Unlock your store’s potential with the right payment gateways! Discover the top 6+ WooCommerce options that streamline transactions, boost customer trust, and enhance your sales. Elevate your e-commerce journey and watch your business thrive!

6+ Top WooCommerce Payment Gateways for Your Store

In the ever-evolving landscape of e-commerce, the heartbeat of your online store lies in its ability to seamlessly process transactions. Choosing the right payment gateway is not just a technical decision—it’s a vital step toward building trust, enhancing user experience, and ultimately driving sales. Whether you’re a budding entrepreneur or an established retailer, the right payment solution can transform your business, offering customers the convenience and security they crave. In this article, we’ll explore the 6+ top WooCommerce payment gateways that can elevate your store to new heights. Join us as we delve into the features and benefits of each option, empowering you to make informed decisions that will fuel your success and inspire your customers to click “buy” with confidence. Let’s unlock the potential of your online store together!

Choosing the Right Payment Gateway for Your WooCommerce Store

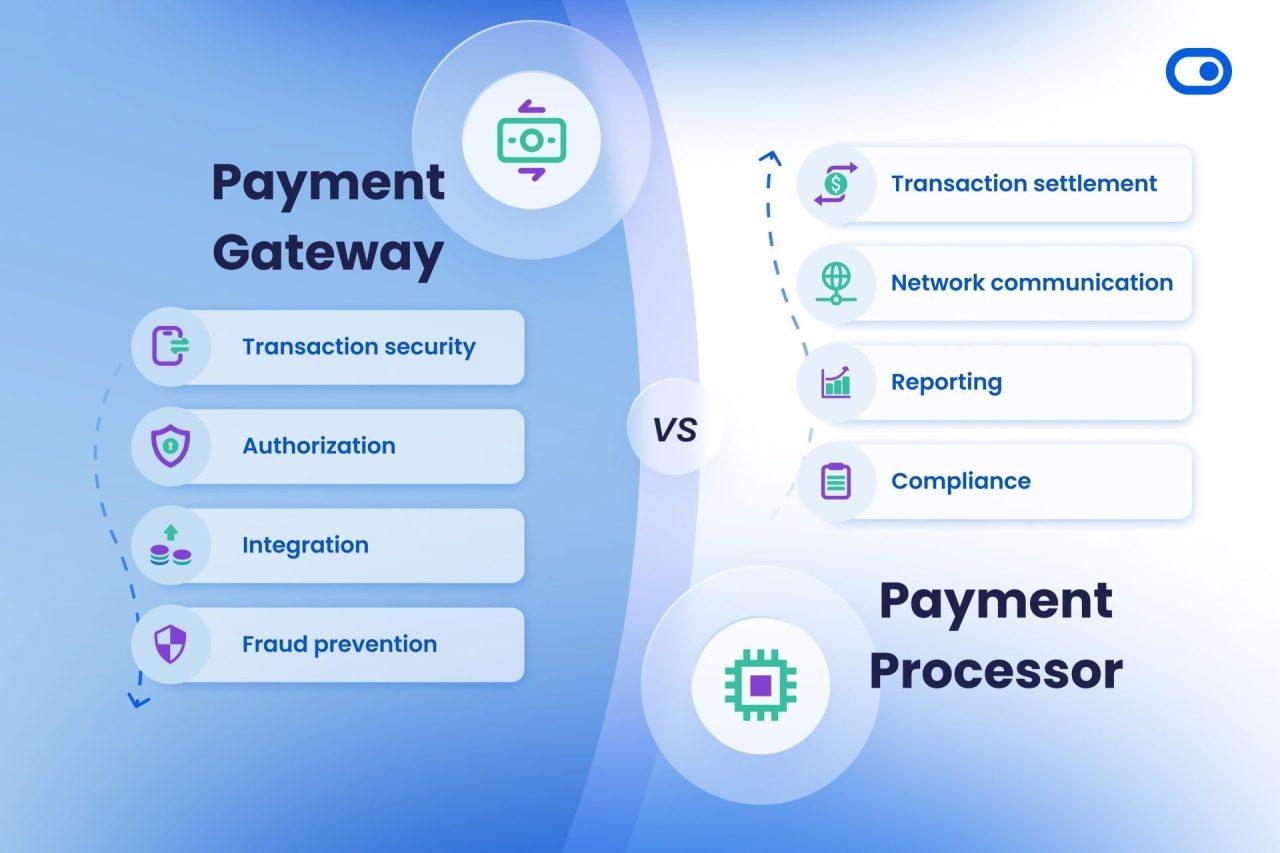

When it comes to running a successful WooCommerce store, choosing the right payment gateway is crucial. The right gateway not only enhances customer experience but also ensures secure transactions and helps build trust. With various options available, let’s explore what to consider when making your choice.

Key Considerations

- Transaction Fees: Every payment gateway has its own fee structure. Understanding these fees is essential, as high charges can cut into your profits.

- Supported Payment Methods: Customers prefer different payment options. Ensure that the gateway you choose supports credit cards, PayPal, and even local payment methods to cater to a broader audience.

- Ease of Integration: A seamless integration with WooCommerce can save you time and effort. Look for gateways that offer straightforward setup processes.

- Security Features: Security should be a top priority. Choose a payment gateway that complies with PCI DSS and offers features like encryption and fraud detection.

- Customer Support: Reliable customer support can make a significant difference. Opt for payment gateways that provide easily accessible assistance to resolve any issues promptly.

Popular Payment Gateways

| Payment Gateway | Transaction Fees | Key Features |

|---|---|---|

| PayPal | 2.9% + $0.30 | Easy setup, worldwide access, buyer protection |

| Stripe | 2.9% + $0.30 | Beautiful UI, powerful APIs, advanced fraud detection |

| Square | 2.6% + $0.10 | Integrated POS, real-time analytics, no monthly fees |

| Authorize.Net | $0.10 + $25/month | Recurring billing, advanced fraud detection, customizable |

By weighing these factors and exploring leading options, you can select a payment gateway that aligns with your business model and enhances your customers’ shopping experience. Remember, the ideal choice is not just about cost; it’s also about the seamless integration and support that can empower your WooCommerce store to thrive.

Unlocking Seamless Transactions with Leading Payment Solutions

In an era where convenience and speed dictate consumer behavior, choosing the right payment gateway can make or break your eCommerce success. The ability to facilitate seamless transactions not only enhances customer satisfaction but also builds trust and loyalty. Here are some of the leading payment solutions that can elevate your WooCommerce store.

Key Features of Top Payment Gateways

- Security: Safeguarding sensitive information is paramount. Top gateways encrypt user data, ensuring a safe transaction environment.

- Versatility: A great payment solution supports multiple payment methods including credit cards, debit cards, and digital wallets.

- User-Friendly Interfaces: Simplified checkout processes reduce cart abandonment, encouraging customers to complete their purchases effortlessly.

- Global Reach: Support for international payments broadens your market, allowing you to cater to a global audience.

Comparative Overview of Leading Payment Gateways

| Payment Gateway | Transaction Fees | Key Benefits |

|---|---|---|

| Stripe | 2.9% + 30¢ per transaction | Wide range of features, excellent API integration |

| PayPal | 2.9% + 30¢ per transaction | Trusted brand, easy setup, extensive buyer protection |

| Square | 2.6% + 10¢ per transaction | All-in-one solution, great for brick-and-mortar and online |

| Authorize.Net | 2.9% + 30¢ per transaction | Reliable customer support, advanced fraud detection |

When it comes to enhancing customer experience, the right payment gateway can also offer features like recurring billing for subscription models, and multi-currency support which is essential for stores targeting diverse markets. By integrating such functionalities, you can make your store more attractive to a wider audience.

Moreover, consider the ease of integration with your existing WooCommerce setup. Many leading payment gateways offer plugins or built-in support, significantly reducing the technical hurdles of implementation. This means you can focus more on marketing your products and less on backend complications.

By choosing a robust payment solution, you’re not just streamlining transactions; you’re also setting the stage for growth. With a well-optimized payment system in place, your store can attract more customers, reduce cart abandonment rates, and ultimately boost your bottom line. The key is to align your payment strategy with your business goals, ensuring you provide a payment experience that resonates with your target audience.

Exploring the Benefits of Using WooCommerce Payment Gateways

When it comes to running a successful online store with WooCommerce, choosing the right payment gateway can make all the difference. With an array of options available, businesses can tailor their payment solutions to meet customer preferences, enhance security, and increase conversion rates. The right payment gateway not only fosters trust but also streamlines the purchasing process for customers, resulting in higher sales and customer satisfaction.

One of the significant advantages of utilizing WooCommerce payment gateways is the flexibility they offer. Each gateway comes with unique features tailored to various business models and customer demographics. For instance, some payment processors focus on low transaction fees, while others provide a seamless checkout experience or support international currencies. This flexibility allows merchants to opt for a solution that aligns with their specific needs and target audience.

Moreover, many WooCommerce payment gateways are equipped with advanced security measures such as PCI compliance, fraud detection, and encryption technologies. By prioritizing security, merchants can protect sensitive customer data, reducing the risk of fraud and chargebacks. This assurance builds trust with customers, leading to increased loyalty and repeat business.

Another key benefit is the integration capabilities of these payment gateways with various tools and platforms. Many gateways seamlessly integrate with popular accounting software, inventory management systems, and customer relationship management (CRM) tools. This integration facilitates efficient business operations and allows for better data analysis, helping merchants make informed decisions to optimize their online store.

The ease of customization offered by many payment gateways is also worth noting. Merchants can modify the checkout experience to match their brand identity, thus enhancing user experience. Options for adding custom fields, logos, and tailored messages during checkout can significantly influence customer perceptions and experiences.

Lastly, WooCommerce payment gateways often provide merchants with valuable analytics and reporting features. Insights into customer behavior, sales trends, and payment processing stats can inform marketing strategies and inventory management. By leveraging this data, businesses can refine their offerings and improve overall operational efficiency, leading to sustained growth.

| Payment Gateway | Key Features | Best For |

|---|---|---|

| PayPal | Widely recognized, easy setup | Small to medium-sized businesses |

| Stripe | Customizable, extensive API | Tech-savvy merchants |

| Square | In-person transactions, integrated POS | Retailers with offline sales |

| Authorize.Net | Robust security, automated fraud detection | Businesses prioritizing security |

How to Select the Perfect Gateway for Your Business Needs

Choosing the right payment gateway is crucial for the success of your WooCommerce store. With a plethora of options available, it can be overwhelming to determine which one aligns best with your business needs. Here are some key factors to consider that will help streamline your decision-making process.

Transaction Fees: Every payment gateway comes with its own fee structure. Understanding these fees is essential as they can significantly affect your profit margins. Look for options that offer competitive rates and transparent pricing models to avoid hidden charges.

Payment Methods: Your customers have different preferences when it comes to payment methods. Ensure that the gateway you choose supports a variety of options, including credit cards, digital wallets, and local payment methods. This flexibility can enhance customer satisfaction and increase conversion rates.

Security Features: In an era where cybersecurity is paramount, selecting a gateway that prioritizes security is non-negotiable. Look for features like PCI compliance, fraud detection, and encrypted transactions. A secure payment experience builds trust with your customers and can lead to repeat business.

Integration and Compatibility: The best payment gateway should seamlessly integrate with your WooCommerce store. Check for compatibility with your existing plugins and consider ease of setup. A user-friendly interface will save you time and reduce the hassle of managing transactions.

Customer Support: Reliable customer support can make a world of difference, especially when unexpected issues arise. Opt for a payment gateway provider that offers excellent support, including live chat, phone support, and comprehensive documentation. This will ensure that you have help when you need it most.

| Payment Gateway | Transaction Fees | Payment Methods | Security Features |

|---|---|---|---|

| PayPal | 2.9% + $0.30 | Card, Wallet | PCI Compliance, Fraud Protection |

| Stripe | 2.9% + $0.30 | Card, ACH, Wallet | 3D Secure, Encrypted Data |

| Square | 2.6% + $0.10 | Card, Digital Wallets | Encryption, Fraud Detection |

| Authorize.Net | $0.10 + $25/month | Card, E-check | Tokenization, PCI Compliance |

By carefully weighing these factors, you can select a payment gateway that not only meets your business requirements but also enhances the overall shopping experience for your customers. A strategic choice will empower you to focus on growth while providing a secure and seamless payment process.

Enhancing Customer Trust with Secure Payment Options

In today’s digital marketplace, customer trust is paramount, especially when handling sensitive financial information. Offering secure payment options not only protects your customers but also enhances your store’s reputation. By integrating reliable payment gateways, you can create a seamless and secure shopping experience that encourages repeat business.

Consider the following key benefits of implementing secure payment options in your WooCommerce store:

- Data Encryption: Secure payment gateways use advanced encryption methods to protect customer data during transactions, ensuring that personal and financial information remains confidential.

- Fraud Detection: Many payment providers offer built-in fraud detection tools that help identify suspicious activity, allowing you to take proactive measures to safeguard your business and your customers.

- Multiple Payment Methods: By offering various payment options, including credit cards, digital wallets, and bank transfers, you cater to a wider audience, increasing the likelihood of conversion.

Integrating these secure payment gateways can not only enhance your customer’s trust but also elevate their overall shopping experience. Consider implementing the following popular WooCommerce payment gateways that are well-known for their security features:

| Payment Gateway | Security Features | Transaction Fees |

|---|---|---|

| Stripe | 2-Step Authentication, PCI Compliance | 2.9% + $0.30 per transaction |

| PayPal | Fraud Protection, Data Encryption | 2.9% + $0.30 per transaction |

| Authorize.Net | Secure Customer Data, AVS Checks | $0.10 per transaction + monthly fee |

| Square | PAT Compliance, Instant Alerts | 2.6% + $0.10 per transaction |

Investing in secure payment options also reflects your commitment to customer care, making your store more appealing in a competitive landscape. Customers are more likely to complete their purchases when they feel their information is protected, paving the way for higher conversion rates and customer loyalty.

enhancing customer trust through secure payment options is not just a technical necessity; it’s a fundamental aspect of building lasting relationships with your clients. By prioritizing security and providing a variety of trusted payment methods, you can foster an environment of confidence that resonates with your audience and drives your business forward.

A Deep Dive into Popular Payment Gateways for WooCommerce

When it comes to selecting a payment gateway for your WooCommerce store, the choices can feel overwhelming. Each option comes with its unique features, fees, and integrations that can significantly impact your customers’ shopping experience. Below, we explore some of the most popular payment gateways that can elevate your online store’s performance and customer satisfaction.

PayPal is a household name in the realm of online payments. Its user-friendly interface and robust security features make it a top choice for merchants and customers alike. With PayPal, customers can complete transactions quickly, often without needing to leave your site. Furthermore, PayPal offers options like PayPal Credit, providing flexible payment plans for buyers.

Stripe is another powerful contender, especially favored by businesses seeking advanced customization. Its seamless integration with WooCommerce helps streamline the checkout process. Stripe supports various payment methods, including credit cards, digital wallets, and even local payment systems, ensuring you can cater to a global audience.

Square is perfect for businesses that operate both online and in brick-and-mortar locations. With features like in-person sales integration and comprehensive inventory management, Square makes it easy to manage all sales through a single platform. Its transparent pricing structure also appeals to many new and small businesses looking to keep costs predictable.

| Gateway | Key Feature | Fees |

|---|---|---|

| PayPal | Instant checkout experience | 2.9% + $0.30 per transaction |

| Stripe | Highly customizable | 2.9% + $0.30 per transaction |

| Square | In-person integration | 2.6% + $0.10 per transaction |

Authorize.Net provides a reliable solution for businesses looking for extensive fraud protection and customer support. Its advanced security features, including tokenization and customer information management, make it trustworthy for businesses handling sensitive data. With a straightforward setup process, Authorize.Net integrates smoothly into WooCommerce.

For those focusing on international sales, Adyen is an excellent choice. This payment gateway supports over 250 payment methods and offers a unified platform to manage transactions across various regions. The ease of managing multi-currency transactions can help expand your business’s reach significantly.

consider Amazon Pay. Leveraging the trust and familiarity many consumers have with Amazon, this option allows customers to use their existing Amazon accounts to check out quickly on your site. This can significantly reduce cart abandonment rates and enhance overall conversion rates, making it a powerful tool in your payment processing arsenal.

In the ever-evolving landscape of eCommerce, choosing the right payment gateway can set your store apart. Prioritizing customer experience, security, and flexibility will not only enhance your store’s performance but also build lasting relationships with your customers.

Maximizing Conversion Rates with Optimized Payment Processes

In today’s digital marketplace, a seamless payment process can make all the difference between a cart abandoned and a sale completed. To maximize conversion rates, it is crucial to choose payment gateways that enhance the customer experience while instilling trust and security. By streamlining payment processes, you can significantly reduce friction that might lead potential buyers to rethink their purchase.

Here are key features to consider when optimizing your payment processes:

- Multiple Payment Options: Offering various payment methods such as credit cards, PayPal, and Apple Pay can cater to diverse customer preferences.

- Mobile-Friendly Interfaces: Ensure your payment gateways are optimized for mobile devices, as more shoppers are using their phones to make purchases.

- Security and Compliance: Choose gateways that offer robust security measures, including SSL encryption and fraud detection tools, to protect customer data.

- Streamlined Checkout Process: Minimize the number of steps required to complete a transaction. A simple, intuitive checkout can significantly reduce cart abandonment rates.

Enhancing your payment processes not only fosters customer satisfaction but also promotes brand loyalty. When customers feel secure and valued, they are more likely to return. Additionally, integrating features such as one-click payments can further simplify transactions and encourage repeat purchases.

Furthermore, it’s essential to monitor your payment gateways’ performance. Set up analytics to track conversion rates, average order values, and cart abandonment rates. A/B testing different payment options can also provide insights into what resonates best with your audience.

| Payment Gateway | Key Features | Ideal For |

|---|---|---|

| PayPal | Widely recognized, offers buyer protection | Businesses of all sizes |

| Stripe | Customizable API, supports multiple currencies | Developers and tech-savvy users |

| Square | Integrated POS, easy inventory management | Brick-and-mortar businesses |

| Authorize.Net | Fraud detection, recurring billing | Subscription-based businesses |

By leveraging the right payment gateways and optimizing your payment process, you can create a frictionless buying experience that not only drives conversions but also sets your online store apart in a competitive landscape. Remember, every little detail counts when it comes to securing sales and building long-term customer relationships.

The Importance of Multi-Currency Support in Global Sales

In today’s interconnected marketplace, the ability to accept multiple currencies is no longer a luxury; it’s a necessity. With online shopping breaking geographical boundaries, consumers expect the convenience of purchasing in their local currency. By integrating multi-currency support, stores can enhance the shopping experience, reduce cart abandonment, and increase conversion rates.

Enhancing Customer Trust

When customers see prices displayed in their own currency, it builds a sense of trust and familiarity. It eliminates confusion surrounding exchange rates and potential hidden fees, allowing shoppers to feel more secure in their purchasing decisions. This transparency can significantly influence buying behavior, leading to higher sales and customer loyalty.

Expanding Market Reach

A store that supports multiple currencies can tap into diverse international markets. This not only increases potential sales but also allows businesses to cater to various demographics. By providing localized pricing, businesses can attract a broader customer base, making it easier for global shoppers to choose your brand over competitors that may not offer such flexibility.

Streamlined Operations

Multi-currency support simplifies accounting and inventory management for global sales. Instead of dealing with various exchange rates, businesses can consolidate their financial operations, keeping everything clear and organized. This reduction in complexity can free up time and resources, allowing store owners to focus on growth and customer satisfaction.

Competitive Advantage

In a crowded e-commerce landscape, offering multi-currency support can set your store apart from competitors. As more customers expect this feature, businesses that fail to implement it may fall behind. By embracing this capability, you position your store as a forward-thinking brand that prioritizes customer experience, which can be a decisive factor for many online shoppers.

| Benefits of Multi-Currency Support | Impact on Sales |

|---|---|

| Improved Customer Experience | Higher conversion rates |

| Increased Trust | Lower cart abandonment |

| Broader Market Access | Expanded customer base |

| Operational Efficiency | Simplified accounting |

Ultimately, adopting multi-currency support is a strategic move that can propel your store into the global e-commerce arena. In a world where consumers expect convenience and choice, providing the ability to pay in their preferred currency is not just an enhancement; it’s a critical component of a successful online sales strategy.

Streamlining Your Checkout Experience for Higher Sales

In today’s fast-paced digital marketplace, ensuring a seamless checkout experience is crucial for maximizing sales and retaining customers. By integrating the right payment gateways into your WooCommerce store, you can simplify transactions, increase trust, and enhance customer satisfaction. Here are some of the leading options to consider:

- Stripe: Known for its versatility and developer-friendly API, Stripe allows businesses to accept payments from customers worldwide. Its intuitive interface and support for multiple currencies make it a favorite among online retailers.

- PayPal: As one of the most recognized names in online payments, PayPal provides a quick and secure way for customers to pay. With options like PayPal Express Checkout, you can reduce cart abandonment by allowing buyers to complete their purchases with just a few clicks.

- Square: Ideal for both online and in-person transactions, Square integrates smoothly with WooCommerce and offers a complete payment solution. Its transparent pricing and easy setup help retailers streamline their operations.

- Authorize.Net: A reliable choice for processing credit card payments, Authorize.Net offers advanced fraud detection tools and a customizable checkout experience, which can help boost conversions and increase security.

- Amazon Pay: Leverage the trust and convenience of Amazon by allowing customers to check out using their Amazon accounts. This can significantly speed up the process and enhance user experience.

- Adyen: With its global reach and support for a wide range of payment methods, Adyen is perfect for businesses looking to expand internationally. Its advanced analytics can help you optimize your sales strategies.

Choosing the right payment gateway is more than just a technical decision; it’s a strategic move that can influence customer loyalty, brand perception, and overall sales. Consider these factors when making your selection:

| Payment Gateway | Transaction Fees | Key Feature |

|---|---|---|

| Stripe | 2.9% + $0.30 | Customizable API |

| PayPal | 2.9% + $0.30 | Express Checkout |

| Square | 2.6% + $0.10 | In-person payments |

| Authorize.Net | 2.9% + $0.30 | Fraud detection |

| Amazon Pay | Variable | Amazon account integration |

| Adyen | Variable | Global payment support |

Ultimately, the goal is to create a frictionless experience that encourages users to complete their purchases confidently. By selecting one or more of these payment gateways, you can cater to a variety of customer preferences while ensuring a secure transaction environment. Start optimizing your checkout process today and watch your sales soar!

Integrating Recurring Payments for Subscription-Based Models

In today’s competitive e-commerce landscape, integrating recurring payments is essential for businesses that operate on a subscription-based model. This seamless payment solution not only enhances customer experience but also ensures a steady cash flow for your store. With the right WooCommerce payment gateway, you can effortlessly manage subscriptions, automate transactions, and maintain customer satisfaction.

When selecting a payment gateway, consider features that specifically cater to subscription management. Look for solutions that offer:

- Flexible Billing Cycles: Allow customers to choose their billing frequency, whether it’s monthly, quarterly, or annually.

- Automatic Renewals: Automate the payment process so that subscriptions renew without manual intervention, reducing churn rates.

- Customer Portal: Empower your customers with a portal for managing their subscriptions, enabling them to update payment methods and plan changes easily.

- Analytics and Reporting: Utilize built-in analytics to track subscription metrics, helping you make informed decisions.

One of the key considerations is the gateway’s fee structure. Some gateways charge a flat fee, while others take a percentage of the transaction. It’s essential to balance cost with the features offered. A well-structured fee system can ultimately lead to more profits as your subscription base grows.

| Payment Gateway | Recurring Payment Support | Transaction Fees |

|---|---|---|

| WooCommerce Subscriptions | ✔️ | Varies by Payment Processor |

| Stripe | ✔️ | 2.9% + 30¢ |

| PayPal | ✔️ | 2.9% + 30¢ |

| Authorize.Net | ✔️ | 2.9% + 30¢ |

Integration of a reliable payment gateway is not just about facilitating transactions; it’s about building trust with your customers. By offering well-known and secure payment options, you can enhance your brand’s credibility. Customers are more inclined to subscribe when they know their payment information is in safe hands.

Lastly, consider your customers’ preferences. Offering multiple payment methods can significantly increase conversion rates. Whether it’s credit cards, PayPal, or even cryptocurrency, ensuring flexibility can make your subscription model more attractive, catering to a wider audience.

Comparing Fees and Costs of Top Payment Gateways

When choosing the right payment gateway for your WooCommerce store, understanding the fees and costs involved is critical. Each gateway has its own pricing structure that can significantly impact your bottom line. Here’s a breakdown of the costs associated with some of the most popular options.

| Payment Gateway | Transaction Fees | Monthly Fees | Setup Fees |

|---|---|---|---|

| PayPal | 2.9% + $0.30 | $0 | $0 |

| Stripe | 2.9% + $0.30 | $0 | $0 |

| Square | 2.6% + $0.10 | $0 | $0 |

| Authorize.Net | 2.9% + $0.30 | $25 | $49 |

| Braintree | 2.9% + $0.30 | $0 | $0 |

PayPal and Stripe are among the most popular gateways due to their straightforward pricing and absence of monthly fees. However, it’s crucial to note that transaction fees can add up, especially for businesses with high sales volumes. If you are a growing store, consider how these fees affect your overall profitability.

On the other hand, Square stands out with slightly lower transaction fees, making it an attractive option for smaller transactions. Additionally, the lack of monthly and setup fees means that you can initiate your online sales without a hefty initial investment.

When evaluating options like Authorize.Net, the monthly fee may deter some, but for businesses that require advanced features or are processing a high volume of transactions, this setup could be worth the investment. Their reliability and customer support are often highlighted as significant advantages.

Lastly, Braintree offers similar fee structures to PayPal and Stripe but is particularly strong in mobile payment processing, making it a fantastic choice for stores aiming to enhance their mobile user experience. Choosing the right gateway isn’t merely about the fees; it’s about aligning those costs with your business model and customer preferences.

Leveraging Mobile Payments for the Modern Shopper

In the ever-evolving landscape of retail, mobile payments have emerged as a game-changer for both merchants and consumers. They provide unparalleled convenience and speed, allowing shoppers to complete transactions at the touch of a button. For WooCommerce store owners, integrating mobile payment options is no longer just an added benefit; it’s a necessity that can significantly enhance the overall shopping experience.

Why Mobile Payments Matter

Today’s shoppers are not just looking for products—they’re seeking seamless experiences. Mobile payments cater to this demand by offering:

- Instant Transactions: Quick payment processing that reduces cart abandonment.

- Enhanced Security: Advanced encryption technologies that protect sensitive information.

- Increased Sales: A frictionless checkout process encourages larger purchases and repeat visits.

By adopting mobile payment solutions, you can tap into the growing trend of consumers who prefer shopping with their smartphones. Research shows that a significant percentage of online shoppers now use mobile devices, and this trend is only expected to grow. Therefore, ensuring your WooCommerce store is equipped with mobile-friendly payment options is essential for capturing this audience.

Key Features to Look For

When selecting a payment gateway for your WooCommerce store, consider gateways that offer:

- Multiple Payment Options: Support for credit/debit cards, digital wallets, and bank transfers.

- User-Friendly Interfaces: Intuitive designs that enhance the customer experience.

- Global Accessibility: The ability to process international transactions seamlessly.

Mobile Payment Gateway Comparison

| Gateway | Transaction Fee | Mobile Compatibility |

|---|---|---|

| PayPal | 2.9% + $0.30 | Yes |

| Stripe | 2.9% + $0.30 | Yes |

| Square | 2.6% + $0.10 | Yes |

| Authorizenet | 2.9% + $0.30 | Yes |

Choosing the right gateway can significantly impact your store’s profitability. Make sure to evaluate each option based on your business model and customer preferences. With the right mobile payment systems in place, you can create a streamlined and enjoyable shopping journey that keeps customers coming back for more.

Future-Proofing Your Store with Innovative Payment Technologies

As the e-commerce landscape evolves, it’s crucial for store owners to stay ahead of the curve by integrating cutting-edge payment technologies. By adopting innovative payment gateways, you not only enhance the customer experience but also bolster your store’s operational efficiency. Seamless transactions lead to higher conversion rates, and in today’s fast-paced market, every second counts.

The right payment gateway can significantly impact your business, offering features like multi-currency support, fraud detection, and mobile optimization. These elements not only cater to a global audience but also instill confidence in security, encouraging more customers to complete their purchases. Here are some of the key features to look for when selecting a payment gateway:

- Speed: Quick transaction processing can reduce cart abandonment rates.

- Flexibility: Support for various payment methods (credit cards, digital wallets, etc.) can meet diverse customer preferences.

- Security: Advanced encryption and compliance with standards like PCI DSS keep customer data safe.

- Integration: A gateway that easily integrates with WooCommerce can streamline your operations.

Let’s explore a few top WooCommerce payment gateways that embody these innovative features:

| Payment Gateway | Key Features | Best For |

|---|---|---|

| Stripe | Instant payouts, subscription billing, fraud prevention | Startups and tech-savvy businesses |

| PayPal | Global reach, easy setup, buyer protection | All businesses |

| Square | Point of sale, mobile payments, inventory management | Retailers with physical stores |

| Authorize.net | Rich reporting, recurring billing, customer profiles | Established online stores |

By selecting the right payment gateway, you’re not merely choosing a processing service; you’re investing in the future of your store. Embracing new technologies will not only enhance your operational capabilities but also create a more engaging shopping experience for your customers. This proactive approach will foster brand loyalty and position your business for sustainable growth.

Furthermore, as digital wallets and contactless payments gain traction, implementing these options can significantly enhance the shopping experience. Customers increasingly expect convenience, and providing a variety of payment options can set your store apart. By being flexible and responsive to changing consumer demands, you establish your brand as a forward-thinking leader in the e-commerce space.

Transforming Your WooCommerce Store with the Right Payment Gateway

Choosing the right payment gateway for your WooCommerce store can significantly impact your business’s success. With a variety of options available, selecting a gateway that aligns with your store’s needs is crucial for enhancing customer experience and boosting sales. Here are some essential factors to consider when transforming your store through payment solutions.

Security and Compliance are paramount in today’s e-commerce landscape. Customers need to feel confident that their sensitive information is protected. Look for payment gateways that offer advanced encryption and comply with industry standards such as PCI DSS. By ensuring top-notch security, you not only protect your customers but also enhance your brand’s reputation.

User Experience plays a vital role in conversion rates. Seamless checkout processes can reduce cart abandonment. Opt for gateways that provide a smooth, intuitive checkout experience, allowing customers to complete their purchases with minimal friction. Some popular gateways offer features like one-click payments or guest checkout options, making it easier for customers to finalize their transactions.

Another key aspect is the availability of multiple payment options. Diverse payment methods cater to a broader audience, allowing customers to choose their preferred way to pay. Consider integrating gateways that support credit cards, digital wallets, and even local payment methods. This flexibility can significantly enhance customer satisfaction and foster loyalty.

When evaluating payment gateways, also consider their transaction fees and pricing structures. Some gateways charge a flat fee per transaction, while others may include monthly fees or additional costs for fraud protection. Make sure to analyze these factors to select a gateway that aligns with your budget and business model. Here’s a simple comparison table:

| Payment Gateway | Transaction Fee | Monthly Fee | Key Features |

|---|---|---|---|

| PayPal | 2.9% + $0.30 | $0 | Widely recognized, buyer protection |

| Stripe | 2.9% + $0.30 | $0 | Customizable API, subscriptions |

| Square | 2.6% + $0.10 | $0 | Point of sale integration, invoicing |

| Authorize.Net | 2.9% + $0.30 | $25 | Recurring billing, fraud detection |

Lastly, consider the level of support each payment gateway offers. Technical issues can arise, and having a responsive support team can significantly minimize downtime and maintain customer satisfaction. Look for providers that offer 24/7 support through various channels, ensuring you can get help when you need it most.

By carefully assessing these factors, you can select a payment gateway that not only fits your business model but also enhances your customers’ shopping experience. The right payment gateway is not just a financial transaction tool; it’s a vital component in building trust and loyalty in your brand.

Frequently Asked Questions (FAQ)

Q&A: 6+ Top WooCommerce Payment Gateways for Your Store

Q1: Why is choosing the right payment gateway crucial for my WooCommerce store?

A: Selecting the right payment gateway is essential because it directly impacts your customers’ shopping experience. A seamless payment process can boost conversions, reduce cart abandonment, and build trust with your customers. With the right gateway, you not only provide various payment options but also ensure secure transactions, enhancing customer satisfaction and loyalty.

Q2: What features should I look for in a WooCommerce payment gateway?

A: When choosing a payment gateway, consider features such as ease of integration, transaction fees, support for multiple currencies, and the range of payment methods offered (credit cards, PayPal, digital wallets, etc.). Additionally, look for advanced security features like PCI compliance and fraud prevention tools. These attributes will help you create a smooth, secure shopping experience that keeps customers coming back.

Q3: Can you highlight a few of the top WooCommerce payment gateways?

A: Absolutely! Some of the top choices include:

- PayPal: A household name with a trusted reputation, offering easy integration and multiple payment options.

- Stripe: Known for its developer-friendly API and advanced features like subscription billing and international payments.

- Authorize.Net: A long-standing player in the payment industry, ideal for businesses seeking extensive fraud protection tools.

- Square: Perfect for businesses that operate both online and in physical locations, providing a unified solution.

- Amazon Pay: Leverage the trust of Amazon to offer a quick checkout process without needing to create a new account.

- Braintree: A PayPal service that allows for seamless mobile and web payments with customizable features.

Each of these gateways brings unique strengths, ensuring you can find the perfect fit for your store’s needs.

Q4: How can these payment gateways enhance customer trust?

A: Trust is paramount in eCommerce, and the right payment gateway can significantly enhance it. Well-known gateways like PayPal and Amazon Pay not only offer familiarity but also robust security measures. By selecting a reputable gateway, you communicate to your customers that their sensitive information is safe, which fosters confidence and encourages them to complete their purchases.

Q5: What are the potential drawbacks of using certain payment gateways?

A: While many payment gateways offer fantastic features, they may also come with drawbacks such as high transaction fees, limited payment options, or complex integration processes. It’s essential to thoroughly research each gateway’s terms and conditions to ensure it aligns with your business model and customer base. Balancing the pros and cons will help you make a more informed decision that benefits your store.

Q6: How can I ensure a smooth integration of my chosen payment gateway?

A: To ensure a seamless integration, start by choosing a gateway that is compatible with WooCommerce. Most reputable gateways offer detailed documentation and support. Additionally, consider running a test transaction to identify any potential issues before going live. This proactive approach will allow you to fine-tune the setup and provide customers with a flawless checkout experience from day one.

Q7: What is the best way to promote my new payment options to customers?

A: Once you’ve integrated your new payment gateways, promote them through various channels. Update your website banners, share posts on social media, and send out newsletters highlighting the benefits of these new options. Emphasize convenience and security, and consider offering promotions or discounts for using specific payment methods. This not only informs customers but also encourages them to engage with your store.

By choosing the right WooCommerce payment gateways, you’re not just facilitating transactions; you’re paving the way for a better shopping experience that inspires customer loyalty and drives growth. Let your payment options reflect the quality and reliability of your store, and watch your business thrive!

The Conclusion

As we conclude our exploration of the top WooCommerce payment gateways for your store, it’s clear that the right payment solution can make all the difference in transforming casual visitors into loyal customers. With the right tools at your disposal, you’re not just selling products; you’re crafting a seamless shopping experience that builds trust and encourages repeat business.

Each of the payment gateways we’ve discussed offers unique features designed to enhance the payment process while ensuring security and convenience for both you and your customers. By carefully selecting the gateway that aligns with your business goals and customer preferences, you can pave the way for growth, improve your conversion rates, and ultimately, drive your eCommerce success.

Remember, in the world of online retail, the customer experience reigns supreme. Embrace the power of these payment gateways and watch as they empower your store to reach new heights. Now is the time to take action—choose the gateway that resonates with your vision, implement it with confidence, and turn your WooCommerce store into a thriving hub of activity. Your customers are waiting, and your journey to eCommerce excellence begins today!

![How to Install a WordPress Theme? [Beginner’s Guide]](https://webhost.review/wp-content/uploads/2026/02/10475-how-to-install-a-wordpress-theme-beginners-guide.jpg)