Networking Activity | Outcome |

|---|---|

| Local Chamber of Commerce Meeting | Partnership with another small business |

| Social Media Group Engagement | New client acquisition |

| Industry Conference Attendance | Access to mentorship opportunities |

| Professional Association Membership | Exclusive resources and support |

Ultimately, the relationships you cultivate can serve as a powerful foundation for your business’s financial success. Invest time in building and maintaining these connections, and you will find that a strong network can be one of your most valuable assets. Embrace the journey of networking, and let it pave the path to your entrepreneurial achievements.

Embracing Innovation to Enhance Profitability

In today’s rapidly changing marketplace, small business owners must harness the power of innovation to stay competitive and increase their profitability. Embracing new technologies and creative strategies can lead to substantial improvements in efficiency, customer engagement, and ultimately, the bottom line.

To effectively leverage innovation, consider the following approaches:

- Adopt Technology: Utilizing the latest software and platforms can streamline operations. From accounting software to customer relationship management (CRM) systems, technology can automate mundane tasks, allowing you to focus on growth.

- Enhance Customer Experience: Innovate your customer service approach. Use chatbots for instant responses, personalized communication, and feedback loops to understand what your customers truly want.

- Explore New Marketing Strategies: Utilize social media and digital marketing tools to reach a broader audience. Experimenting with content marketing and influencer partnerships can help in attracting new customers.

- Invest in Employee Training: Your team is your greatest asset. Providing ongoing education and resources for your employees can lead to a more skilled workforce that is adaptable to change.

Moreover, innovation is not confined to technology alone. It can also manifest through creative business models and partnerships. For instance, consider collaborating with other local businesses to create bundled offerings that provide value to customers while sharing costs. This not only enhances customer attraction but also fosters community ties.

| Innovation Strategy | Potential Benefits |

|---|---|

| Integrating E-commerce | Expanded market reach and increased sales. |

| Utilizing Data Analytics | Informed decision-making and targeted marketing efforts. |

| Green Practices | Attract environmentally conscious consumers and reduce costs. |

Lastly, do not underestimate the power of feedback. Actively seek input from both customers and employees regarding innovative ideas and improvements. This participatory approach not only generates fresh insights but also cultivates a culture of innovation within your organization.

the journey towards enhanced profitability through innovation is ongoing. By being proactive, embracing change, and remaining open to new ideas, small business owners can transform challenges into opportunities, setting a solid foundation for a successful future.

The Importance of Continuous Learning and Adaptation

The landscape of small business ownership is ever-changing, influenced by economic shifts, technological advancements, and evolving consumer preferences. In this dynamic environment, the most successful entrepreneurs understand that standing still is not an option. Instead, they embrace a mindset of continuous learning and adaptation, recognizing that these elements are crucial for sustained success.

To thrive, small business owners should prioritize the following strategies:

- Embrace Lifelong Learning: The most successful entrepreneurs are often avid learners. They stay informed about industry trends, emerging technologies, and best practices. This commitment often involves reading books, attending seminars, and enrolling in online courses.

- Network with Peers: Engaging with other business owners can provide invaluable insights and fresh perspectives. Sharing experiences, challenges, and solutions fosters a supportive community that encourages growth and innovation.

- Solicit Feedback: Gathering feedback from customers and employees is essential for understanding how to improve products and services. Successful entrepreneurs actively seek constructive criticism and use it to refine their offerings.

- Experiment and Innovate: The willingness to test new ideas and embrace failure as a learning opportunity is a hallmark of successful business leaders. Innovation often arises from trying something new and learning from the outcomes.

Moreover, adaptation isn’t just about learning new skills; it’s also about rethinking strategies and processes. For instance, consider how the pandemic forced many businesses to pivot to online platforms. Entrepreneurs who quickly adapted to this shift not only survived but thrived by reaching new customers and reducing overhead costs.

| Adaptation Strategies | Benefits |

|---|---|

| Leveraging Technology | Increased efficiency and access to wider markets |

| Flexible Business Models | Ability to pivot swiftly in response to market demands |

| Regular Skill Development | Enhanced competitiveness and employee morale |

Ultimately, the journey of a small business owner is a continuous cycle of learning, adapting, and evolving. By committing to these principles, entrepreneurs can ensure their ventures remain relevant and successful, regardless of external challenges. This proactive approach not only empowers business owners but also inspires their teams and customers, creating a ripple effect of positivity and growth.

Effective Marketing Strategies to Boost Revenue

In the competitive landscape of small business, having a clear marketing strategy is essential for driving revenue. Here are some powerful approaches that can transform your outreach and engage your target audience effectively:

- Leverage Social Media Platforms: Utilize platforms like Instagram, Facebook, and LinkedIn to connect with your audience. Share compelling content, showcase customer testimonials, and run targeted ads to increase visibility.

- Email Marketing Campaigns: Build a mailing list and create engaging newsletters. Personalization is key; tailor your messages to specific demographics to increase open rates and drive conversions.

- Content Marketing: Develop valuable content that addresses your customers’ pain points. Blogging, infographics, and videos can position you as an authority in your field and attract organic traffic.

- SEO Optimization: Optimize your website for search engines to improve visibility. Use relevant keywords, create quality backlinks, and ensure a mobile-friendly experience to enhance user engagement.

Experimenting with promotional tactics can also yield significant returns. Consider implementing the following strategies to drive immediate results:

- Limited-Time Offers: Create urgency with flash sales or seasonal discounts. This not only boosts sales but also encourages customer loyalty.

- Referral Programs: Encourage satisfied customers to refer friends and family. Offering incentives for both the referrer and the new customer can enhance your reach and build trust.

- Collaborations and Partnerships: Team up with other local businesses to co-host events or promotions. This can expand your audience and provide mutual benefits.

To track the effectiveness of your marketing strategies, consider using the following metrics:

| Metric | Description | Importance |

|---|---|---|

| Conversion Rate | Percentage of visitors who take a desired action. | Measures effectiveness of marketing efforts. |

| Customer Acquisition Cost | Cost associated with acquiring a new customer. | Helps evaluate the profitability of campaigns. |

| Return on Investment (ROI) | Comparison of net profit to marketing investment. | Indicates overall success of marketing strategies. |

By integrating these strategies into your business model, you can not only increase your revenue but also establish a strong brand presence in your market. Consistent evaluation and adaptation of your marketing plans will ensure sustained success and growth.

Creating a Resilient Cash Flow Management System

Establishing a resilient cash flow management system is vital for any small business aiming for long-term success. Effective cash flow management not only ensures that your operations run smoothly but also empowers you to seize growth opportunities as they arise. Here are essential strategies to create a robust cash flow management system that can withstand economic fluctuations:

- Monitor Cash Flow Regularly: Implement a routine to assess your cash flow on a weekly or monthly basis. This helps you identify trends, anticipate shortages, and make informed decisions.

- Develop Accurate Forecasts: Utilize historical data and market analysis to project future cash flows. Create best-case and worst-case scenarios to prepare for various possibilities.

- Streamline Invoicing Processes: Adopt electronic invoicing to expedite the billing process. Ensure invoices are clear, detailed, and sent promptly to encourage faster payments.

- Encourage Prompt Payments: Consider offering discounts for early payments or imposing late fees on overdue invoices to motivate clients to pay on time.

- Maintain a Cash Reserve: Build a financial cushion to cover unexpected expenses. Aim to save at least three to six months’ worth of operating costs.

Another key aspect is understanding the difference between cash flow and profit. Many small business owners confuse the two, which can lead to mismanagement. Profit is the net income after expenses, while cash flow refers to the movement of cash in and out of your business. To clarify this, consider presenting a simplified cash flow statement:

| Cash Inflows | Cash Outflows |

|---|---|

| Sales Revenue | Operating Expenses |

| Investment Income | Loan Payments |

| Asset Sales | Equipment Purchases |

| Total Cash Inflows | Total Cash Outflows |

In addition, fostering strong relationships with suppliers and clients can provide added flexibility in cash flow management. Establish open lines of communication regarding payment terms and delivery schedules, which can create a more favorable cash flow. Consider negotiating longer payment terms with suppliers while ensuring you maintain a good reputation for timely payments.

Lastly, leverage technology to automate and streamline your cash flow processes. There are numerous software tools available that can help you track expenses, forecast cash flow, and generate reports effortlessly. By embracing technology, you not only save time but also reduce the risk of errors that can arise from manual tracking.

Leveraging Technology for Financial Efficiency

In today’s fast-paced business landscape, small business owners must harness the full potential of technology to streamline operations and enhance financial health. The right technological solutions can automate mundane tasks, allowing owners to focus on strategic growth. Here are several key areas where technology can make a substantial difference:

- Cloud Accounting Software: Utilizing platforms like QuickBooks or Xero can simplify tracking income and expenses, generating real-time insights into your financial status.

- Budgeting Tools: Implementing financial planning tools can help create and adjust budgets effectively, ensuring that spending aligns with business goals.

- Payment Processing Solutions: Streamlining transactions with services like Square or PayPal can reduce overhead costs and improve cash flow.

- Inventory Management Systems: Automating inventory control through systems like TradeGecko can minimize waste and optimize stock levels.

Moreover, leveraging data analytics can provide critical insights into customer behavior and market trends. By analyzing sales data, small business owners can make informed decisions regarding product offerings, pricing strategies, and marketing efforts. This data-driven approach not only reduces risks but also enhances profitability.

| Technology | Benefit |

|---|---|

| Cloud Accounting | Real-time financial tracking |

| Inventory Management | Reduced waste |

| Analytics Tools | Informed decision-making |

Investing in these technologies not only boosts efficiency but also fosters a culture of innovation. Small business owners can stay agile and adapt to changing market conditions, positioning themselves for long-term success. Embracing technology is no longer optional; it’s a necessity for those who want to thrive in a competitive environment.

As financial challenges continue to evolve, so too must the approaches to overcoming them. By remaining open to new technological solutions and continuously seeking ways to improve processes, small business owners can unlock new levels of financial efficiency and drive their businesses forward. The journey to financial success starts with a willingness to adapt and innovate.

Investing in Your Team: The Backbone of Success

When it comes to building a thriving small business, the most valuable asset you possess isn’t your product line or marketing strategy—it’s your team. Investing in your employees goes beyond paying salaries; it encompasses creating an environment that fosters growth, collaboration, and innovation. A committed workforce can elevate your business to new heights, ensuring sustainability and long-term success.

Consider the following ways to invest in your team:

- Training and Development: Equip your team with the skills they need to excel. Regular workshops, online courses, and mentorship programs can enhance their capabilities and confidence.

- Open Communication: Establish a culture where feedback is welcomed and valued. Regular check-ins and open-door policies encourage transparency and trust.

- Employee Recognition: Celebrate achievements, both big and small. Acknowledging your team’s hard work fosters loyalty and encourages a positive work environment.

- Work-Life Balance: Support flexible working arrangements that allow your team to thrive both personally and professionally. Happy employees are more productive and engaged.

Moreover, investing in your team can significantly reduce turnover rates. The cost of replacing an employee can be staggering—often exceeding their annual salary. By nurturing your talent and providing growth opportunities, you cultivate a loyal workforce that is deeply invested in your company’s success.

To illustrate the impact of employee investment, consider the following table:

| Investment Area | Impact on Business |

|---|---|

| Training | Increased efficiency and innovation |

| Recognition | Improved morale and retention |

| Communication | Enhanced teamwork and problem-solving |

| Work-Life Balance | Higher employee satisfaction and productivity |

the secret to a financially successful small business lies in the strength of its team. A well-trained, valued, and motivated workforce not only drives performance but also attracts customers who resonate with your company’s values. Investing in your employees isn’t just good ethics; it’s a savvy business strategy. Commit to their growth, and watch as they propel your business forward.

Understanding Your Market: Research as a Financial Tool

In the fast-paced world of small business, understanding your market is not just an advantage; it’s a necessity. By conducting thorough research, you unveil insights that can drive your financial decisions and set you apart from the competition. This knowledge empowers you to tailor your offerings, optimize pricing strategies, and discover untapped customer segments.

Market research is akin to having a financial compass, guiding you through the complexities of consumer behavior and market trends. Here are some critical aspects to focus on:

- Customer Insights: Understanding who your customers are, what they want, and how they behave can help you create more targeted marketing campaigns that resonate with their needs.

- Competitive Analysis: Analyzing your competitors allows you to identify gaps in the market. Knowing their strengths and weaknesses enables you to position your business effectively.

- Industry Trends: Staying informed about industry trends helps you make proactive decisions. Whether it’s adopting new technologies or shifting your business model, being ahead of the curve can significantly impact your bottom line.

Utilizing tools such as surveys, focus groups, and online analytics not only provides quantitative data but also qualitative insights. This blend helps you craft a more robust business strategy. For example, a simple survey can reveal customer preferences, while analytics can show you how they interact with your online presence.

To illustrate the impact of effective market research, consider the following table detailing potential benefits:

| Benefit | Description |

|---|---|

| Informed Decision-Making | Data-driven decisions reduce risks and enhance profitability. |

| Improved Customer Relationships | Understanding customer needs fosters loyalty and repeat business. |

| Optimized Marketing Spend | Targeted campaigns yield better ROI compared to broad approaches. |

| Innovation Opportunities | Identifying market gaps can lead to new products or services. |

As you delve deeper into market research, remember that the goal is not just to gather data but to find actionable insights. This strategy will help you allocate resources more efficiently and ensure that every dollar spent contributes to your business’s growth.

Ultimately, the most financially successful small business owners are those who strategically utilize market research as a dynamic tool. Embrace this practice, and you will not only enhance your financial acumen but also build a resilient business that thrives in an ever-evolving market landscape.

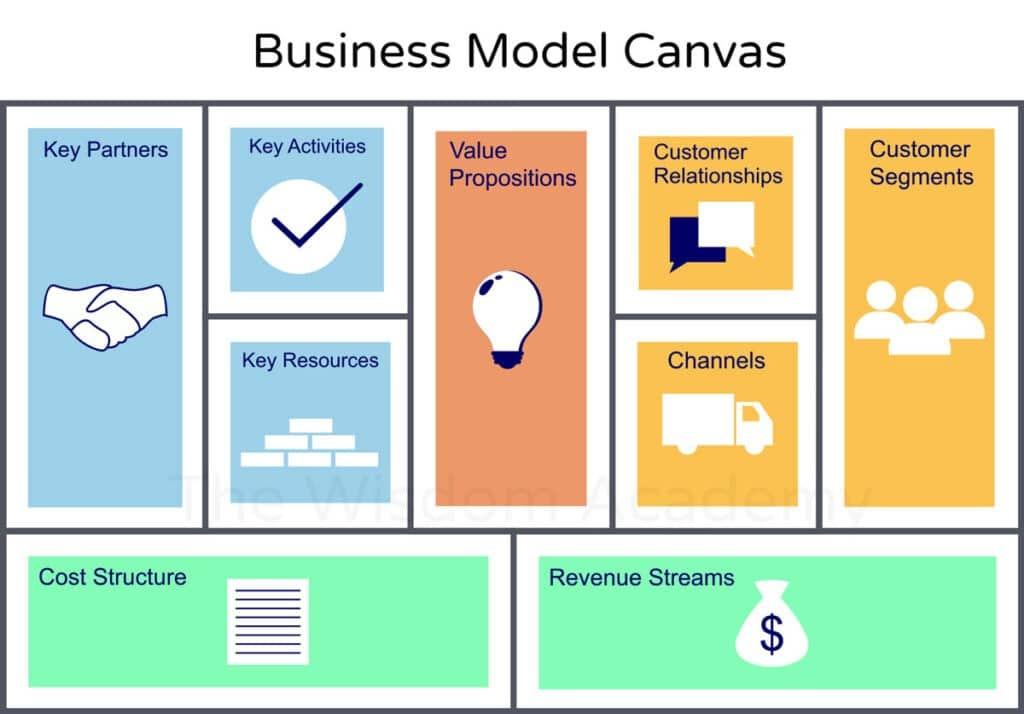

Developing a Robust Business Model for Longevity

Creating a sustainable business model is the backbone of any successful small business. The foundation begins with a clear understanding of your target market. Identify your ideal customers and tailor your offerings to meet their needs. This requires consistent market research and staying updated with trends that affect your audience.

Another essential component is diversification of revenue streams. Relying on a single source of income can be risky. Consider incorporating additional products or services that align with your primary offerings. This not only mitigates risk but also enhances customer loyalty, as clients appreciate a one-stop-shop experience.

Emphasizing customer relationships is vital. Engaging with your customers through personalized communication and feedback channels can help cultivate loyalty. Create a system for collecting customer insights, whether through surveys or direct interactions. Use this information to refine your services continually.

Financial management cannot be overlooked in crafting a successful business model. Maintain a detailed budgeting process and regularly review your financial statements. Understanding your cash flow is key to making informed decisions. Consider using software tools that streamline financial tracking and reporting.

| Revenue Stream | Potential Benefits |

|---|---|

| Product Sales | Direct income and brand recognition |

| Memberships/Subscriptions | Recurring revenue and customer engagement |

| Consultations/Services | Personalized offerings and expertise monetization |

Lastly, always stay adaptable. The marketplace is constantly changing, and being open to innovation can set your business apart from competitors. Embrace technology and explore new ways to reach your audience. Whether it’s enhancing your online presence or leveraging social media platforms, the ability to pivot and adjust can secure your longevity in the business landscape.

The Role of Customer Relationships in Financial Success

In the competitive landscape of small business, the strength of customer relationships can often be the determining factor between success and failure. Building a loyal customer base goes beyond merely providing a product or service; it involves crafting experiences that resonate with clients on a personal level. When customers feel valued and appreciated, they are more likely to return and recommend your business to others.

Successful small business owners understand that each interaction is an opportunity to foster deeper connections. Here are some strategies that can enhance customer relationships:

- Personalization: Tailor communications and offers based on customer preferences and purchase history. This shows that you understand their needs.

- Listening: Actively solicit feedback and genuinely listen to what your customers have to say. Their insights can guide your business decisions and help you improve.

- Consistency: Ensure that every customer interaction reflects your brand’s values and quality. Consistency builds trust and reliability.

- Engagement: Use social media and newsletters to keep in touch with your customers. Share updates, promotions, and stories that resonate with them.

Moreover, the benefits of nurturing these relationships extend beyond just repeat business. A satisfied customer is likely to become a brand advocate. This word-of-mouth marketing is invaluable, as it often leads to new customer acquisition at little to no cost. Consider the following points:

| Customer Relationship Benefits | Impact on Financial Success |

|---|---|

| Increased Loyalty | Higher customer retention rates, leading to stable revenue. |

| Referral Business | New customers gained through recommendations can lower marketing costs. |

| Feedback Loop | Direct insights lead to better products and services, enhancing overall profitability. |

Ultimately, investing in customer relationships is investing in the longevity of your business. By prioritizing these connections, small business owners can create a loyal customer base that not only sustains but actively contributes to financial growth. Remember, the heart of a successful business lies in the relationships it builds; fostering these connections is the secret ingredient that can lead to enduring financial success.

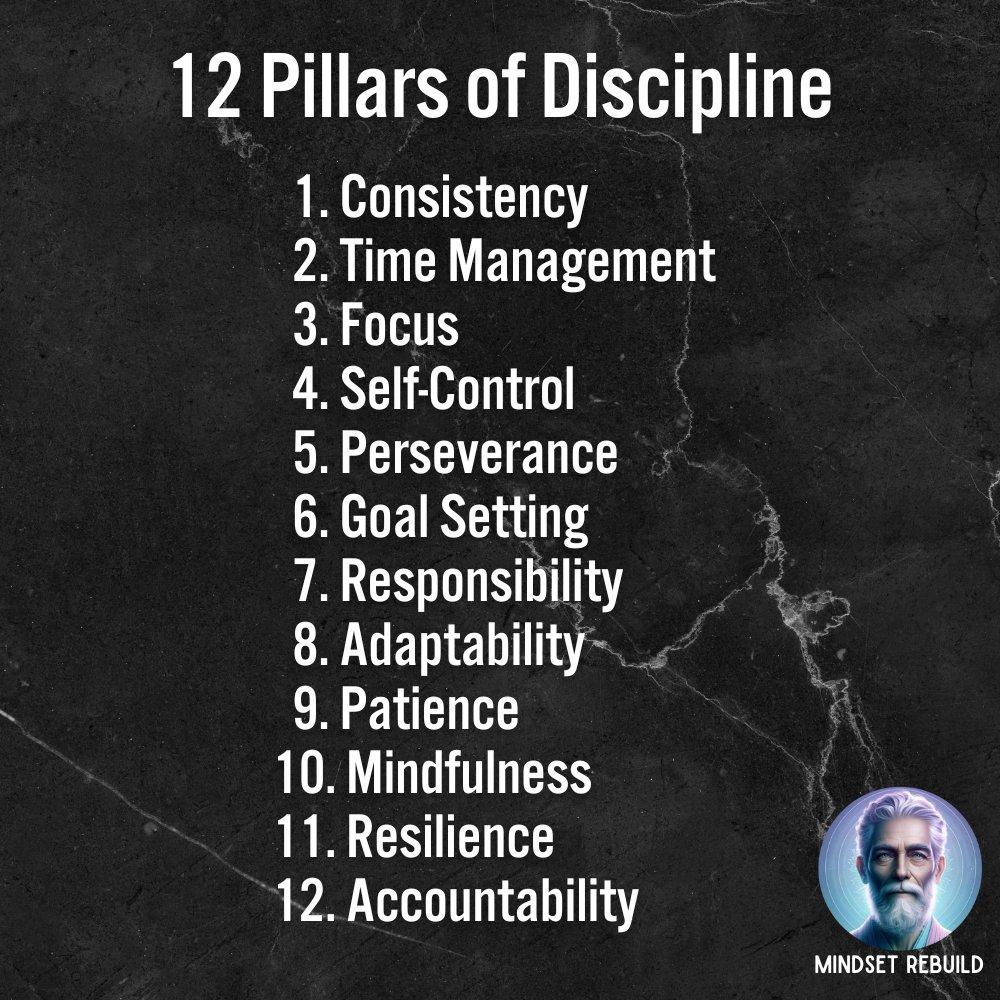

Cultivating a Mindset of Discipline and Commitment

In the world of small business, success is rarely the result of chance; instead, it is cultivated through a steadfast mindset that prioritizes discipline and commitment. These two attributes serve as the backbone of any prosperous venture, allowing owners to navigate challenges and seize opportunities with confidence. When you approach each day with a disciplined mindset, you create a structured environment where goals are not just dreams but actionable targets.

To foster such a mindset, consider implementing the following practices:

- Set Clear Goals: Define what success looks like for your business. Whether it’s achieving a specific revenue target or expanding your customer base, having clear goals will keep you focused.

- Prioritize Tasks: Use tools like to-do lists or project management software to identify and focus on high-impact tasks. This discipline ensures that your efforts align with your overall objectives.

- Maintain a Routine: Establishing a daily or weekly routine can significantly enhance your productivity. Consistency breeds discipline, and a routine helps to solidify that habit.

- Reflect and Adjust: Regularly assess your progress and be willing to pivot. This level of commitment to self-improvement ensures that you’re always moving forward.

Moreover, discipline goes hand-in-hand with commitment. It’s about showing up—no matter how tough things get. Financially successful small business owners understand that commitment is more than just a word; it’s a lifestyle. Here’s how commitment manifests in the daily lives of these entrepreneurs:

- Investing in Learning: Committing to continuous personal and professional development is crucial. Attend workshops, read books, and seek mentorship to stay ahead in your industry.

- Building Relationships: Successful owners dedicate time to nurturing relationships with customers, suppliers, and employees. These connections can lead to invaluable support and opportunities.

- Staying Resilient: Commitment is tested in times of adversity. Those who succeed have the resilience to face challenges head-on and come out stronger.

To visualize the impact of discipline and commitment on your business, consider the following table that outlines key outcomes for disciplined entrepreneurs versus those who lack focus:

| Aspect | Disciplined Owners | Less Disciplined Owners |

|---|---|---|

| Goal Achievement | Consistently meet or exceed | Struggle to reach |

| Time Management | Effective prioritization | Frequent distractions |

| Adaptability | Proactively adjust strategies | Reactive and slow to change |

| Business Growth | Steady and sustainable | Erratic and uncertain |

Ultimately, the journey to becoming a financially successful small business owner is paved with discipline and unwavering commitment. Embrace these qualities, and you will not only enhance your business acumen but also inspire those around you to strive for greatness. After all, in the realm of entrepreneurship, it’s not just about making money; it’s about building a legacy fueled by hard work and perseverance.

Frequently Asked Questions (FAQ)

Q&A: Secrets of Financially Successful Small Business Owners

Q1: What is the most important mindset a small business owner should have for financial success?

A1: The most crucial mindset for financial success is a growth-oriented perspective. Successful entrepreneurs view challenges as opportunities for learning and growth. They embrace innovation, remain adaptable to market changes, and are persistent in pursuing their goals. By fostering a mindset of resilience and positivity, you not only enhance your problem-solving abilities but also inspire your team to strive for excellence, creating a culture that thrives on creativity and collaboration.

Q2: How do financially successful small business owners approach budgeting?

A2: Successful business owners treat budgeting as a dynamic roadmap rather than a static plan. They meticulously track their income and expenses, understand their cash flow, and make data-driven decisions. By setting realistic financial goals and regularly reviewing their budget, they can identify areas for improvement and allocate resources efficiently. This proactive approach allows them to anticipate challenges and seize opportunities, ultimately leading to sustained growth.

Q3: What role does networking play in the financial success of small business owners?

A3: Networking is a powerful catalyst for growth and financial success. Building strong relationships with other business owners, mentors, and industry leaders opens doors to valuable resources, partnerships, and opportunities. Successful entrepreneurs actively engage in their communities, attend industry events, and leverage social media to expand their network. These connections often lead to collaborations, referrals, and insights that can dramatically enhance profitability and visibility.

Q4: How important is having a solid marketing strategy for small business financial success?

A4: A well-crafted marketing strategy is essential for attracting and retaining customers. Successful small business owners understand their target audience and tailor their marketing efforts accordingly. They utilize a mix of digital and traditional marketing channels to build brand awareness and drive sales. By continuously analyzing the effectiveness of their strategies and staying ahead of market trends, they can adapt and optimize their campaigns, ensuring a steady flow of revenue and growth.

Q5: What financial tools do successful small business owners rely on?

A5: Financially savvy small business owners leverage various tools to streamline their operations and enhance financial management. They utilize accounting software for accurate bookkeeping, cash flow management tools to monitor financial health, and analytics platforms to track performance metrics. Additionally, they often seek professional advice from financial advisors or accountants to navigate complex financial landscapes, ensuring they make informed decisions that support their long-term goals.

Q6: Can you share a powerful tip for maintaining financial discipline?

A6: One of the most effective tips for maintaining financial discipline is to automate your savings and expenses. Establishing automatic transfers to your savings account or investment funds ensures that you prioritize your financial goals without relying solely on willpower. This approach minimizes the temptation to overspend and creates a habit of saving that can significantly impact your business’s financial health over time. Remember, consistent small actions lead to substantial results!

Q7: What final piece of advice do you have for aspiring small business owners aiming for financial success?

A7: Embrace the journey with passion and purpose. Financial success is not merely about numbers; it’s about creating value for your customers, building a strong team, and making a positive impact in your community. Set clear goals, stay committed to your vision, and continuously educate yourself on best practices and emerging trends. Surround yourself with a supportive network, and never hesitate to seek help when needed. Your determination and perseverance will be the keys to unlocking your business’s true potential. Remember, every great success story begins with a dream and the courage to pursue it relentlessly!

The Conclusion

the journey to becoming a financially successful small business owner is paved with challenges, but it is also rich with opportunities for growth and innovation. By embracing the secrets we’ve discussed—strategic planning, diligent financial management, building a strong network, and a commitment to continuous learning—you can transform your business aspirations into reality. Remember, every successful entrepreneur started somewhere, facing their own set of hurdles.

As you take the next steps on your path, keep your vision clear and your determination strong. Surround yourself with mentors, seek out knowledge, and remain adaptable in the face of change. The world of small business is not just about survival; it’s about thriving, creating, and making an impact.

So, dare to dream big and take action today. Your success story is waiting to be written. With passion, perseverance, and the right strategies, you hold the key to unlocking your full potential as a small business owner. Embrace the journey, trust in your abilities, and watch as your hard work transforms into lasting success. The future is not just what happens to you; it’s what you create. Let’s make it extraordinary!