Direct bank transfers are revolutionizing online payments, offering unmatched security and convenience. Say goodbye to complex passwords and fees! Embrace this seamless method that empowers you to transact with confidence and take control of your finances.

How Direct Bank Transfers Are Changing the Way We Pay Online

In a world where convenience reigns supreme and technology continually reshapes our daily lives, the way we handle our finances is undergoing a revolutionary transformation. Enter direct bank transfers, a payment method that is swiftly becoming a game changer in the realm of online transactions. No longer confined to the traditional routes of credit cards and third-party payment services, direct bank transfers are empowering consumers and businesses alike to embrace a faster, safer, and more streamlined approach to managing their finances. As we delve into this transformative shift, we will explore how direct bank transfers not only enhance security and reduce fees but also foster a sense of trust and simplicity in an ever-complex digital marketplace. Join us on this journey as we unveil the profound impact of direct bank transfers on the future of online payments, inspiring a new wave of financial freedom and accessibility for everyone.

The Rise of Direct Bank Transfers in the Digital Age

The landscape of online payments is evolving rapidly, and at the forefront of this transformation is the increasing popularity of direct bank transfers. No longer confined to traditional banking environments, these transfers are now being embraced by users seeking efficiency, security, and simplicity in their financial transactions.

Why Direct Bank Transfers Are Gaining Traction:

- Speed: Direct bank transfers can often be completed within minutes, allowing for immediate transactions that are crucial in today’s fast-paced digital marketplace.

- Cost-Effectiveness: Many financial institutions offer lower fees for direct transfers compared to credit card transactions, making it an attractive option for both consumers and merchants.

- Security: With advanced encryption and direct connections to banks, these transfers reduce the risk associated with sharing sensitive financial information.

- Convenience: Users can initiate transfers easily from their banking apps or websites, eliminating the need for third-party payment processors.

As digital wallets and payment apps continue to proliferate, businesses are recognizing the necessity of integrating direct bank transfer options into their payment systems. This not only enhances the customer experience but also fosters trust and loyalty. A seamless payment process is integral to retaining customers, and direct bank transfers provide a straightforward solution that aligns with modern consumer expectations.

For businesses considering this shift, it’s essential to understand the demographic trends driving these changes. A growing number of consumers, especially millennials and Generation Z, prefer banking solutions that prioritize transparency and direct engagement with their financial institutions. The traditional reliance on credit cards is giving way to a more holistic approach to banking, where direct transfers take center stage.

| Advantages of Direct Bank Transfers | Traditional Payment Methods |

|---|---|

| Lower transaction fees | Higher transaction fees |

| Instant processing | Possible delays |

| Enhanced security | Vulnerability to fraud |

| Direct connection to banks | Third-party intermediaries |

In this digital age, the adoption of direct bank transfers is not just a trend; it’s a movement towards a more efficient and user-focused financial ecosystem. As technology continues to advance and consumer preferences shift, those who adapt to these changes will find themselves at the forefront of the financial revolution. Embracing this method of payment is not only practical but also a step towards shaping a future where banking is more accessible and user-friendly than ever before.

Transforming Convenience: Why Direct Bank Transfers Are the Future

The digital payment landscape is undergoing a seismic shift, as more consumers and businesses recognize the inherent advantages of direct bank transfers. This payment method is not just a passing trend; it represents a fundamental change in how transactions are conducted online, fostering efficiency and security.

One of the most compelling reasons to embrace direct bank transfers is the unmatched convenience they offer. Unlike traditional payment methods, which often involve multiple steps and potential fees, direct transfers streamline the process. With just a few clicks, users can send and receive funds directly between bank accounts without the need for intermediaries. This not only saves time but also reduces the frustration often associated with lengthy payment processes.

The security that comes with direct bank transfers is another key advantage. As cyber threats evolve, consumers are increasingly concerned about the safety of their financial information. Direct transfers minimize the risk of sensitive data exposure, as they do not require users to share credit card details or personal information through third-party platforms. This inherent security feature provides peace of mind to both consumers and merchants, making it a preferred choice for many.

Moreover, direct bank transfers are paving the way for greater financial inclusion. By allowing individuals without access to traditional banking facilities to engage in online transactions, this method democratizes financial services. Innovative solutions, such as mobile banking apps that enable direct transfers, are empowering users in underserved regions, fostering a more equitable financial landscape.

To illustrate the growing trend, let’s compare traditional payment methods against direct bank transfers:

| Feature | Traditional Payment Methods | Direct Bank Transfers |

|---|---|---|

| Processing Time | 1-3 days | Instant |

| Transaction Fees | Varies (up to 3% or more) | Often No Fees |

| Security | Moderate | High |

| Accessibility | Requires credit card | Bank account only |

This comparison highlights the advantages that direct bank transfers bring to the table. As businesses and consumers alike recognize these benefits, it’s clear that this method will soon become the norm in online payments.

Lastly, as technology continues to evolve, so too will the capabilities of direct bank transfers. From blockchain innovations to enhanced mobile payment systems, the future holds exciting possibilities for this payment method. By embracing direct bank transfers, users can be at the forefront of this transformation, harnessing the power of simplicity, security, and efficiency in their online transactions.

Unlocking Security: How Direct Bank Transfers Protect Your Finances

In an era where digital transactions dominate, the need for security has never been greater. One of the most effective ways to ensure that your financial information remains safe is through direct bank transfers. This payment method not only simplifies the transaction process but also adds layers of protection that traditional methods often lack.

When you choose direct bank transfers, you are opting for a payment method that minimizes the risk of fraud. Unlike credit cards or third-party payment services, direct transfers operate on secure banking networks. This means your sensitive data is less likely to be intercepted by malicious actors. With fewer intermediaries involved, the potential for data breaches significantly decreases, providing peace of mind in an age of rampant cyber threats.

Another compelling reason to embrace direct bank transfers is the cost-effectiveness they offer. Many banks do not charge fees for direct transfers, making them a financially savvy choice. In contrast, credit card companies and payment processors often impose transaction fees that can add up, especially for businesses. By reducing these costs, direct transfers allow you to retain more of your hard-earned money.

Moreover, the speed at which direct transfers are processed cannot be overstated. Transactions that once took days can now be completed within hours or even minutes. This immediacy not only enhances your cash flow but also ensures that your payments are made right when they are needed. Whether you’re a consumer paying for a product or a business settling invoices, the efficiency of direct transfers keeps everything running smoothly.

Here are some key benefits of using direct bank transfers:

- Enhanced Security: Reduced risk of fraud and data breaches.

- Lower Fees: Minimized transaction costs compared to credit cards.

- Faster Processing: Quick transaction times that improve cash flow.

- Convenience: Easy to use for both individuals and businesses.

As we move toward a more digitized world, the shift to direct bank transfers is a natural evolution in how we handle payments. Banks continually invest in technology to enhance security measures, ensuring that your finances are protected at every step. Choosing this method not only safeguards your assets but also aligns you with a future where financial transactions are seamless and secure.

| Feature | Direct Bank Transfers | Credit Cards | Third-Party Services |

|---|---|---|---|

| Security | High | Moderate | Variable |

| Fees | Low/None | High | Variable |

| Processing Time | Fast | Instant | Variable |

| Convenience | Easy | Convenient | Moderate |

Cost Efficiency: The Hidden Savings of Choosing Direct Bank Transfers

In the evolving landscape of online payments, direct bank transfers are emerging as a game changer, not just for convenience but also for their potential to create significant savings. Many businesses and individuals often overlook the cost implications of their payment choices, but opting for bank transfers can reveal a treasure trove of hidden savings.

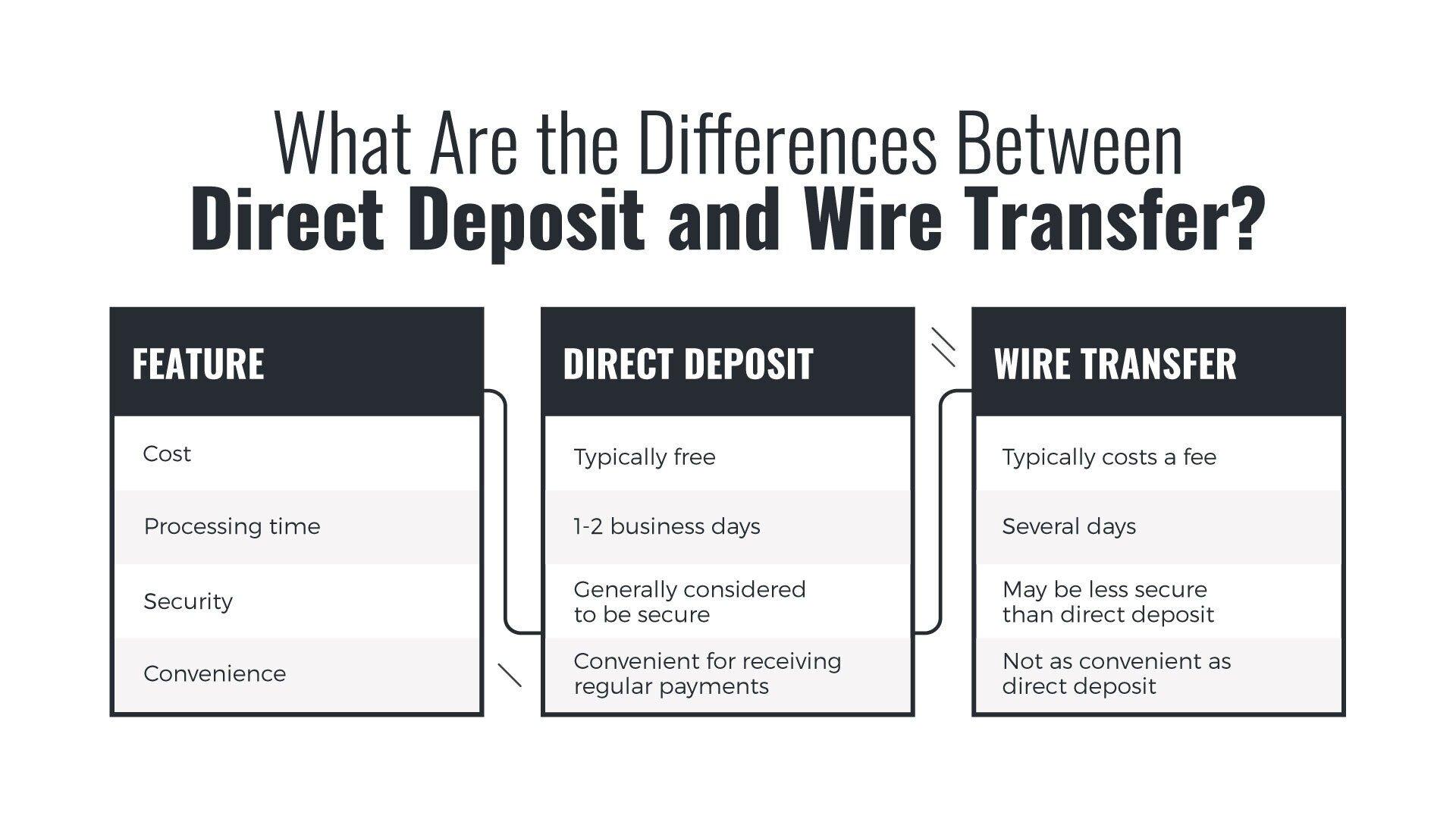

Transaction Fees: Traditional payment methods, such as credit cards or third-party payment processors, often come with hefty transaction fees. These can eat into profit margins and reduce the overall value of a transaction. On the other hand, direct bank transfers typically incur minimal or no fees. This shift can lead to substantial savings, especially for businesses with high transaction volumes.

Time Efficiency: While it may seem like a minor detail, the speed of transactions can also impact overall costs. Direct bank transfers usually process payments quickly and directly between accounts, eliminating the delays associated with intermediaries. This efficiency not only enhances cash flow but also reduces the time spent managing payments, allowing businesses to allocate resources to more productive areas.

Security and Fraud Prevention: By choosing direct bank transfers, businesses can reduce the risk of fraud often associated with credit card processing. Fewer intermediaries mean less exposure to potential cyber threats, which can be costly to manage. Establishing a secure payment method not only protects valuable assets but also fosters trust between businesses and customers, leading to repeat sales and long-term relationships.

Streamlined Accounting: Managing finances can be a daunting task, especially for small businesses. Direct bank transfers simplify the accounting process, as they result in clear and straightforward records. This clarity can reduce the time and costs associated with bookkeeping, allowing business owners to focus on growth rather than administrative burdens.

| Payment Method | Average Fees | Processing Time |

|---|---|---|

| Direct Bank Transfer | Low or No Fees | Instant to 1 Day |

| Credit Card | 2% – 3% per Transaction | 1-3 Days |

| Third-party Payment Processors | 3% – 5% per Transaction | 1-5 Days |

Ultimately, the decision to embrace direct bank transfers is not just a tactical financial choice; it is a strategic move that can redefine how businesses operate. By identifying and leveraging the hidden savings inherent in this payment method, businesses can enhance their profitability, efficiency, and sustainability in the competitive online marketplace.

Speed Matters: Instant Payments and Their Impact on Online Shopping

In the fast-paced world of online shopping, speed can be the difference between a satisfied customer and a lost sale. Direct bank transfers are revolutionizing the way we pay online, offering a frictionless experience that meets consumer demand for immediacy. As technology evolves, so too do the expectations of shoppers who want their transactions to be smooth and instantaneous. The shift towards instant payments not only enhances the shopping experience but also builds trust and loyalty among customers.

Consider the advantages of embracing direct bank transfers:

- Instant Processing: Unlike traditional payment methods that can take days to settle, direct bank transfers allow for near-instantaneous transactions, empowering customers to complete their purchases without delay.

- Enhanced Security: With the increasing number of online fraud cases, direct bank transfers offer enhanced security features, providing peace of mind for both merchants and consumers.

- Lower Transaction Costs: Businesses can save on processing fees associated with credit card transactions, allowing them to pass savings onto customers or reinvest in their operations.

- Global Reach: Direct bank transfers facilitate cross-border transactions, making it easier for businesses to tap into international markets and for customers to shop globally.

Online retailers are already noticing a significant impact on their conversion rates following the integration of instant payment options. According to recent studies, businesses that adopted direct bank transfers reported:

| Benefit | Percentage Increase |

|---|---|

| Conversion Rates | 25% |

| Repeat Purchases | 30% |

| Customer Satisfaction | 40% |

As consumers experience the speed and convenience of direct bank transfers, their expectations will continue to grow. The ability to make instant payments not only satisfies their demand for immediacy but also positions businesses as forward-thinking and customer-centric. This shift is not merely a trend; it’s a fundamental change in how we perceive and execute online transactions.

In a landscape where every second counts, adopting direct bank transfers is not just an operational choice; it is a strategic imperative. By prioritizing speed and efficiency, businesses can create a more engaging shopping experience that fosters loyalty and drives sales. As the digital marketplace becomes increasingly competitive, those who harness the power of instant payments will undoubtedly stand out as leaders in innovation and customer satisfaction.

Empowering Businesses: The Benefits of Embracing Direct Bank Transfers

In today’s fast-paced digital economy, businesses are constantly seeking innovative solutions to streamline transactions and improve customer experience. Direct bank transfers are emerging as a powerful alternative to conventional payment methods, offering numerous advantages that can significantly enhance business operations.

Cost Efficiency is one of the most compelling reasons to adopt direct bank transfers. By eliminating intermediaries such as credit card processors, businesses can save on transaction fees. These cost savings can then be reinvested into other areas of the business, such as marketing or product development, ultimately driving growth.

Moreover, direct bank transfers enhance transaction speed. Unlike traditional payment methods that may take several days to process, bank transfers can often be completed within the same day. This rapid processing not only improves cash flow but also increases customer satisfaction, as buyers appreciate swift and efficient service.

Another significant benefit is the heightened security that direct bank transfers provide. With advanced encryption and fraud detection technologies, businesses can minimize the risk of chargebacks and fraudulent transactions, giving both merchants and customers peace of mind. The transparency of bank transfers also fosters trust, as customers can easily verify their payments.

Accessibility is another advantage worth mentioning. With the rise of online banking, direct bank transfers have become more accessible to consumers across various demographics. This inclusivity means that businesses can cater to a broader audience, tapping into markets that may have previously been overlooked.

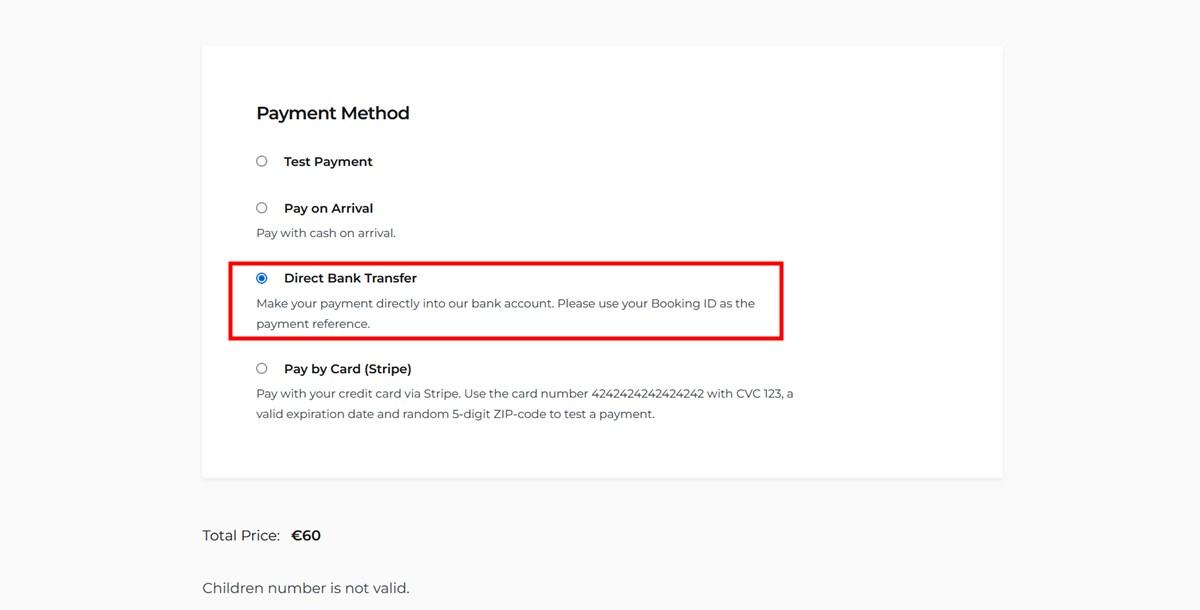

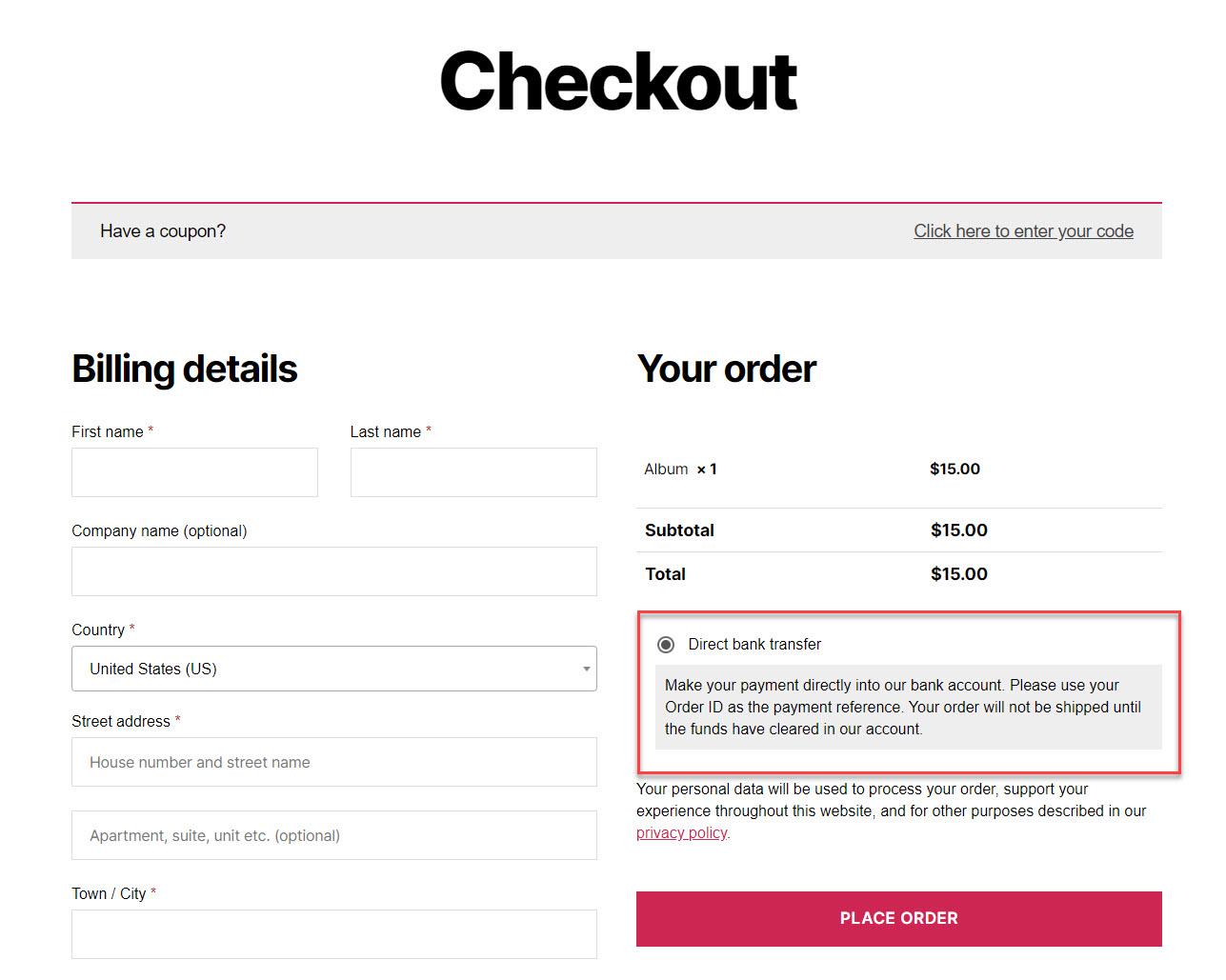

Additionally, direct bank transfers allow for improved customer experience. By offering a familiar and straightforward payment method, businesses can create a seamless checkout process that encourages higher conversion rates. Customers appreciate the convenience and often prefer to use a method that requires fewer steps and less hassle.

| Benefit | Description |

|---|---|

| Cost Efficiency | Lower transaction fees compared to credit cards. |

| Speed | Transactions can be completed quickly, often within the same day. |

| Security | Reduced risk of fraud and chargebacks with secure encryption. |

| Accessibility | Available to a wide range of demographics through online banking. |

| Customer Experience | Simpler and faster checkout process enhances user satisfaction. |

By embracing direct bank transfers, businesses are not only optimizing their operations but also positioning themselves as forward-thinking entities in a competitive market. The transformative power of these transactions can lead to lasting relationships with customers and sustained growth in the ever-evolving landscape of online commerce.

User Experience Revolution: Simplifying Transactions for Everyone

In an era where convenience reigns supreme, the adoption of direct bank transfers is leading a transformative movement in online payment systems. This innovation is not just a trend; it’s a fundamental shift towards making transactions more accessible and efficient for everyone. With the integration of direct bank transfers, the complexities that once accompanied online payments are being dismantled, paving the way for a future where every individual can engage in digital commerce with ease.

Consider the traditional barriers that have long plagued online payments:

- Multiple payment gateways that often confuse users.

- Hidden fees that undermine trust in digital transactions.

- Lengthy processing times that can frustrate buyers.

- Security concerns that deter potential customers.

Direct bank transfers address these pain points head-on. By allowing users to transact directly from their bank accounts, we eliminate the need for intermediaries. This not only streamlines the payment process but also enhances security. Users can enjoy:

- Faster transaction times, with funds moving almost instantly.

- Lower overall costs, as fees associated with third-party processors diminish.

- A more transparent experience, where users see exactly what they are paying without hidden charges.

Moreover, the simplicity of direct bank transfers fosters inclusivity. Individuals who may have previously felt alienated by complex payment systems now find it easier to participate in the digital economy. This democratization of online payments is particularly impactful for:

- Small business owners who can operate without high transaction fees.

- Gig economy workers who require swift payment processing.

- Consumers in underserved regions who benefit from easier access to online shopping.

To illustrate the impact of this shift, consider the following table showcasing the advantages of direct bank transfers compared to traditional payment methods:

| Payment Method | Transaction Speed | Fees | Security Level |

|---|---|---|---|

| Direct Bank Transfer | Instant | Low | High |

| Credit Card | 1-3 Days | Moderate | Medium |

| PayPal | Instant | High | Medium |

This evolution in payment technology not only streamlines transactions but also cultivates trust between businesses and consumers. As direct bank transfers continue to gain traction, we can envision a robust ecosystem where digital payments are not just a convenience but a seamless part of everyday life. The future is bright for a payment landscape that is simpler, faster, and more inclusive—one where everyone can thrive.

Connecting Globally: Direct Bank Transfers and Cross-Border Payments

In an increasingly interconnected world, the way we manage our finances is evolving at a rapid pace. Direct bank transfers and cross-border payments have emerged as pivotal tools that empower individuals and businesses to engage globally with ease and efficiency. This transformation is not merely a technological upgrade; it represents a shift in how we perceive and execute financial transactions.

Speed and Efficiency

One of the most significant advantages of direct bank transfers is the speed at which transactions can be completed. Unlike traditional methods that often require days for clearance, modern banking technologies facilitate almost instantaneous transfers. This immediacy is critical in today’s fast-paced market where delays can lead to missed opportunities. With just a few clicks, you can initiate a transaction that reaches its destination in real-time, breaking down geographical barriers.

Cost-Effectiveness

In addition to speed, direct bank transfers often come with lower fees compared to other payment methods, especially for cross-border transactions. Many financial institutions have begun to waive or reduce transfer fees, making it more affordable for businesses and consumers alike to send money internationally. This democratization of financial services allows more people to participate in the global economy without the burden of excessive costs.

Enhanced Security

Security is a paramount concern when it comes to financial transactions. Direct bank transfers utilize advanced encryption and authentication technologies to safeguard users’ information and funds. The peace of mind that comes from knowing your money is protected cannot be overstated. Consumers can confidently engage in cross-border payments, trusting that their financial data remains secure.

Accessibility and Inclusivity

As the world becomes more digital, accessibility to banking services is crucial. Direct bank transfers are increasingly available to people in regions that previously had limited financial services. This inclusivity empowers individuals and small businesses, allowing them to engage in international trade and investment opportunities that were once reserved for larger corporations. By bridging the gap, direct transfers foster economic growth and innovation on a global scale.

| Feature | Traditional Methods | Direct Bank Transfers |

|---|---|---|

| Transaction Speed | 3-5 Days | Instant |

| Transfer Fees | High | Low or No Fees |

| Security Level | Moderate | High |

| Accessibility | Limited | Widespread |

As we embrace these changes, the future of online payments holds exciting possibilities. The rise of direct bank transfers is reshaping our financial landscape, making it more transparent, efficient, and user-friendly. With each transaction, we are not just moving money; we are building connections, fostering trust, and paving the way for a truly global economy.

The Role of Technology in Shaping Direct Bank Transfer Solutions

The advancement of technology has significantly transformed the landscape of banking, particularly in the realm of direct bank transfers. As consumers increasingly seek seamless and efficient payment solutions, technology has risen to the occasion, streamlining processes that were once cumbersome and time-consuming. This evolution not only enhances user experience but also fosters greater confidence in online transactions.

Today’s direct bank transfer solutions leverage cutting-edge technologies to offer a multitude of benefits:

- Speed and Efficiency: Transfers that previously took days can now be completed in real-time, thanks to innovations like instant payment systems.

- Security Enhancements: Advanced encryption methods and biometric authentication ensure that transactions are secure, instilling greater trust among users.

- User-Friendly Interfaces: Modern applications focus on intuitive design, allowing users to navigate payment processes effortlessly.

- Cost-Effectiveness: Lower transaction fees compared to traditional banking methods make direct bank transfers a financially savvy choice for consumers and businesses alike.

Moreover, the integration of artificial intelligence and machine learning into direct bank transfer systems has ushered in a new era of personalization. By analyzing user behavior, these systems can offer tailored services, such as predictive suggestions for payment amounts or reminders for upcoming bills. This level of personalization enhances user engagement and optimizes the payment experience.

Collaboration between financial institutions and fintech startups further accelerates the development of innovative solutions. This partnership fosters a culture of creativity, where ideas can rapidly evolve into practical applications. As a result, new features such as cross-border transfers, multi-currency support, and the option for recurring payments are becoming commonplace, effectively breaking down barriers in global commerce.

To illustrate the transformative impact of technology on direct bank transfers, consider the following comparison of traditional methods versus modern solutions:

| Aspect | Traditional Method | Modern Direct Bank Transfer |

|---|---|---|

| Transfer Time | 1-3 Business Days | Instant |

| Transaction Fees | High | Low/No Fees |

| Security | Basic Encryption | Advanced Multi-Factor Authentication |

| User Experience | Complex | Streamlined and Intuitive |

As technology continues to evolve, the future of direct bank transfers looks promising. We are on the brink of even more revolutionary changes, with concepts like blockchain and decentralized finance (DeFi) paving the way for innovative payment solutions that prioritize speed, security, and user satisfaction. Embracing these advancements not only empowers consumers but also fosters a more interconnected and efficient global economy.

Building Trust: How Direct Bank Transfers Foster Consumer Confidence

In today’s digital landscape, the way we handle transactions is rapidly evolving, and direct bank transfers are at the forefront of this transformation. Unlike traditional payment methods that often involve intermediaries, direct transfers facilitate a smoother transaction process, fostering a sense of security for consumers. When individuals know that their financial information is being handled directly by their bank, it can significantly enhance their confidence in making online purchases.

Moreover, direct bank transfers eliminate many of the risks associated with credit card transactions, such as fraud or chargebacks. This straightforward approach not only reduces the potential for errors but also protects consumers from unauthorized access to their funds. As digital wallets and online payment platforms gain popularity, the transparency and reliability of bank transfers stand out, reassuring customers that their money is safe.

Some key benefits that contribute to building trust through direct bank transfers include:

- Lower Fees: Direct transfers often incur fewer fees compared to credit card transactions, making them a cost-effective option for consumers and businesses alike.

- Faster Transactions: Many banks offer real-time processing of transfers, allowing consumers to receive the funds almost instantly, which enhances their satisfaction and trust in the payment process.

- Privacy and Security: Direct bank transfers typically provide a higher level of security, as they do not require the sharing of sensitive credit card information.

- Ease of Use: With growing familiarity, consumers find direct transfers to be a convenient and user-friendly alternative to more complex payment systems.

Furthermore, the integration of advanced security measures like two-factor authentication and encryption adds another layer of protection to direct bank transfers. These technological advancements not only safeguard transactions but also reinforce the perception of banks as trusted institutions. As consumers become more aware of these features, their confidence in using direct transfers for online payments continues to rise.

To illustrate the growing trust in direct bank transfers, consider the following comparison of consumer preferences:

| Payment Method | Consumer Trust Rating (%) |

|---|---|

| Direct Bank Transfer | 85% |

| Credit Card | 70% |

| Digital Wallet | 65% |

As evident in this data, direct bank transfers command a higher level of trust among consumers compared to other payment methods. This growing confidence is not just a passing trend; it represents a shift in consumer behavior towards more reliable and secure ways of managing their finances. Consequently, businesses that adopt and promote direct bank transfers can benefit from enhanced customer loyalty and increased sales.

Future Trends: What’s Next for Direct Bank Transfers in E-Commerce

As technology continues to advance, direct bank transfers are poised to redefine the landscape of e-commerce payments. The growing demand for quicker, safer, and more transparent payment methods is pushing businesses to adopt direct bank transfers as a viable solution. This shift not only enhances customer experience but also streamlines the operational aspects of online transactions.

One of the most significant trends on the horizon is the integration of real-time payment systems. With the adoption of instant payment platforms, transactions can be completed within seconds, eliminating the lengthy processing times associated with traditional methods. This level of immediacy will not only satisfy consumer impatience but also significantly improve cash flow for businesses.

- Enhanced Security Protocols: As cyber threats evolve, so too do the security measures protecting direct bank transfers. Advanced encryption techniques and biometric authentication will likely become standard, ensuring that consumers feel safe when providing sensitive information.

- Increased Adoption of Blockchain Technology: Blockchain offers a decentralized and secure framework for transactions. Its capacity to provide transparent records of transfers could encourage more businesses to embrace direct bank transfers.

- Mobile Banking Integration: With the rise of mobile commerce, direct bank transfers will increasingly be integrated into mobile banking apps, allowing users to make payments directly from their phones with just a few taps.

Moreover, the rise of cross-border transactions is set to alter the e-commerce payment landscape significantly. Businesses will be able to engage with international customers seamlessly, thanks to direct bank transfers that minimize transaction fees and reduce the risk of currency conversion discrepancies. This will open new markets for merchants and empower consumers globally.

Another exciting development is the emphasis on personalization. E-commerce platforms will leverage data analytics to tailor payment experiences to individual preferences, creating user-friendly checkout processes that prioritize direct bank transfers where applicable. By allowing customers to choose their preferred payment method while highlighting the benefits of direct transfers, businesses can enhance conversion rates and customer loyalty.

| Trend | Description |

|---|---|

| Real-time Payments | Instant transactions that enhance customer satisfaction and cash flow. |

| Enhanced Security | Advanced encryption and biometric security measures to protect users. |

| Blockchain Adoption | Decentralized and secure transaction records to build trust. |

| Mobile Integration | Streamlined payments through mobile banking apps for convenience. |

| Global Transactions | Facilitate easy access to international markets with lower fees. |

as direct bank transfers continue to gain traction, they will not only reshape the way consumers interact with online merchants but will also drive innovation in payment technologies. Embracing these changes will empower businesses to thrive in an increasingly competitive e-commerce environment, setting the stage for a new era of financial transactions that prioritize speed, security, and user experience.

Making the Switch: Practical Steps to Transition to Direct Bank Transfers

Transitioning to direct bank transfers can seem daunting, but with the right approach, it can be a seamless process that enhances your financial transactions. Here are some practical steps to guide you through this shift.

- Research Your Options: Start by exploring various banks and financial institutions that offer direct transfer services. Look for features such as low fees, speed of transactions, and user-friendly interfaces.

- Set Up Online Banking: Ensure you have a robust online banking setup. Most banks provide a secure platform for managing your accounts and conducting transfers, making the process more efficient.

- Verify Your Details: Double-check your bank account details, including account numbers and routing information, to avoid any errors during transfers.

- Educate Yourself on Security: Understand the security measures in place for direct bank transfers. Familiarize yourself with encryption, two-factor authentication, and other protective measures offered by your bank.

Once you’ve laid the groundwork, the next step is to inform your contacts and vendors about your new payment method. This not only helps in building trust but also encourages others to adopt the same method.

Consider keeping a transaction log to track your payments, which can help you identify any discrepancies and monitor your spending habits. A simple table can help organize your transactions:

| Date | Payee | Amount | Status |

|---|---|---|---|

| 2023-10-01 | Supplier A | $150.00 | Completed |

| 2023-10-05 | Service Provider B | $75.00 | Pending |

embrace the change! Adapting to direct bank transfers not only streamlines your transactions but also provides a heightened sense of control over your finances. Enjoy the convenience and security that come with making the switch, and watch as your payment processes become more efficient and reliable.

Inspiring Change: Encouraging Wider Adoption of Direct Bank Transfers

As we navigate an increasingly digital landscape, the way we conduct financial transactions is evolving at an unprecedented pace. Direct bank transfers are emerging as one of the most promising solutions to enhance payment efficiency and security. By embracing this method, businesses, consumers, and financial institutions alike can foster a culture of trust and innovation.

One of the key advantages of direct bank transfers is their ability to streamline the payment process. Unlike traditional payment methods that often involve multiple intermediaries, direct transfers eliminate unnecessary steps, making transactions faster and more reliable. This shift not only reduces transaction fees but also minimizes the risk of fraud, which is a growing concern in an era where cybersecurity threats are rampant. As more users experience the benefits firsthand, the appeal of direct bank transfers will continue to grow.

To encourage wider adoption, it is essential to address common misconceptions surrounding direct bank transfers. Many potential users fear that these transactions may be complicated or time-consuming, when in fact, they can be incredibly user-friendly. By leveraging intuitive interfaces and clear instructions, businesses can demystify the process and showcase the simplicity of direct transfers. Consider the following strategies to promote understanding:

- Educational Content: Create informative articles, videos, or infographics that explain the mechanics and advantages of direct bank transfers.

- Customer Support: Offer robust customer support to assist users in their transition to this payment method.

- Promotional Incentives: Implement discounts or rewards for customers who choose direct bank transfers over traditional payment methods.

Moreover, collaboration between financial institutions and businesses can catalyze this shift. By partnering to create seamless integrations between bank transfer systems and online payment platforms, we can enhance user experience and build confidence in the process. The evolution of technology, including mobile banking apps and digital wallets, provides an excellent opportunity for stakeholders to innovate together.

Below is a simple table highlighting the benefits of direct bank transfers compared to traditional payment methods:

| Feature | Direct Bank Transfers | Traditional Methods |

|---|---|---|

| Speed | Instant or same-day | 1-5 business days |

| Cost | Lower fees | Higher transaction fees |

| Security | End-to-end encryption | Vulnerable to fraud |

| User Experience | Simplified interface | Complex processes |

The potential to inspire change lies in our hands. By advocating for direct bank transfers, we can create a more efficient, secure, and user-friendly payment ecosystem. As customers experience the transformative power of this method, they will become advocates, further amplifying its reach and acceptance. The future of online payments is bright, and direct bank transfers are at the forefront of this exciting evolution.

Your New Payment Paradigm: Embracing the Direct Bank Transfer Revolution

The digital landscape is evolving at an unprecedented pace, and with it emerges a payment method that’s reshaping our financial interactions: direct bank transfers. This innovative approach is not just a temporary trend; it represents a substantial shift in how we think about online transactions. By bypassing traditional payment processors, direct bank transfers offer a plethora of benefits that are too significant to ignore.

Security and Trust: One of the most compelling advantages of direct bank transfers is the enhanced security they provide. Unlike credit card transactions, which can be susceptible to fraud, direct transfers utilize the existing banking infrastructure, leading to reduced risk of unauthorized access. Customers can conduct transactions with peace of mind, knowing their sensitive information is safeguarded.

Cost Efficiency: For businesses and consumers alike, cost savings are a primary concern. Direct bank transfers eliminate the need for expensive payment processing fees typically associated with credit card payments and other intermediaries. This means that both sellers and buyers can benefit from lower transaction costs, allowing for better pricing strategies and improved margins.

Speed and Convenience: In a world where time is of the essence, the speed of direct bank transfers is a game changer. Transactions can be processed in real-time, providing immediate access to funds and facilitating faster business operations. Gone are the days of waiting for checks to clear or dealing with payment holds. With direct transfers, the flow of money mirrors the pace of the digital economy.

Global Reach: As businesses expand their horizons, the ability to transact across borders becomes increasingly important. Direct bank transfers enable companies to connect with customers around the globe without the complexities often associated with currency conversion and cross-border fees. This opens up new markets and customer bases, empowering businesses to thrive in the international arena.

| Benefits | Description |

|---|---|

| Security | Minimizes risk of fraud by using secure banking channels. |

| Cost Savings | Reduces transaction fees compared to traditional methods. |

| Efficiency | Offers real-time processing for faster transactions. |

| Global Access | Facilitates seamless international transactions. |

As we embrace this direct bank transfer revolution, it’s essential to consider its implications for personal finance management. With greater control over cash flow and reduced dependency on credit, consumers can cultivate healthier financial habits. Direct bank transfers encourage individuals to spend within their means, promoting a culture of financial responsibility.

The future of online payments is here, and it’s time to adapt. By harnessing the power of direct bank transfers, both consumers and businesses can unlock new levels of efficiency, security, and profitability. As we move forward, this payment model will undoubtedly pave the way for a more streamlined, transparent, and empowering transaction experience.

Frequently Asked Questions (FAQ)

Q&A: How Direct Bank Transfers Are Changing the Way We Pay Online

Q: What are direct bank transfers, and how do they work?

A: Direct bank transfers are electronic payments made directly from one bank account to another without the need for intermediaries. This method utilizes secure banking networks to facilitate transactions, allowing individuals and businesses to send and receive money swiftly and safely. With just a few clicks, users can initiate payments, making it a hassle-free experience.

Q: Why are direct bank transfers becoming more popular?

A: The popularity of direct bank transfers is skyrocketing due to their convenience, security, and cost-effectiveness. Unlike traditional payment methods that often involve processing fees, direct transfers typically come with lower or no fees, allowing users to save money. Furthermore, the rising awareness of cybersecurity issues has prompted people to seek more secure payment alternatives, and direct bank transfers offer unparalleled peace of mind.

Q: How do direct bank transfers enhance security compared to credit card payments?

A: Security is a top concern for online transactions. Direct bank transfers utilize encrypted protocols and two-factor authentication, significantly reducing the risk of fraud and identity theft. Unlike credit card payments, which can expose sensitive information to multiple parties, direct transfers keep your banking details private, enhancing your overall security while shopping online.

Q: In what ways are direct bank transfers transforming the e-commerce landscape?

A: Direct bank transfers are revolutionizing e-commerce by enabling faster transactions, which ultimately leads to improved cash flow for businesses. With instant payment confirmations, sellers can dispatch goods immediately, enhancing customer satisfaction. Additionally, the integration of direct bank transfers into e-commerce platforms simplifies the payment process, encouraging more consumers to complete their purchases.

Q: How do direct bank transfers empower millennials and Gen Z consumers?

A: Younger generations are digital natives who crave efficiency and control over their finances. Direct bank transfers align perfectly with their values, offering a seamless, no-fuss payment method that fits their fast-paced lifestyle. By embracing direct transfers, they can manage their money more effectively, making it easier to send money to friends, pay for services, or shop online—all in real time.

Q: What are the future implications of adopting direct bank transfers?

A: As more consumers and businesses adopt direct bank transfers, we can expect a significant shift in online payment ecosystems. This change has the potential to lower transaction costs, increase accessibility for underserved populations, and foster financial innovation. The future is bright; embracing direct bank transfers could lead to a more inclusive and efficient financial landscape for everyone.

Q: How can individuals and businesses get started with direct bank transfers today?

A: Getting started with direct bank transfers is simple! Individuals can check with their banks or financial institutions to learn about available services and how to set up direct transfers. Businesses can explore payment processing platforms that support this method, ensuring they offer it as an option at checkout. By taking these steps, both consumers and businesses can be at the forefront of this payment revolution.

Q: What’s the overall message about the impact of direct bank transfers on our payment habits?

A: The rise of direct bank transfers represents a significant leap toward a more efficient, secure, and user-centric financial future. By embracing this innovative payment method, we’re not just changing how we pay; we’re reshaping our relationship with money. Join the movement today, and be part of this transformative change—let direct bank transfers empower your financial journey!

To Wrap It Up

In a world where convenience and security are paramount, direct bank transfers stand out as a beacon of innovation in the realm of online payments. By embracing this seamless method of transaction, we are not just simplifying the way we pay; we are also fostering a more inclusive financial ecosystem that empowers individuals and businesses alike.

Imagine a future where the barriers of traditional payment methods are dismantled, paving the way for faster, more reliable transactions that prioritize your peace of mind. Each direct bank transfer is a step toward realizing this vision, ensuring that your hard-earned money is handled with the utmost care and efficiency.

As we continue to navigate the digital landscape, let us seize the opportunity to advocate for and adopt practices that enhance our financial freedom. Together, we can champion a payment revolution that not only transforms how we engage in commerce but also reinforces trust and stability in our financial lives.

So, let’s take that leap forward, embrace the change, and make direct bank transfers the preferred choice for our online transactions. The future of payments is at our fingertips, and it’s time to harness its potential for a smarter, more connected world.