Building a tax-compliant WooCommerce store on WordPress doesn’t have to be daunting. Embrace the power of smart tools and user-friendly plugins that simplify compliance, letting you focus on what you love—growing your business and serving customers!

How to Build a Tax-Compliant WooCommerce Store on WordPress Without Extra Overhead

Introduction

In today’s digital age, launching an online store has never been more accessible, especially with powerful platforms like WooCommerce and WordPress at your fingertips. However, amidst the excitement of building your e-commerce empire, the complexities of tax compliance can often feel overwhelming, causing budding entrepreneurs to hesitate. But what if we told you that it’s possible to create a thriving, tax-compliant WooCommerce store without incurring hefty overhead costs or sacrificing your creative vision?

Imagine a world where your business not only flourishes but also adheres to the ever-evolving landscape of tax laws with ease. In this article, we’re here to inspire you and provide step-by-step guidance on how to harness the full potential of WooCommerce, ensuring your store operates smoothly and legally. Whether you’re a seasoned seller or a passionate newcomer, this journey towards tax compliance can empower you to focus on what truly matters—growing your business and serving your customers. Let’s dive into the strategies that will transform your WooCommerce store into a tax-compliant powerhouse, all while keeping your expenses in check and your ambitions soaring!

Creating a Seamless Tax-Compliant WooCommerce Experience

When it comes to eCommerce, ensuring tax compliance can seem daunting. However, integrating tax compliance into your WooCommerce store doesn’t have to lead to unnecessary complexity or stress. With the right approach, you can create a seamless shopping experience for your customers while staying compliant with local regulations. Here are some strategies to streamline the process and enhance customer satisfaction.

| Region | Tax Rate | Tax Class |

|---|---|---|

| California | 7.25% | Standard |

| New York | 4% | Standard |

| Texas | 6.25% | Standard |

By implementing these strategies, you can create a tax-compliant WooCommerce experience that feels seamless for your customers. Embrace the tools and features available to you, and watch as your online store not only meets legal standards but also thrives in a competitive marketplace.

Understanding the Importance of Tax Compliance for E-commerce Success

In today’s competitive e-commerce landscape, tax compliance is not merely a legal requirement but a fundamental pillar that can determine the success of your online store. For WooCommerce merchants, understanding and implementing proper tax practices is essential for building trust with customers and ensuring smooth operations. Ignoring tax compliance can lead to significant penalties and loss of credibility, which can cripple your business.

One of the key advantages of maintaining tax compliance is the potential for increased customer confidence. When buyers see that your store adheres to tax regulations, they are more likely to trust your brand and complete their purchase. Consider how transparency in your pricing can enhance customer satisfaction. Here are a few reasons why consumers appreciate compliant e-commerce stores:

- Clear Pricing: Customers value knowing the full cost of their purchase upfront, including taxes.

- Reliable Service: Compliance reflects professionalism and reliability, leading to repeat business.

- Positive Reputation: A tax-compliant business is often seen as more reputable and authentic.

Moreover, tax compliance can facilitate smoother cash flow management. By accurately calculating taxes and understanding your obligations, you can avoid unexpected liabilities at the end of the fiscal year. This proactive approach allows you to allocate resources more effectively and plan for future growth. A well-organized financial strategy not only supports compliance but also sets a strong foundation for expansion.

To aid in your WooCommerce store’s tax compliance journey, utilizing the right tools can streamline the process significantly. Platforms like WooCommerce offer various plugins designed to automate tax calculations and ensure adherence to regional tax laws. Here are some popular plugins that can simplify your operations:

- WooCommerce Tax: Automatically calculates sales tax based on customer location.

- TaxJar: Provides real-time sales tax calculations and reporting.

- Avalara: Offers comprehensive tax compliance features and integrations.

Furthermore, it’s crucial to stay updated with tax laws that affect your e-commerce business. Regularly reviewing tax regulations at local, state, and federal levels can prevent costly mistakes and ensure you are always compliant. Here’s a simple checklist to follow:

| Action Item | Frequency |

|---|---|

| Review tax regulations | Quarterly |

| Update tax rates in WooCommerce | Monthly |

| Consult with a tax professional | Annually |

prioritizing tax compliance is integral to establishing a successful WooCommerce store. By embracing these practices, you not only safeguard your business against legal pitfalls but also enhance your brand’s reputation. Ultimately, a compliant e-commerce operation paves the way for long-term success, customer loyalty, and sustainable growth in an ever-evolving digital marketplace.

Choosing the Right Hosting Provider for Optimal Performance

When setting up a WooCommerce store on WordPress, selecting the right hosting provider is critical for ensuring high performance and reliability. A quality hosting service can significantly enhance your site’s speed, security, and uptime, all of which are essential for providing a seamless shopping experience for your customers.

Consider the following factors when choosing your hosting provider:

- Performance: Look for hosting that boasts high uptime percentages and fast loading times, as these directly impact user experience and SEO rankings.

- Scalability: As your store grows, you’ll need a hosting plan that can easily scale with your traffic and resource demands.

- Support: Opt for a provider with 24/7 customer support, preferably with a focus on WordPress and WooCommerce troubleshooting.

- Security Features: Ensure the host offers robust security protocols, such as SSL certificates, firewalls, and regular backups.

- Managed Services: Consider whether you want a fully managed service that takes care of updates and maintenance to keep your store running smoothly.

To illustrate these points, here’s a comparison of popular hosting providers:

| Provider | Performance Rating | Scalability | Support | Security Features |

|---|---|---|---|---|

| SiteGround | 9.5/10 | Good | 24/7 live chat | Daily backups, SSL |

| Bluehost | 8.5/10 | Excellent | 24/7 phone and chat | Free SSL, WordPress staging |

| Kinsta | 9.8/10 | Outstanding | 24/7 expert support | Automatic backups, high-grade security |

Each hosting provider has its strengths, and choosing one that aligns with your specific needs will set the foundation for your WooCommerce store’s success. Additionally, consider the host’s compatibility with essential plugins that help ensure tax compliance, as this is critical for avoiding headaches later on.

don’t underestimate the importance of reading user reviews and conducting your own research. The experience of other users can provide valuable insights into the reliability and efficiency of the hosting provider. With the right choice, you can focus on building your store while leaving the technical details to the experts.

Essential WooCommerce Plugins for Tax Management

Managing taxes in your WooCommerce store can be a daunting task, but with the right plugins, you can streamline the process and ensure compliance without the headache. Here are some essential plugins that will help you handle tax calculations, reporting, and filing with ease:

- WooCommerce Taxamo: This plugin simplifies the complex VAT compliance for digital goods across different regions. It automatically calculates the correct tax rate based on the buyer’s location, ensuring you stay compliant with the latest regulations.

- TaxJar: Integrating seamlessly with WooCommerce, TaxJar automates sales tax calculations and provides detailed reports that can be invaluable for filing your taxes. It helps you track your sales tax liability by state, making tax season much less stressful.

- Avalara AvaTax: A powerful tool for businesses of all sizes, Avalara integrates with WooCommerce to provide real-time tax calculations. It covers thousands of tax jurisdictions, giving you peace of mind that you’re charging the correct rates.

- WooCommerce EU VAT Compliance: If you sell digital products to customers in the EU, this plugin is a must-have. It helps you comply with the EU VAT MOSS regulations by automatically applying the correct VAT rates based on your customers’ locations.

When choosing the right plugins for your online store, consider the following factors:

| Plugin | Key Features | Best For |

|---|---|---|

| WooCommerce Taxamo | Automatic VAT Calculation, Compliance Reporting | Digital Goods Sellers |

| TaxJar | Automated Sales Tax Filing, State Tracking | Businesses with Multi-State Sales |

| Avalara AvaTax | Real-Time Tax Calculations, Extensive Jurisdiction Support | All Businesses |

| WooCommerce EU VAT Compliance | EU VAT Rate Application, Customer Verification | EU Digital Product Sellers |

By integrating these plugins into your WooCommerce store, you can simplify your tax management process, reduce the risk of errors, and focus on what truly matters: growing your business. Make tax compliance a hassle-free component of your e-commerce operation, so you can invest your time and resources in expanding your brand and improving customer experiences.

Configuring Your WooCommerce Tax Settings for Maximum Accuracy

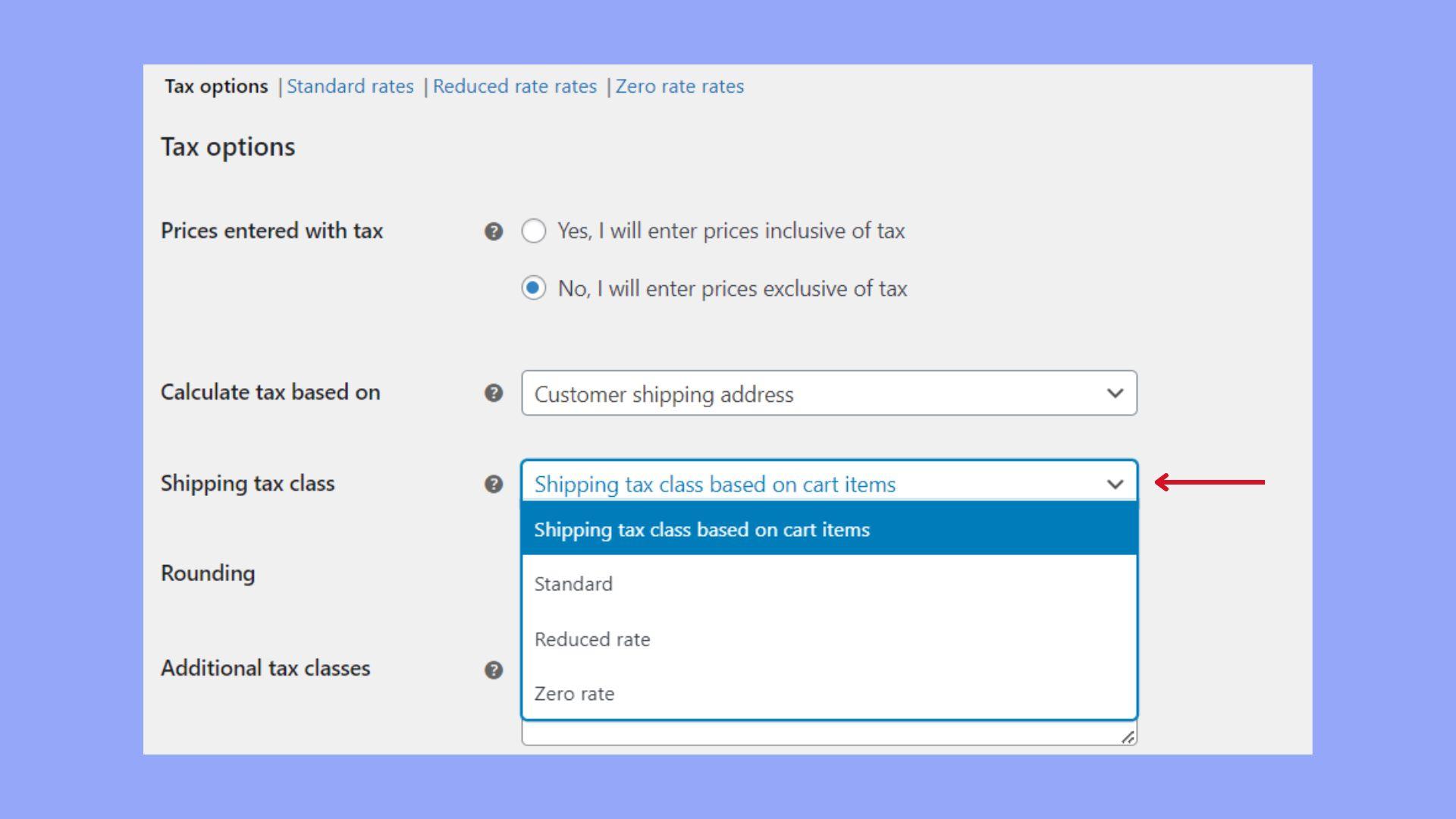

To ensure your WooCommerce store operates within the bounds of tax compliance, it’s crucial to delve into the tax settings provided by WooCommerce. With a little configuration, you can maximize accuracy, streamline your workflow, and eliminate the stress of tax season.

Begin by navigating to WooCommerce > Settings > Tax. Here, you’ll find several essential settings that can help you tailor your tax calculations to your specific business needs. Make sure to enable tax calculations by checking the box that says Enable taxes and tax calculations. This is the first step to ensuring that your store is ready to handle taxes efficiently.

Next, you’ll want to choose how your prices are displayed. You can opt to show prices inclusive or exclusive of tax. If your target market is accustomed to seeing taxes included in the price, select the inclusive option. Conversely, if you prefer transparency, showing prices exclusive of tax might be the way to go. Consider your audience and what they expect when making this choice.

Additionally, don’t forget to configure your tax classes. WooCommerce allows you to create distinct tax classes for different types of products. This is particularly beneficial if you sell items that are taxed at different rates. To set this up:

- Go to WooCommerce > Settings > Tax > Additional Tax Classes.

- Input the names of the classes you want to create, separated by commas.

- Once created, you can set specific rates for each class in the Tax Classes settings.

When defining tax rates, ensure you are using the correct rates for your geographical area. To simplify this process, consider using the following table format to keep track of your tax rates:

| Country Code | State Code | Rate (%) | Tax Class |

|---|---|---|---|

| US | CA | 7.25 | Standard |

| CA | ON | 13 | HST |

| UK | 20 | Standard |

regularly review and update your tax settings to reflect any changes in tax law or your business model. Automating tax calculations and staying current with regulations will save you time and effort, ensuring that you remain compliant without any extra overhead. Embrace the tools available within WooCommerce, and watch your business thrive while staying on the right side of tax regulations!

Leveraging Automated Tax Calculation Tools to Simplify Your Workflow

In the fast-paced world of e-commerce, managing taxes can often feel like navigating a labyrinth. However, with the advent of automated tax calculation tools, streamlining this aspect of your WooCommerce store has never been easier. Imagine freeing up countless hours spent on calculations and ensuring compliance with tax regulations—all while focusing on what truly matters: growing your business.

Automated tax tools integrate seamlessly with your WooCommerce setup, allowing you to:

- Calculate taxes in real-time: No more guessing games with tax rates! Automated tools provide up-to-date calculations based on the customer’s location and applicable laws.

- Generate detailed reports: Keep track of your tax obligations without the headache of manual entries. These solutions often come with features that allow you to generate comprehensive reports at the click of a button.

- Ensure compliance: As tax laws change, automated tools update accordingly, ensuring that your store remains compliant without constant oversight.

Moreover, these tools reduce human error, a common risk associated with manual calculations. Consider the peace of mind that comes from knowing your tax calculations are accurate. By automating this process, you not only save time but also enhance your customers’ trust in your business.

For those worried about the cost associated with implementing such technology, many solutions are designed to be affordable and scalable. You can start small, benefiting from basic features, and upgrade as your business grows. Here’s a simple comparison table of some popular automated tax calculation tools for WooCommerce:

| Tool Name | Key Features | Pricing |

|---|---|---|

| TaxJar | Real-time calculations, Automated filing | Starting at $19/month |

| Avalara | Comprehensive tax support, Compliance updates | Contact for pricing |

| WooCommerce Tax | Easy setup, Free tool | Free |

By choosing the right tool, you can simplify your tax process significantly. Think of it not just as a feature, but as a strategic advantage that allows you to focus on customer experience and product offerings rather than getting bogged down by tax-related tasks. In today’s competitive landscape, leveraging technology effectively can set you apart from the competition.

Navigating Local and International Tax Regulations with Confidence

Building a tax-compliant WooCommerce store on WordPress can feel like a daunting task, especially when navigating the complexities of local and international regulations. However, with the right approach and tools, you can streamline this process and ensure your business operates smoothly and ethically. Start by familiarizing yourself with the specific tax laws that apply to your business and your customers, as these can vary significantly based on location.

Key considerations for maintaining compliance include:

- Identifying your business tax registration requirements.

- Understanding sales tax collection obligations for different regions.

- Exploring VAT implications if you sell internationally.

- Keeping accurate records of transactions for tax reporting.

One effective method to manage these complexities is by utilizing various WordPress plugins designed for tax compliance. For example, integrating plugins like WooCommerce Tax or TaxJar can automate tax calculations based on your customer’s location. This not only saves you time but also reduces the risk of human error in tax reporting.

Additionally, consider the following steps to enhance your compliance strategy:

- Choose the right hosting provider: Ensure your hosting is reliable and offers SSL certificates for secure transactions.

- Regularly update your plugins and themes: This keeps your site secure and compliant with the latest regulations.

- Consult a tax professional: They can provide tailored advice based on your specific business model and location.

| Plugin Name | Key Features |

|---|---|

| WooCommerce Tax | Automatic tax calculations based on customer location. |

| TaxJar | Real-time sales tax calculations and reporting. |

| WP Simple Pay | Easy integration with Stripe for tax-inclusive pricing. |

By taking these proactive steps, you can build a WooCommerce store that not only meets legal requirements but also fosters customer trust. When your customers see that you prioritize compliance, they are more likely to engage with your store and make purchases, ultimately boosting your bottom line. Remember, a solid foundation in tax compliance doesn’t just protect your business—it empowers it to thrive.

Implementing Transparent Pricing Strategies to Enhance Customer Trust

In today’s competitive e-commerce landscape, establishing trust with customers is paramount. One of the most effective ways to build this trust is through transparent pricing strategies. When customers feel confident about what they are paying for, they are more likely to convert and become loyal advocates for your brand.

Transparent pricing involves clearly communicating the total cost of a product or service, including any potential additional fees. This not only helps customers make informed decisions but also alleviates any anxiety associated with hidden costs. Here are some strategies to implement:

- Clear Pricing Breakdown: Always provide a detailed breakdown of prices. Show base prices, taxes, shipping fees, and any discounts applied. For instance, you might structure your pricing information like this:

| Item | Price |

|---|---|

| Product Base Price | $50.00 |

| Tax (10%) | $5.00 |

| Shipping | $7.00 |

| Total | $62.00 |

- Highlighting Discounts: If you offer any promotions, ensure these are prominently displayed with clear terms. Customers appreciate transparency regarding how discounts are applied and will be more likely to engage with your offers.

- No Hidden Fees: Make it a point to eliminate any hidden fees that may surprise customers at checkout. This builds credibility and fosters a sense of fairness in your pricing practices.

- Customer Education: Use your website’s blog or FAQ section to educate customers about your pricing structure. Informative content can help demystify terms like tax calculations, shipping methods, and what influences pricing.

By ensuring customers are aware of exactly what they are paying for, you not only enhance their shopping experience but also reinforce your store’s reputation. Trust is a currency in e-commerce, and transparent pricing can provide a solid foundation for a long-lasting relationship with your customers.

Building an Intuitive User Experience for a Stress-Free Checkout

When it comes to ensuring a seamless checkout experience, the key lies in simplicity and clarity. A user-friendly checkout process can significantly reduce cart abandonment rates and encourage repeat customers. Here are several strategies to enhance your WooCommerce store’s checkout experience:

- Streamlined Forms: Minimize the number of fields users need to fill out. Only ask for essential information to complete the purchase.

- Guest Checkout Option: Allow customers to make purchases without creating an account. This reduces friction and accelerates the buying process.

- Progress Indicators: Use clear progress bars to show customers how far along they are in the checkout process, making it feel less daunting.

- Consistent Design: The checkout page should maintain the same look and feel as the rest of your site. Consistency builds trust.

- Responsive Design: Ensure the checkout process is mobile-friendly. More users are shopping on their phones, and a smooth mobile experience is crucial.

Moreover, integrating trust signals can significantly enhance user confidence. Consider displaying:

| Trust Signal | Description |

|---|---|

| Security Badges | Display recognizable security certifications to assure customers their data is safe. |

| Money-Back Guarantee | Offer a hassle-free return policy to eliminate the fear of making a wrong purchase. |

| Customer Reviews | Include testimonials or ratings to show social proof and build credibility. |

Another essential aspect to consider is the payment options you offer. Providing multiple payment methods caters to various customer preferences, enhancing convenience. Here’s a quick list of options to consider:

- Credit/Debit Cards

- PayPal

- Apple Pay/Google Pay

- Bank Transfers

- Buy Now, Pay Later Services

To further enhance the experience, ensure that your shipping options are clearly outlined. Customers appreciate transparency regarding their delivery costs and timelines. Offering real-time shipping estimates during checkout can add value and reduce anxiety over unexpected fees.

Lastly, remember to test and iterate. Regularly analyze user behavior to identify any pain points in the checkout process. Use A/B testing to experiment with different layouts and features, and gather feedback directly from customers to continually refine their experience.

Regularly Updating Your Tax Compliance Knowledge and Resources

In an ever-evolving landscape of tax regulations, staying informed is not just beneficial; it’s essential for the long-term success of your WooCommerce store. By regularly updating your tax compliance knowledge, you can navigate the complexities of tax laws with confidence, ultimately protecting your business from potential pitfalls.

Consider the following strategies to stay ahead:

- Subscribe to Tax Newsletters: Many financial and tax advisory firms offer newsletters that provide the latest updates on tax laws and compliance requirements. This can be a quick and efficient way to stay informed.

- Participate in Online Webinars: Regularly attending webinars focusing on e-commerce taxation can help you understand the nuances of tax compliance. Look for sessions that target WooCommerce specifically.

- Join Online Communities: Engaging with fellow store owners on forums or social media groups can provide insight into common compliance challenges and solutions.

- Follow Regulatory Bodies: Websites of IRS, state tax authorities, and other regulatory bodies often publish updates and guidelines which are crucial for your business operations.

Additionally, consider investing in resources that can streamline your tax compliance efforts:

| Resource Type | Benefit |

|---|---|

| Tax Compliance Software | Automates tax calculations and filings, reducing manual errors. |

| Consultation with Tax Professionals | Provides tailored advice specific to your business needs. |

| Online Courses | Deepens your understanding of tax laws and compliance strategies. |

Remember, compliance is not a one-time task; it’s an ongoing commitment. By consistently updating your resources and knowledge, you empower yourself to make informed decisions, ensuring that your WooCommerce store not only thrives but also adheres to all necessary regulations. Embrace the journey of learning as part of your business strategy, and let it pave the way for your success.

Establishing a Reliable Record-Keeping System for Audits

Creating a robust record-keeping system is essential for any WooCommerce store looking to maintain tax compliance and streamline audit processes. A well-organized system not only simplifies your financial tracking but also fosters trust with stakeholders and tax authorities alike. Here are several strategies to help you build an effective record-keeping framework:

- Choose the Right Tools: Utilize reliable accounting software that integrates seamlessly with WooCommerce. Popular options include QuickBooks, Xero, and FreshBooks, which can help automate data entry and minimize errors.

- Establish a Consistent Schedule: Set aside regular time slots—daily, weekly, or monthly—to update your records. This habit will ensure that no transaction goes unrecorded, and you’ll have real-time insights into your financial health.

- Organize Your Documents: Create a systematic filing system for digital and physical documents. Categorize by type (e.g., invoices, receipts, bank statements) and date. Consider using cloud storage solutions like Google Drive or Dropbox for easy access and backup.

To further enhance your record-keeping, consider the following measures:

| Record Type | Frequency of Updates | Retention Period |

|---|---|---|

| Sales Invoices | Daily | 7 years |

| Expense Receipts | Weekly | 7 years |

| Bank Statements | Monthly | 7 years |

Another key component of a reliable record-keeping system is ensuring that you engage in regular audits of your records. Schedule periodic reviews to verify the accuracy and completeness of your financial data. This proactive approach can help identify discrepancies early and reduce the risk of penalties during external audits.

Lastly, foster a culture of compliance within your organization. Ensure that all team members involved in financial processes understand the importance of accurate record-keeping. Providing training and resources can empower your team to maintain high standards in data management, ultimately contributing to the success of your tax-compliant WooCommerce store.

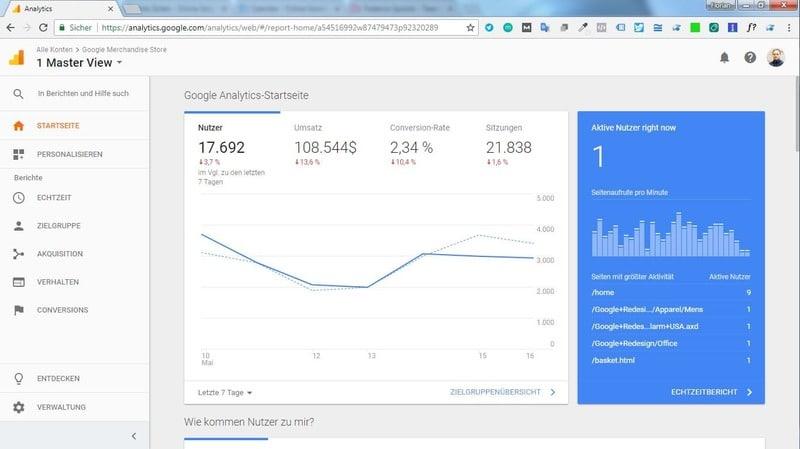

Utilizing Analytics to Monitor Tax Performance and Optimize Sales

To enhance your WooCommerce store’s financial health, leveraging analytics is essential. By implementing robust tracking methods, you can gain insights into your tax performance and align it with your sales strategies, ensuring compliance while maximizing profits.

First, consider integrating tools such as Google Analytics and WooCommerce analytics. These platforms enable you to:

- Track sales data: Understand which products perform best and during what times.

- Analyze customer behavior: Discover how users navigate your site, leading to more informed marketing strategies.

- Monitor tax-related metrics: Keep tabs on sales tax collected versus tax obligations to avoid surprises during tax season.

To further refine your approach, set clear key performance indicators (KPIs) related to tax and sales. Consider the following metrics:

| Metric | Description |

|---|---|

| Tax Collected | Amount of tax charged on sales over a specific period. |

| Tax Liability | Total tax due based on your sales tax obligations. |

| Sales Growth Rate | Percentage increase in sales over time, indicating overall business health. |

With a clear understanding of these metrics, you can make data-driven decisions that enhance both tax performance and sales optimization. Regularly reviewing your analytics allows you to:

- Adjust pricing strategies: Ensure your prices reflect tax obligations while remaining competitive.

- Identify trends: Spot seasonal sales patterns that influence tax collection.

- Streamline operations: Eliminate inefficiencies that could result in excess tax exposure.

remember to utilize reporting features within your analytics tools. Generate monthly or quarterly reports that summarize your tax performance and sales. These documents not only facilitate compliance but also provide a roadmap for future growth strategies.

Embracing Future Trends in E-commerce Tax Compliance

As e-commerce continues to evolve, staying ahead of trends in tax compliance becomes essential for WooCommerce store owners. The digital marketplace is not only expanding globally but also becoming more complex with varying regulations and tax obligations. Embracing these trends allows businesses to operate smoothly and avoid costly penalties.

One of the most significant trends is the shift towards automated tax solutions. By integrating tools that automatically calculate tax rates based on customer location, you can simplify the compliance process. Consider the following benefits of automation:

- Accuracy: Reduce errors caused by manual calculations.

- Efficiency: Save time spent on tax management.

- Scalability: Easily manage growing sales without additional overhead.

Moreover, the rise of the digital economy has led to an increased focus on cross-border transactions. Understanding VAT and sales tax obligations in different regions is crucial. Implementing a robust system that can handle multiple tax jurisdictions ensures your store remains compliant. Key points to consider include:

- Research local regulations: Stay informed about tax laws in regions where you sell.

- Dynamic tax calculations: Use software that updates tax rates in real-time.

- Transparent reporting: Maintain clear records of tax collected for easy reporting.

Furthermore, the increasing consumer demand for sustainable practices is influencing tax policies. As governments encourage eco-friendly practices, being proactive in adopting green initiatives can positively impact your tax obligations. This can include:

- Utilizing eco-friendly packaging: Explore potential tax credits for sustainable materials.

- Adopting energy-efficient technologies: Invest in systems that may qualify for tax incentives.

Lastly, leveraging data analytics is becoming essential in navigating tax compliance. By analyzing sales data, you can identify trends and adjust your tax strategies accordingly. Consider creating a simple table to track key metrics:

| Month | Sales Volume | Tax Collected | Tax Rate |

|---|---|---|---|

| January | $10,000 | $800 | 8% |

| February | $15,000 | $1,200 | 8% |

| March | $20,000 | $1,600 | 8% |

By embracing these trends, you not only ensure compliance but also position your WooCommerce store for success in an ever-changing marketplace. Stay informed, stay adaptable, and let your business thrive in the digital age.

Inspiring Growth through a Solid Tax Strategy in Your WooCommerce Store

Establishing a successful WooCommerce store goes beyond just selling products; it encompasses a comprehensive understanding of your financial obligations. A well-executed tax strategy can not only ensure compliance but can also foster sustainable growth for your online business.

To build a tax-compliant WooCommerce store, consider the following pillars of a solid tax strategy:

- Understand Your Tax Obligations: Research the sales tax rates applicable in the regions you operate. Each state or country may have different requirements.

- Automate Tax Calculations: Utilize plugins that integrate seamlessly with WooCommerce to automate tax calculations based on the customer’s location.

- Maintain Accurate Records: Keep detailed records of all transactions, including sales tax collected. This will simplify filing and improve transparency.

- Stay Updated on Tax Laws: Tax laws can change frequently. Regularly review updates and adjust your strategy accordingly to remain compliant.

Implementing effective tax solutions in your WooCommerce store can free up valuable resources. When you automate tax calculations, you minimize the risk of human error and save time that can be redirected to growing your business. Consider leveraging robust plugins like WooCommerce Taxamo or TaxJar, which can simplify the complexities of multi-jurisdictional tax management.

| Plugin | Features | Price |

|---|---|---|

| WooCommerce Taxamo | Real-time tax calculations, compliance reports | Starts at $20/month |

| TaxJar | Automated sales tax reporting, filing services | Starts at $19/month |

Another vital aspect is to consult with tax professionals who specialize in eCommerce. Their expertise can provide insights into deductions and credits that you may qualify for, ultimately enhancing your profitability. With the right guidance, you can uncover opportunities that may have otherwise gone unnoticed.

Additionally, consider the long-term implications of your tax strategy on your business growth. A proactive approach can position you favorably when it comes to scaling your operations. For instance, if you plan to expand your product line or enter new markets, understanding the tax implications of these decisions can help you make informed choices that align with your growth objectives.

a robust tax strategy is not merely a necessity for compliance but a powerful tool for inspiring growth within your WooCommerce store. Embrace this opportunity to not only safeguard your business but also to empower its future potential.

Frequently Asked Questions (FAQ)

Q&A: How to Build a Tax-Compliant WooCommerce Store on WordPress Without Extra Overhead

Q1: Why should I choose WooCommerce for my online store?

A: WooCommerce is not just a plugin; it’s a powerful eCommerce platform that integrates seamlessly with WordPress. By choosing WooCommerce, you gain access to a vast array of customizable features, allowing you to create a unique shopping experience for your customers. Plus, its strong community support and extensive documentation make troubleshooting and enhancements a breeze. Most importantly, it’s designed to help you operate efficiently and stay compliant with tax regulations, which means you can focus on growing your business rather than worrying about legalities.

Q2: What does “tax-compliant” mean in the context of an online store?

A: Being tax-compliant means that your store adheres to the tax laws applicable in the regions where you operate. This includes collecting the correct sales tax from customers, remitting those taxes to the appropriate authorities, and keeping accurate records for auditing purposes. Compliance not only protects your business from hefty fines but also builds trust with your customers, ensuring they feel secure shopping with you.

Q3: How can I build a tax-compliant store without incurring extra overhead costs?

A: Building a tax-compliant WooCommerce store doesn’t have to drain your resources. Start by utilizing WooCommerce’s built-in tax settings, which allow you to automatically calculate sales tax based on customer location. Pair this with a reliable tax compliance plugin, such as TaxJar or Avalara, to simplify reporting and remittance. By leveraging these tools, you minimize manual tracking and reduce the risk of errors, ultimately keeping your operational costs low.

Q4: Are there any specific plugins or tools I should consider for tax compliance?

A: Absolutely! Besides the aforementioned tax compliance plugins, consider using WooCommerce’s built-in features to set up tax classes and rates. You can also explore accounting software integrations like QuickBooks or Xero, which can help you manage finances and keep track of tax obligations effortlessly. These tools not only streamline your processes but also provide valuable insights, helping you make data-driven decisions that foster growth.

Q5: What are the common pitfalls to avoid when setting up my WooCommerce store?

A: One common pitfall is underestimating the complexity of tax regulations, which can vary greatly by state or country. Failing to set up tax correctly can lead to compliance issues down the line. Another mistake is neglecting to keep your plugins and software updated, which can expose you to security vulnerabilities and potential compliance risks. Staying informed about changes in tax laws and regularly reviewing your store’s settings will help you avoid these pitfalls.

Q6: Can I manage a tax-compliant store on my own?

A: Yes! While tax compliance may seem daunting, many resources are available to guide you. With WooCommerce’s intuitive interface and the right plugins, you can handle tax management with minimal technical knowledge. Furthermore, utilizing online courses, forums, and community support can empower you to take charge of your store confidently. Remember, every successful entrepreneur started small; you have the potential to achieve greatness too!

Q7: What’s the first step I should take to get started?

A: Start by laying a solid foundation. Begin with selecting a reliable hosting provider that offers excellent performance and support. Next, install WordPress and the WooCommerce plugin. From there, familiarize yourself with the tax settings in WooCommerce. Set up your store’s basic structure, and then gradually integrate additional tools and plugins as your business grows. Each step you take will bring you closer to creating a thriving, tax-compliant online store that reflects your vision and serves your customers passionately.

Embrace the journey of building your WooCommerce store with confidence and creativity! With the right strategies and tools in place, you can achieve tax compliance while keeping your overhead low, allowing you to focus on what truly matters—delivering exceptional products and experiences to your customers.

Final Thoughts

Conclusion: Empower Your E-Commerce Journey

Building a tax-compliant WooCommerce store on WordPress doesn’t have to be daunting or complicated. By following the steps outlined in this article, you can create an efficient online business that not only meets legal requirements but also thrives in a competitive marketplace. Remember, the key to success lies in preparation, organization, and leveraging the right tools.

As you embark on this journey, keep in mind that every great venture begins with a single step. Embrace the challenges, learn from your experiences, and adapt as you grow. With dedication, you can transform your WooCommerce store into a flourishing enterprise that not only generates revenue but also fosters trust and loyalty among your customers.

So take the leap! Equip yourself with the knowledge and resources at your disposal, and start building your tax-compliant WooCommerce store today. Your entrepreneurial dreams are within reach—let the world see what you can achieve!