Are you ready to elevate your e-commerce game? While Shopify Payments offers convenience, exploring alternatives can unlock new possibilities. Discover the 6+ best payment solutions that provide flexibility, lower fees, and tailored features to power your business dreams!

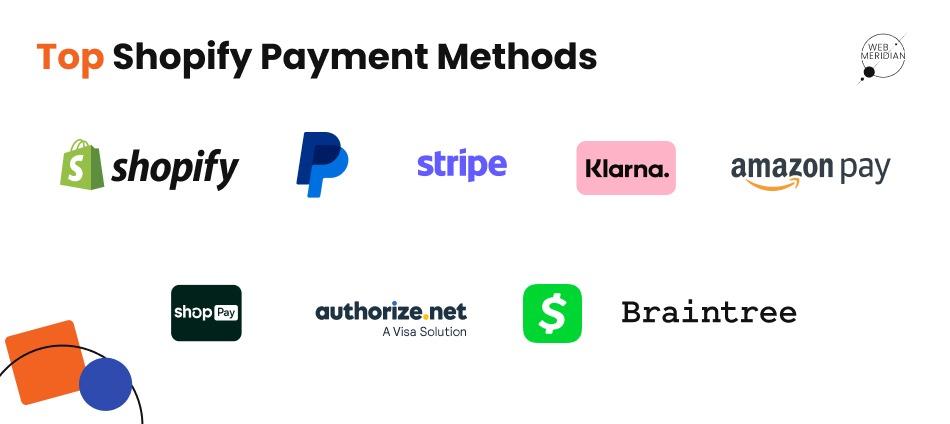

6+ Best Shopify Payments Alternatives

In the dynamic world of e-commerce, the payment processing landscape is ever-evolving, and for entrepreneurs seeking to build successful online stores, the choice of payment solutions can make or break their business. While Shopify Payments offers a streamlined experience for many, it’s not the only option available. In fact, relying solely on one provider can limit your store’s potential and your ability to cater to diverse customer needs. That’s where the power of alternatives comes into play.

Imagine the freedom of selecting a payment solution that not only aligns with your business model but also enhances your customer experience. Whether you’re looking for lower transaction fees, advanced features, or support for international currencies, the right payment processor can propel your e-commerce venture to new heights. In this article, we’ll explore six of the best Shopify Payments alternatives that can empower you to take control of your financial operations, optimize your conversions, and ultimately, elevate your business to the next level. Get ready to unlock new possibilities and transform the way you do business online!

Discover the Power of Shopify Payments Alternatives

In today’s ever-evolving eCommerce landscape, relying solely on a single payment processor can limit your business potential. Exploring alternatives to Shopify Payments can empower your online store, offering greater flexibility, reduced fees, and enhanced customer experiences. Here are some compelling options to consider:

- PayPal: A household name, PayPal provides a seamless checkout experience and is trusted by millions. Integrating PayPal not only increases conversion rates but also caters to customers who prefer its familiar interface.

- Stripe: Known for its robust API and extensive customization capabilities, Stripe allows businesses to tailor their payment processes to fit their exact needs, offering features like subscription billing and multi-currency support.

- Authorize.Net: This payment gateway is excellent for businesses looking for an all-in-one solution. With advanced fraud detection and recurring billing options, Authorize.Net can help streamline your payment processes.

- Square: Perfect for merchants with both online and offline sales, Square integrates in-person transactions with your online store. Its user-friendly interface and comprehensive analytics make it a standout choice.

- Amazon Pay: Tap into Amazon’s customer base by offering Amazon Pay on your site. This option provides convenience and familiarity, encouraging trust and repeat purchases.

- 2Checkout (now Verifone): 2Checkout accommodates global sales effortlessly, supporting multiple currencies and languages. Its flexible payment options can cater to diverse customer preferences.

Incorporating multiple payment solutions not only enhances user experience but can also lead to increased sales and customer loyalty. By offering choices, you cater to varied customer preferences, removing barriers to purchase and encouraging conversions.

| Payment Processor | Key Features | Best For |

|---|---|---|

| PayPal | Easy integration, high trust factor | All types of businesses |

| Stripe | Customizable API, subscription features | Developers and tech-savvy merchants |

| Authorize.Net | Fraud detection, recurring billing | Established businesses |

| Square | Offline/online integration, analytics | Retailers with physical locations |

| Amazon Pay | Familiar checkout experience | Retail and subscription businesses |

| 2Checkout | Global support, flexible payments | International sellers |

Experimenting with different payment processors can uncover new opportunities for your business. Whether you’re a startup or an established brand, diversifying your payment options opens the door to new customer segments and can significantly enhance your overall performance in the competitive eCommerce market.

Unlocking New Opportunities for Your Online Store

In the fast-evolving world of e-commerce, it’s essential to explore various payment processing options that can help you stand out from the competition. While Shopify Payments may be a popular choice, there are several alternatives that can unlock new opportunities for your online store. By diversifying your payment options, you give your customers the flexibility to choose their preferred method, enhancing their overall shopping experience.

Consider integrating platforms that offer low transaction fees and quick settlements. Not only do these alternatives provide cost-effective solutions, but they can also improve your cash flow. Here are some popular options that can cater to different business needs:

- PayPal: A widely recognized name in online payments, it allows customers to transact with ease and confidence.

- Stripe: Known for its developer-friendly interface, Stripe provides comprehensive tools for managing payments, subscriptions, and even fraud prevention.

- Square: Ideal for businesses that operate both online and offline, Square offers seamless integration with various point-of-sale (POS) systems.

- Authorize.Net: This alternative is perfect for merchants looking for robust security features and customizable payment options.

By offering multiple payment options, you can cater to a broader audience. Each payment method has its own unique set of features, making it crucial to assess which combination aligns best with your business goals. A well-rounded approach can lead to increased conversion rates, as customers are more likely to complete their purchase when they see their preferred payment method available.

Furthermore, it’s vital to consider user experience when selecting your payment processors. A smooth, hassle-free checkout process can significantly impact customer satisfaction and retention. Here’s a quick comparison of key features to look out for:

| Payment Provider | Transaction Fees | Main Feature |

|---|---|---|

| PayPal | 2.9% + $0.30 per transaction | Wide acceptance and trust |

| Stripe | 2.9% + $0.30 per transaction | Customizable API and features |

| Square | 2.6% + $0.10 per transaction | Integrated POS system |

| Authorize.Net | $0.10 per transaction + monthly fee | Advanced security features |

Exploring these alternatives not only empowers you to make informed decisions but also positions your online store for growth. As you implement various payment options, keep an eye on customer feedback and analytics. This will help you refine your approach and adapt to changing preferences, ensuring your e-commerce business remains competitive and profitable.

Exploring the Top Payment Solutions for Every Business

In the ever-evolving landscape of e-commerce, businesses need to stay ahead of the curve by choosing the right payment solutions. With Shopify being a popular choice for online retailers, it’s essential to explore alternatives that can cater to diverse business needs and customer preferences. Here are some top contenders worth considering:

- PayPal: A household name, PayPal offers seamless integration with Shopify stores. It provides users with the flexibility of paying through their PayPal balance, debit, or credit cards, ensuring a smooth checkout experience.

- Stripe: Known for its developer-friendly features, Stripe allows businesses to customize their payment processing extensively. With support for multiple currencies and subscription billing, it’s a fantastic choice for growing enterprises.

- Square: Ideal for businesses that operate both online and in physical locations, Square offers a unified payment solution. Its robust point-of-sale system paired with e-commerce capabilities makes it a versatile option.

- Authorize.Net: A reliable payment gateway that is especially beneficial for businesses with a high volume of transactions. Authorize.Net provides advanced fraud detection tools and multiple payment options.

- 2Checkout (now Verifone): This payment solution excels in global reach, making it suitable for businesses with an international customer base. 2Checkout supports a wide array of payment methods and currencies.

- Amazon Pay: Leveraging the trust and familiarity of the Amazon brand, Amazon Pay allows users to check out using their Amazon accounts. This convenience can significantly reduce cart abandonment rates.

When evaluating these options, businesses should consider several factors:

| Payment Solution | Best For | Key Features |

|---|---|---|

| PayPal | Ease of Use | Instant transfers, broad user base |

| Stripe | Customization | API access, multi-currency support |

| Square | Multi-channel Selling | Integrated POS, inventory management |

| Authorize.Net | High Volume Transactions | Fraud detection, recurring billing |

| 2Checkout | International Sales | Global payment options, subscription services |

| Amazon Pay | Trust Factor | Amazon account integration, fast checkout |

Ultimately, the right payment solution should align with your business model, customer expectations, and growth aspirations. By thoroughly assessing these alternatives, entrepreneurs can elevate their online store’s performance and customer satisfaction. Embrace the flexibility of modern payment systems, and empower your business to thrive in the competitive e-commerce space.

Unleashing the Benefits of Diversifying Your Payment Options

In today’s fast-paced digital marketplace, offering a variety of payment options is not just a luxury; it’s a necessity for any successful online business. By diversifying payment methods, you open up a world of possibilities that can enhance customer satisfaction and drive sales. When shoppers encounter their preferred payment method, they are more likely to complete their purchase, reducing cart abandonment rates and boosting your bottom line.

Consider the diverse needs of your customer base. Some may prefer traditional credit cards, while others might feel more secure using digital wallets or even cryptocurrencies. By providing multiple payment options, you cater to varying preferences, thus creating a more inclusive shopping environment. This not only builds trust but also fosters loyalty among your customers, who will appreciate the flexibility you provide.

Here are some significant benefits of offering diversified payment options:

- Increased Sales: The more options you provide, the higher the likelihood of converting visitors into paying customers.

- Global Reach: Different regions have varying payment preferences. By accommodating these, you can expand your market reach.

- Enhanced Customer Experience: A seamless checkout process, tailored to individual preferences, enhances user experience and satisfaction.

- Reduced Fraud Risk: Reliable payment options can help in mitigating fraud, providing added security for both you and your customers.

To help you better understand the landscape of payment options, here’s a simple comparison of some alternative payment solutions that integrate well with Shopify:

| Payment Option | Key Features | Best For |

|---|---|---|

| PayPal | Widely recognized, easy to use, buyer protection | All types of eCommerce businesses |

| Stripe | Customizable, powerful API, supports subscriptions | Tech-savvy businesses and startups |

| Amazon Pay | Quick checkout for Amazon users, trusted brand | Businesses targeting Amazon shoppers |

| Apple Pay | Fast, secure mobile payments, user-friendly | Stores with a mobile-friendly audience |

| Google Pay | Integration with Google services, quick transactions | Businesses targeting Android users |

Ultimately, embracing a variety of payment methods not only satisfies consumer demand but also positions your brand as forward-thinking and customer-centric. As you explore options beyond traditional payment methods, you’ll likely find that the benefits extend far beyond increased sales; they can lead to deeper customer relationships and long-term brand loyalty. In a competitive market, being adaptable and responsive to consumer preferences can set you apart and drive your business to new heights.

Comparative Analysis of Fees and Features

When evaluating payment processors for your Shopify store, it’s crucial to look beyond just the transaction fees. Different platforms offer a variety of features that can significantly enhance your online business. As you consider alternatives to Shopify Payments, here’s a breakdown of key aspects to help you make an informed choice.

Fees Overview

Understanding the fee structures of various payment processors can save you a substantial amount of money in the long run. Here are some of the common fees associated with popular alternatives:

| Payment Processor | Transaction Fee | Monthly Fee | Currency Conversion Fee |

|---|---|---|---|

| PayPal | 2.9% + $0.30 | None | Up to 3% |

| Stripe | 2.9% + $0.30 | None | 1% |

| Authorize.Net | 2.9% + $0.30 | $25 | 1% |

| Square | 2.6% + $0.10 | None | None |

Feature Comparison

While fees are a significant factor, the features offered by each payment processor can greatly impact the efficiency of your operations. Consider the following:

- Integration Ease: Some platforms, like Stripe, offer seamless integration with Shopify, making setup a breeze.

- Payment Methods: Ensure the processor supports a variety of payment options including credit cards, digital wallets, and even cryptocurrencies.

- Customer Support: Reliable customer support can be a lifesaver; prioritize options that provide 24/7 assistance.

- Reporting Tools: Advanced analytics and reporting features can help you understand sales trends, customer behavior, and overall performance.

Furthermore, consider the level of security provided. Payment processors like PayPal and Stripe are known for their robust security measures, which can build customer trust and reduce fraud risk. Always verify that the services you choose comply with PCI DSS standards, ensuring that your customer transactions are secure.

In the competitive landscape of eCommerce, choosing the right payment processor could be the difference between a successful sale and a lost customer. By comparing fees and features side-by-side, you can identify the best solution that aligns with your business goals, offering both value and functionality.

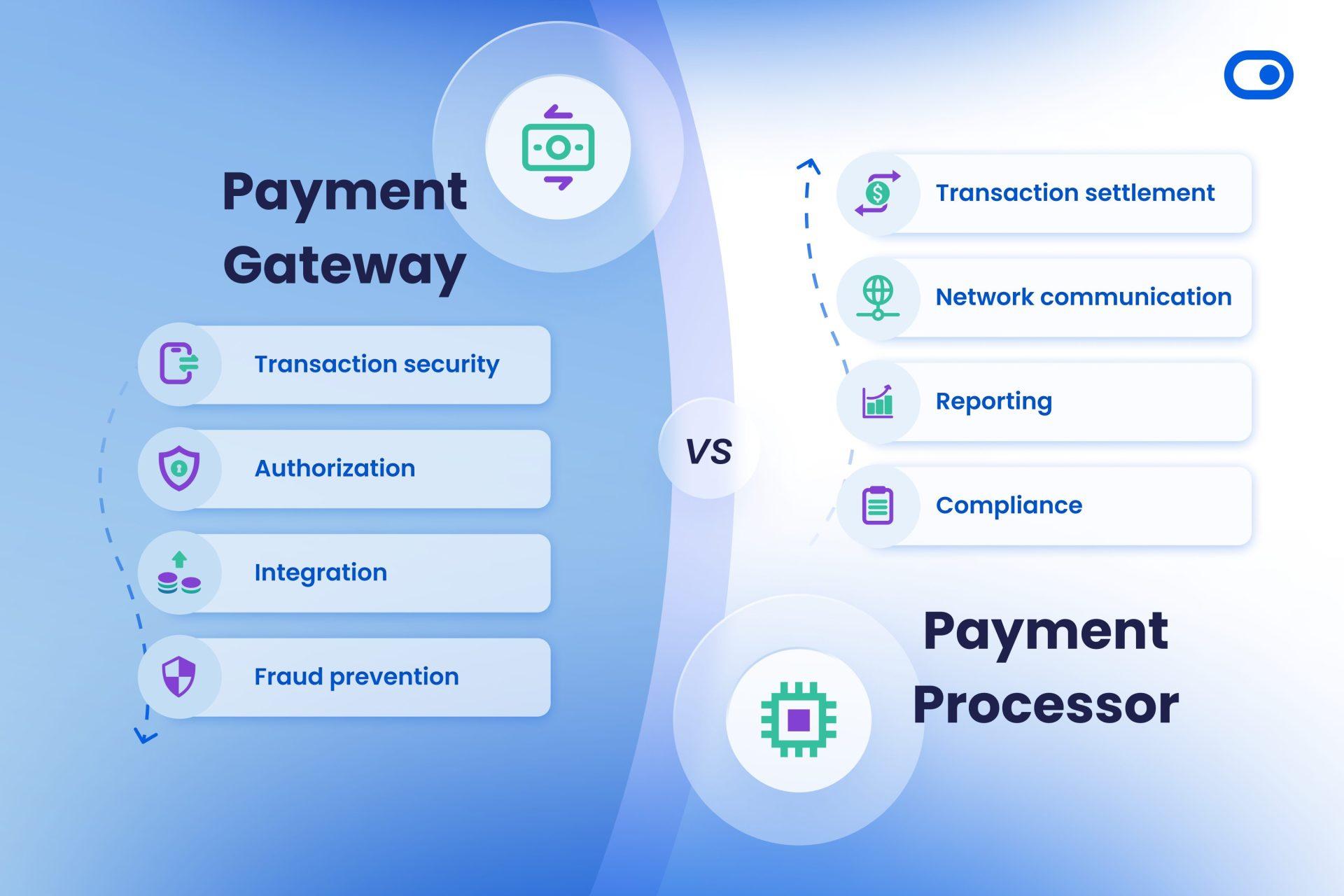

User Experience: Choosing the Right Payment Gateway

In the evolving landscape of e-commerce, the choice of a payment gateway can significantly influence your customer’s journey. A seamless payment experience not only enhances user satisfaction but also fosters trust and encourages repeat business. When selecting a payment gateway, consider the following aspects to ensure it aligns with your business needs:

- Transaction Fees: Different gateways come with varying fee structures. Look for a provider that offers competitive rates without compromising on service quality.

- Payment Methods Supported: Ensure the gateway supports a wide range of payment options, including credit cards, digital wallets, and even local payment methods that cater to your target audience.

- Integration Ease: Choose a gateway that integrates smoothly with your Shopify store. A complicated setup can lead to frustration and potential lost sales.

- Security Features: With the rise in online fraud, robust security measures are essential. Opt for gateways that provide advanced encryption and fraud detection tools.

- Customer Support: Reliable customer support can make a world of difference, especially during critical times. Ensure the provider offers 24/7 assistance, so you can resolve issues swiftly.

The user experience can break or make your online store. A poorly designed payment process can lead to cart abandonment, whereas a straightforward and intuitive checkout boosts conversion rates. Pay attention to the checkout flow of the payment gateway. It should be simple, allowing users to complete their purchases with minimal clicks.

Additionally, consider the mobile optimization of the payment gateway. With an increasing number of consumers shopping via smartphones, it’s crucial that your payment process is mobile-friendly. A gateway that offers a responsive design will ensure users have a smooth experience, regardless of the device they’re using.

keep an eye on customer feedback. Real-world experiences from other Shopify users can provide valuable insights into the performance and reliability of a payment gateway. Look for reviews on forums, social media, and business directories to make an informed decision.

| Payment Gateway | Transaction Fees | Supported Currencies | Mobile Optimization |

|---|---|---|---|

| PayPal | 2.9% + $0.30 | 100+ | Yes |

| Stripe | 2.9% + $0.30 | 135+ | Yes |

| Square | 2.6% + $0.10 | USD, CAD, GBP, EUR | Yes |

| Authorize.Net | 2.9% + $0.30 | USD | Yes |

the right payment gateway can create a frictionless experience for your users, ensuring they feel secure and valued during their transactions. By taking the time to evaluate these essential factors, you set the stage for a thriving online store that not only attracts but retains loyal customers.

Security Matters: Protecting Your Transactions and Customers

In today’s digital landscape, ensuring the safety of your transactions is not just a necessity but a responsibility. Customers entrust their personal information to businesses, and safeguarding this data is paramount to building trust and loyalty.

When exploring alternative payment solutions for your Shopify store, consider the following critical aspects:

- Data Encryption: Look for payment processors that offer advanced encryption technology to protect sensitive information.

- Fraud Detection: Choose platforms that include robust fraud detection tools to identify and mitigate potential threats in real-time.

- Compliance Standards: Ensure that the payment processor complies with PCI DSS (Payment Card Industry Data Security Standard) to keep customer data secure.

- Transparent Fees: Opt for providers with clear fee structures to avoid unexpected costs that could impact your financial planning.

- User-Friendly Interfaces: The best payment solutions are not only secure but also easy to use, ensuring a seamless experience for both you and your customers.

The right payment processor can significantly enhance the security of your transactions. For instance, platforms like PayPal and Square are not only widely recognized but also offer comprehensive security features and buyer protection policies. These attributes help in instilling a sense of confidence among customers as they complete their purchases.

Moreover, utilizing services such as Stripe can provide businesses with tools to customize their payment processes, enhancing security while maintaining a flexible shopping experience. Features like two-factor authentication and mobile payment capabilities ensure that both merchants and customers are protected at every step.

| Payment Processor | Key Features | Security Measures |

|---|---|---|

| PayPal | Widely used, Easy integration | Buyer protection, Two-step verification |

| Square | Point-of-sale solutions, Fast transfer | Encryption, Fraud monitoring |

| Stripe | Customizable options, Global support | Tokenization, PCI compliance |

| Authorize.Net | Recurring billing, Mobile payments | Advanced fraud detection, SSL encryption |

Ultimately, choosing a secure payment solution is about more than just functionality; it’s about assuring your customers that their transactions are safe. By investing in reliable payment options, you not only protect your business but also foster a trusting relationship with your clientele. Remember, security is a continuous process, and staying informed about the latest technologies and threats is essential for maintaining a secure transaction environment.

Integration Made Easy: Seamless Connections for Your Shopify Store

In today’s fast-paced eCommerce landscape, having flexible payment options is crucial for maximizing conversions and ensuring customer satisfaction. While Shopify Payments offers a robust framework, exploring alternative payment processors can unlock new opportunities for your store. Embracing these alternatives can provide a more tailored shopping experience for your customers, and potentially lower transaction fees.

PayPal stands out as one of the most recognized payment gateways globally. With its user-friendly interface and instant checkout features, PayPal allows customers to complete purchases quickly and securely. By integrating PayPal into your Shopify store, you’re not just adding a payment option; you’re enhancing trust and credibility, which can lead to increased sales.

Square is another fantastic alternative that bridges the gap between online and offline sales. If you have a brick-and-mortar location, Square offers seamless integration with your Shopify store, allowing you to manage inventory and sales from one platform. This all-in-one solution can simplify your operations, giving you more time to focus on growing your business.

Stripe is often lauded for its developer-friendly API and extensive customization options. This flexible payment solution allows you to create a tailored checkout experience that aligns with your brand. Moreover, Stripe supports a multitude of payment methods, including credit cards, digital wallets, and even cryptocurrencies, catering to a broader audience and driving more conversions.

| Payment Processor | Key Features | Best For |

|---|---|---|

| PayPal | Instant checkout, global reach | Trust and credibility |

| Square | Offline & online integration | Brick-and-mortar businesses |

| Stripe | Extensive customization, multiple payment options | Developers and tech-savvy users |

Consider also integrating Authorize.Net. This long-standing payment gateway is known for its reliability and robust security measures. With features like recurring billing and a customer information manager, it provides a comprehensive solution for your eCommerce needs. This can be particularly beneficial for subscription-based businesses, where managing repeat payments is crucial.

Lastly, don’t overlook Amazon Pay. By allowing customers to use their existing Amazon accounts to make purchases on your Shopify store, you tap into a vast pool of users who appreciate convenience. This seamless checkout process can significantly reduce cart abandonment rates and increase your conversion rates.

Whether you choose to integrate one or more of these payment alternatives, the key is to provide your customers with options that enhance their shopping experience. By doing so, you can build stronger relationships and foster loyalty, all while driving your business towards new heights.

Customer Support: Finding a Partner You Can Rely On

In today’s fast-paced digital economy, having reliable customer support is not just an option; it’s a necessity. When choosing a payment processor for your Shopify store, the quality of support can make or break your business operations. A dependable partner ensures that you can swiftly address any issues that arise, allowing you to focus on what matters most—growing your business.

What to Look For in Customer Support

- 24/7 Availability: Your business runs round the clock, and so should your support. Look for providers that offer 24/7 assistance through multiple channels.

- Expertise and Experience: Ensure that the support team has a deep understanding of e-commerce and the intricacies of payment processing.

- Responsiveness: Quick response times can significantly reduce downtime. Aim for partners that prioritize customer queries.

- Resources and Documentation: Comprehensive FAQs, tutorials, and community forums can empower you to solve basic issues independently.

Consider the potential impact on your customer satisfaction. If your payment processor experiences downtime or transaction issues, your customers may become frustrated. A responsive support team can alleviate these concerns and provide timely solutions, helping to maintain your hard-earned reputation. Look for testimonials and case studies that highlight how other businesses have benefited from excellent support.

Examples of Top Payment Processors with Stellar Support

| Payment Processor | Support Features | Customer Rating |

|---|---|---|

| PayPal | 24/7 support, live chat, extensive resources | 4.5/5 |

| Stripe | Email support, chat, developer resources | 4.7/5 |

| Square | Phone, chat, and email support | 4.6/5 |

Choosing the right payment processor involves more than just transaction fees and features. Consider the long-term relationship you’ll build with your provider. A strong support system will not only streamline your operations but also provide you with peace of mind, knowing you have a partner who genuinely cares about your business success. Invest the time to research and connect with potential partners, asking pointed questions about their support capabilities. The right choice can empower you to achieve your e-commerce ambitions with confidence.

Success Stories: Brands Thriving with Alternative Payment Solutions

Future-Proofing Your Business: Staying Ahead in Ecommerce

In the rapidly evolving world of ecommerce, staying competitive means being adaptable and open to exploring various payment solutions. While Shopify Payments may be the go-to option for many merchants, there are several compelling alternatives that can enhance your business operations and customer experience.

Consider the following alternatives:

- PayPal: A household name, PayPal offers seamless integration with Shopify stores, allowing customers to pay quickly and securely.

- Stripe: Known for its developer-friendly interface, Stripe provides powerful tools for customization and analytics, making it ideal for businesses looking to scale.

- Square: Perfect for businesses that operate both online and in brick-and-mortar locations, Square offers a cohesive solution that bridges the gap between offline and online sales.

- Authorize.Net: With robust security features and excellent customer support, Authorize.Net is a reliable choice for small to medium-sized businesses aiming for growth.

- 2Checkout: This platform supports international transactions, making it a great option for businesses with a global customer base.

- Adyen: A comprehensive payment solution that supports various payment methods, Adyen is ideal for larger enterprises seeking to streamline their payment processes.

By diversifying your payment options, you not only enhance customer satisfaction but also build trust and credibility within your brand. Customers appreciate having choices, and offering multiple payment methods can significantly reduce cart abandonment rates.

It’s essential to consider how each payment processor aligns with your specific business needs. For instance, if you’re focused on international sales, opting for a platform like 2Checkout or Adyen can give you the leverage needed to reach a global audience. Alternatively, if you prioritize ease of use and setup, PayPal and Square might be the best fit.

Investing time in researching and integrating these alternatives can significantly impact your bottom line. By providing your customers with various payment options, you cater to their preferences and boost your chances of making that sale. Remember, a future-proof business is one that anticipates customer needs and adapts accordingly.

| Payment Processor | Key Features | Best For |

|---|---|---|

| PayPal | Fast setup, trusted brand | Small businesses |

| Stripe | Customizable API, analytics | Developers and tech-savvy businesses |

| Square | Offline/online integration | Brick-and-mortar + online |

| Authorize.Net | Strong security, excellent support | Growing small businesses |

| 2Checkout | International support | Global merchants |

| Adyen | Comprehensive payment solutions | Large enterprises |

Making the Switch: A Step-by-Step Guide to Transitioning

Transitioning to a new payment processor is a significant step for any business owner looking to optimize sales and enhance customer experience. With numerous alternatives to Shopify Payments available, the process might seem daunting, but with a clear strategy, you can make the switch seamlessly. Here’s how to get started:

Assess Your Needs

Before diving into your options, take a moment to evaluate your specific business requirements. Consider factors such as:

- Transaction fees: Look for payment processors that offer competitive rates.

- Payment methods: Ensure the processor supports various payment options, including credit cards, digital wallets, and more.

- Customer support: Opt for a provider known for excellent customer service.

Research Alternatives

Once you’ve assessed your needs, it’s time to explore the alternatives. Here are some standout options:

- PayPal: A widely recognized platform that offers flexibility and trust.

- Stripe: Known for its developer-friendly integrations and robust features.

- Square: Perfect for businesses that also have a physical presence.

Compare Features and Fees

Make a detailed comparison of the features and fees associated with each alternative. A simple table can help you visualize the differences:

| Payment Processor | Transaction Fee | Supported Currencies | Integration |

|---|---|---|---|

| PayPal | 2.9% + $0.30 | 100+ currencies | Easy |

| Stripe | 2.9% + $0.30 | 135+ currencies | Developer-friendly |

| Square | 2.6% + $0.10 | USD only | Simple |

Implement and Test

Once you’ve chosen your new provider, it’s time to implement the changes. Follow these steps:

- Integrate the payment processor: Follow the provider’s installation guide to set up your account.

- Test transactions: Run several test transactions to ensure everything is functioning correctly.

- Train your team: Ensure everyone is familiar with the new system to avoid confusion down the line.

Monitor Performance

After the switch, closely monitor your payment processor’s performance. Look for improvements in transaction speed, customer satisfaction, and overall sales. This will help you determine if the switch was successful and if further adjustments are necessary.

By following these steps, you can confidently transition to a payment processor that aligns with your business goals and enhances your customers’ shopping experience.

Empowering Your Growth: Building a Robust Payment Strategy

In today’s ever-evolving digital marketplace, having a flexible and reliable payment strategy is crucial for your business growth. Exploring alternative payment solutions not only diversifies your offerings but also enhances customer experience, fostering loyalty and increasing conversion rates. Here are some of the top alternatives to Shopify Payments that can empower your growth:

- PayPal: Renowned for its global reach and ease of use, PayPal allows customers to pay using their accounts or credit cards. Its user-friendly interface can significantly reduce cart abandonment.

- Stripe: Known for its developer-friendly tools, Stripe offers a comprehensive suite of payment options, including subscription billing and marketplace payments, catering to a wide array of business models.

- Square: Ideal for businesses that operate both online and offline, Square integrates payment processing with inventory management, making it a seamless choice for retailers.

- Authorize.Net: A veteran in the payment processing arena, Authorize.Net offers robust fraud protection and customizable payment solutions, ensuring your transactions are secure and reliable.

- Adyen: With its powerful global payment capabilities, Adyen is perfect for businesses looking to scale internationally, offering over 250 payment methods.

- Braintree: A PayPal service, Braintree supports a variety of payment methods, including PayPal, credit cards, and even Venmo, making it a versatile choice for diverse customer preferences.

Choosing the right payment alternative is about aligning with your business goals and customer needs. Each of these platforms offers unique features that can enhance your operational efficiency. For instance, integrating multiple payment processors can help mitigate risks associated with downtime or outages from a single provider.

To help you make an informed decision, consider evaluating these alternatives based on factors such as:

| Payment Processor | Fees | Supported Currencies | Best For |

|---|---|---|---|

| PayPal | 2.9% + $0.30 per transaction | 100+ currencies | Small to large businesses |

| Stripe | 2.9% + $0.30 per transaction | 135+ currencies | Online services and e-commerce |

| Square | 2.6% + $0.10 per transaction | USD | Retail and service businesses |

| Authorize.Net | $25/month + transaction fees | USD | Established businesses requiring customer support |

| Adyen | Varies by region | 250+ currencies | International businesses |

| Braintree | 2.9% + $0.30 per transaction | Multiple currencies | Mobile app developers |

Each choice provides distinct advantages that can contribute to your success. By investing time in selecting a payment solution that resonates with your brand and customers, you not only improve your operational effectiveness but also build a foundation for sustained growth. Empower your business today by finding the perfect payment strategy that meets your needs.

The Road Ahead: Embracing Innovation in Payment Processing

As the landscape of e-commerce continues to evolve, businesses must adapt to stay ahead. The rise of digital wallets, mobile payments, and cryptocurrency has transformed how consumers engage with brands. To thrive in this dynamic environment, merchants must not only embrace technological advancements but also explore diverse payment processing solutions that cater to their unique needs.

Leveraging alternative payment platforms is no longer just an option; it’s a necessity. With options beyond traditional Shopify Payments, businesses can provide their customers with enhanced flexibility and convenience. Here are some key benefits of adopting alternative payment methods:

- Increased Conversion Rates: Offering various payment options can reduce cart abandonment and encourage more purchases.

- Wider Customer Reach: Different customers have different preferences; catering to these preferences can attract a broader audience.

- Enhanced Security: Many alternative payment processors offer advanced security features, providing peace of mind to both merchants and customers.

Moreover, integrating innovative payment solutions can streamline operations and improve cash flow. For instance, platforms that support instant payouts can enable businesses to access their funds quicker, allowing for more agile financial planning. This operational efficiency not only benefits the merchants but also enhances the customer experience.

To give you a clearer picture, consider the following comparison of popular Shopify payment alternatives that embody these innovations:

| Payment Processor | Key Features | Best For |

|---|---|---|

| PayPal | Fast transactions, PayPal Credit | Small businesses and international sales |

| Stripe | Customizable API, subscription billing | Tech-savvy merchants |

| Square | Point of Sale integration, invoicing | Retail and service-based businesses |

| Klarna | Buy now, pay later options | Shoppers seeking flexible payments |

As we venture into the future of commerce, businesses willing to embrace change will undoubtedly find themselves at the forefront of their industries. By exploring these innovative payment solutions, merchants can not only enhance customer satisfaction but also build a resilient business model that adapts to the ever-changing market demands.

Frequently Asked Questions (FAQ)

Q&A: 6+ Best Shopify Payments Alternatives

Q1: Why should I consider alternatives to Shopify Payments?

A: Exploring alternatives to Shopify Payments can give you greater flexibility, lower transaction fees, and enhanced payment options for your customers. Depending on your business model, different payment processors can help you optimize your cash flow and provide a seamless shopping experience, ultimately leading to increased sales and customer satisfaction.

Q2: What are some key benefits of using payment alternatives?

A: The benefits include improved payment processing speed, access to diverse payment methods (like cryptocurrencies or local payment options), better integration with accounting software, and customer support tailored to your business needs. By choosing the right payment processor, you can enhance your store’s performance and engage more effectively with your customer base.

Q3: Can you name some of the best alternatives to Shopify Payments?

A: Absolutely! Some of the top alternatives include:

- PayPal – Universally recognized and trusted, it offers both customer and seller protections.

- Stripe – Known for its developer-friendly interface and customizable solutions, making it ideal for tech-savvy merchants.

- Square – Offers a robust point-of-sale system and integrates effortlessly with online stores.

- Authorize.Net – A long-standing player with excellent customer support and comprehensive fraud protection.

- 2Checkout (now Verifone) – Great for global sales, providing a variety of payment options.

- Amazon Pay – Leverages the trust of the Amazon brand to provide a familiar checkout experience for shoppers.

Q4: How do these alternatives integrate with my Shopify store?

A: Most payment alternatives offer easy integration with Shopify. Simply navigate to the Payments section in your Shopify settings, choose your preferred alternative, and follow the setup prompts. Each provider typically offers step-by-step guidance, ensuring a streamlined process, so you can start accepting payments quickly and efficiently.

Q5: Will using alternative payment methods confuse my customers?

A: On the contrary! Offering multiple payment options can enhance your customers’ shopping experience. Many shoppers prefer to use trusted payment methods they are already familiar with. By providing a variety of choices, you increase the likelihood of completing sales and reducing cart abandonment.

Q6: How do I choose the right payment alternative for my business?

A: Consider factors such as transaction fees, payment features, customer support, and your target market’s preferences. Analyze your business needs—are you focusing on local or international sales? Do you want to offer subscription services? By aligning your payment processor with your specific goals, you’ll set your business up for success.

Q7: What if I face issues with my chosen payment alternative?

A: Most reputable payment processors offer dedicated customer support to assist with any issues you may encounter. They understand that your business depends on smooth transactions and strive to provide timely and effective solutions. Plus, reading reviews and comparing experiences can help you choose a provider known for exceptional service.

Q8: How can I ensure the security of my transactions with these alternatives?

A: Leading payment processors invest heavily in security measures, including encryption, fraud detection, and compliance with industry standards. When selecting an alternative, review their security protocols and certifications to ensure your customer data and transactions are protected, building trust in your brand.

Q9: Is it worth the effort to switch from Shopify Payments?

A: Absolutely! The right payment processor can greatly impact your bottom line and enhance customer experience. By investing time in exploring and selecting the best alternative, you open doors to new opportunities for growth and innovation in your business. Embrace the challenge, and watch your brand flourish!

Conclusion:

In the world of eCommerce, adaptability is key. By considering the best Shopify Payments alternatives, you’re not just making a choice; you’re paving the way for a brighter future for your business. Take the leap, explore your options, and empower your store with the payment solutions that work best for you!

Closing Remarks

As we conclude our exploration of the six best Shopify Payments alternatives, it’s vital to remember that choosing the right payment solution for your online store can significantly impact your business’s success. Each alternative we’ve discussed offers unique features that can cater to your specific needs, enhance your customer experience, and ultimately drive sales.

In a rapidly evolving e-commerce landscape, empowerment comes from choice. By considering these alternatives, you’re not just making a decision for today; you’re laying the groundwork for a more flexible, resilient, and customer-centric future. Embrace the opportunity to explore new avenues that can elevate your business beyond the ordinary.

So take the leap! Investigate these options, weigh their benefits, and make an informed choice that aligns with your vision. Your customers deserve a seamless, secure, and enjoyable shopping experience, and you have the power to provide it. Remember, the right payment solution is out there waiting for you—one that not only meets your needs but also inspires growth and innovation.

Step confidently into this new chapter, and let the journey of transforming your e-commerce venture begin!