When choosing the best payment gateway for WooCommerce, consider factors like transaction fees, ease of integration, and customer support. Popular options like PayPal and Stripe offer reliability and flexibility. Make the right choice to boost your sales!

What Is the Best Payment Gateway for WooCommerce

When it comes to running an online store with WooCommerce, choosing the right payment gateway can feel like navigating a maze. With so many options available, how do you know which one will serve your business best? The truth is, a well-chosen payment gateway can streamline your transactions, enhance customer satisfaction, and ultimately boost your sales. Whether you’re a seasoned e-commerce pro or just starting out, understanding the features, fees, and functionalities of different payment gateways is crucial. In this article, we’ll dive into the top contenders, weighing their pros and cons, so you can make an informed decision that sets your WooCommerce store up for success. Let’s find the perfect match for your business and help you keep your customers coming back for more!

Understanding Payment Gateways and Their Importance for WooCommerce

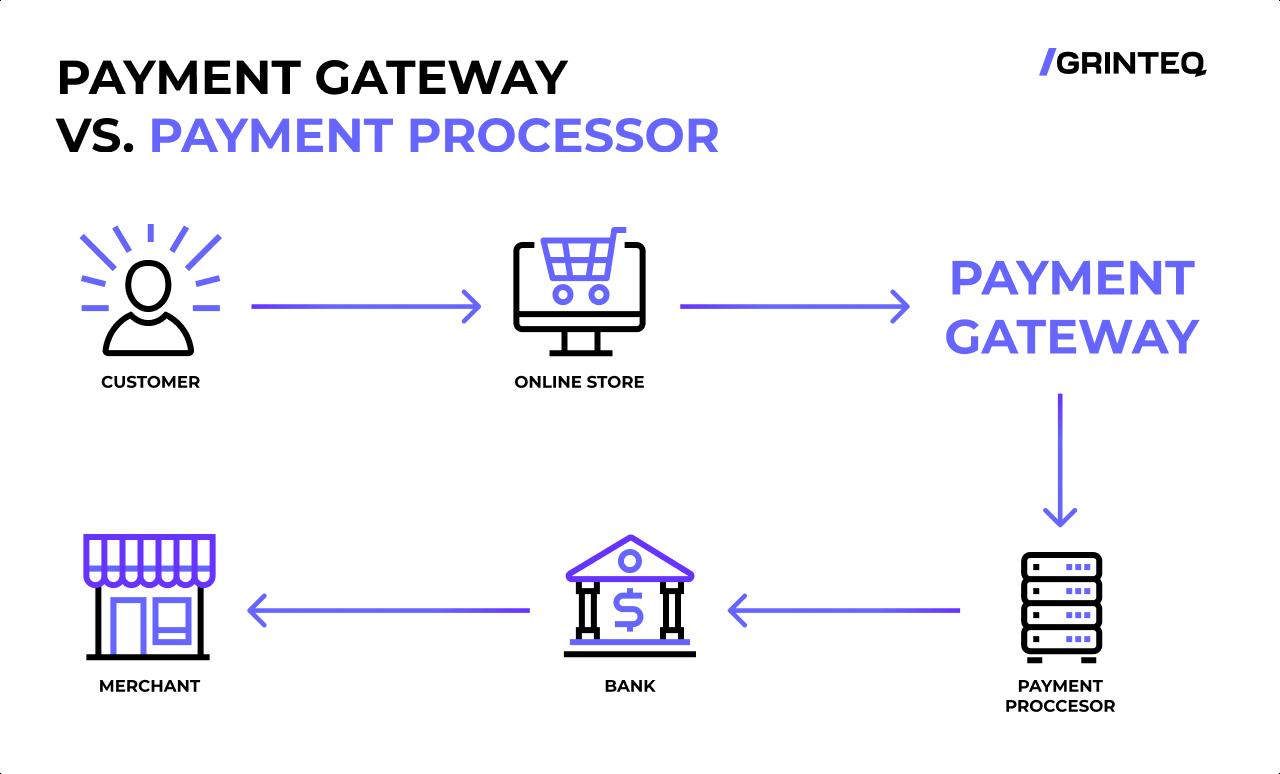

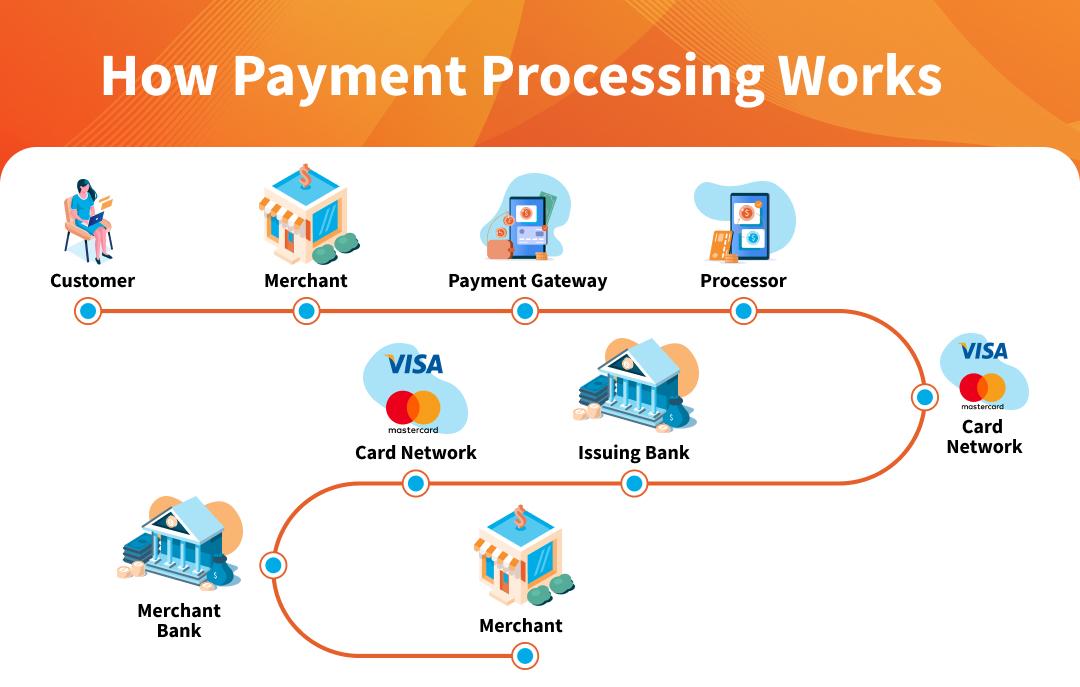

Payment gateways are a critical component of any online store, especially for WooCommerce users. They serve as the bridge between your customers’ payment methods and your online storefront. By securely processing transactions, these gateways help to ensure that sensitive financial information remains protected during every purchase. Understanding how these gateways function can significantly impact your eCommerce success.

When selecting a payment gateway for your WooCommerce store, consider the following key factors:

- Security: A reliable payment gateway will comply with PCI DSS standards, providing a secure environment for transactions.

- Ease of Integration: Look for gateways that seamlessly integrate with WooCommerce to enhance user experience and simplify the setup process.

- Transaction Fees: Different gateways have varying fee structures. It’s important to choose one that offers competitive rates that align with your business goals.

- Customer Support: Opt for gateways that provide robust customer support to resolve any issues that may arise, ensuring minimal disruption to your business.

Additionally, the choice of payment gateway can influence your customers’ purchasing decisions. Consumers often prefer to shop where they feel safe and have multiple payment options. Offering a variety of payment methods—such as credit cards, PayPal, and even cryptocurrency—can enhance their shopping experience and increase conversion rates.

Here’s a quick comparison of some popular payment gateways for WooCommerce:

| Payment Gateway | Features | Transaction Fees |

|---|---|---|

| Stripe | Easy integration, supports multiple currencies | 2.9% + 30¢ per transaction |

| PayPal | Trusted brand, buyer protection | 2.9% + 30¢ per transaction |

| Authorize.Net | Recurring billing, fraud detection | $0.10 per transaction + monthly fee |

| Square | In-person payments integration, inventory sync | 2.6% + 10¢ per transaction |

Ultimately, the best payment gateway for your WooCommerce store is one that aligns with your business model and meets your customers’ needs. Take the time to research and test out different options to find the perfect fit. Remember, investing in a robust payment processing solution can lead to increased sales, improved customer satisfaction, and long-term business success.

Key Features to Look for in a Payment Gateway

When choosing a payment gateway for WooCommerce, there are several key features that can significantly impact your online store’s efficiency and customer satisfaction. Let’s explore these features to ensure you make the right choice for your business.

- Security Protocols: Safety is paramount in online transactions. Look for gateways that offer robust security measures like SSL encryption, PCI compliance, and fraud detection tools. This not only protects your customers but also builds trust in your brand.

- Payment Options: A flexible payment gateway should support various payment methods, including credit cards, debit cards, and alternative options like PayPal, Apple Pay, or even cryptocurrencies. This diversity accommodates your customers’ preferences and can enhance conversion rates.

- Transaction Fees: Understanding the fee structure is crucial. Some gateways charge a flat rate per transaction, while others may have percentage-based fees. Compare these costs to ensure you’re not sacrificing your profits for convenience. Check the table below for a quick comparison of common fee structures:

| Payment Gateway | Setup Fee | Transaction Fee |

|---|---|---|

| Gateway A | No | 2.9% + $0.30 |

| Gateway B | $10/month | 2.5% + $0.20 |

| Gateway C | No | 3.5% flat |

- Mobile Compatibility: With the rise of mobile shopping, ensure your chosen gateway is optimized for mobile transactions. A seamless mobile experience can significantly reduce cart abandonment rates.

- Integration Capabilities: Your payment gateway should easily integrate with WooCommerce without requiring extensive modifications. This not only saves time but also minimizes potential technical issues down the line.

- Customer Support: Reliable customer support can make a world of difference when you encounter issues. Look for gateways that offer 24/7 support, detailed documentation, and community forums where you can find solutions quickly.

- Reporting and Analytics: A good gateway will provide comprehensive reporting tools. These tools are essential for tracking sales, understanding customer behavior, and optimizing your business strategy.

Comparing Popular Payment Gateways for WooCommerce

When it comes to selecting a payment gateway for your WooCommerce store, the options can feel overwhelming. Each gateway has its own unique features, fees, and integrations that make them more suitable for different types of businesses. Below, we’ll highlight some of the most popular choices and what makes each one stand out.

PayPal is perhaps the most recognized payment solution globally. It offers a seamless integration with WooCommerce, allowing for easy setup. With PayPal, customers can pay using their PayPal balance, credit cards, or bank accounts. The key features include:

- Global reach with support for multiple currencies

- Buyer protection guarantees

- Easy refunds and transaction management

Another strong contender is Stripe. Known for its developer-friendly API, Stripe enables you to customize the payment experience significantly. This is particularly beneficial for those looking to create a branded checkout process. Highlights of Stripe include:

- Support for subscription billing and recurring payments

- Robust security features, including PCI compliance

- Ability to accept a wide variety of payment methods, such as Apple Pay and Google Pay

For those focusing on European markets, Adyen is worth considering. This payment gateway supports local payment methods and offers an all-in-one solution for various payment services. Key advantages of Adyen are:

- Unified commerce experience across online and offline sales

- Advanced fraud protection tools

- Rich data insights for sales and customer behavior

For merchants prioritizing security and low fees, Authorize.Net could be the answer. With its long-standing reputation, Authorize.Net offers reliable services with a host of features, including:

- Advanced fraud detection suite

- Recurring billing options

- Support for digital payment methods

| Payment Gateway | Transaction Fees | Key Features |

|---|---|---|

| PayPal | 2.9% + $0.30 per transaction | Global reach, easy refunds |

| Stripe | 2.9% + $0.30 per transaction | Custom branding, wide payment support |

| Adyen | Varies by region | Unified commerce, fraud protection |

| Authorize.Net | 2.9% + $0.30 per transaction | Recurring billing, fraud detection |

Ultimately, the best payment gateway for your WooCommerce store depends on your specific needs, target audience, and business model. By understanding the strengths and weaknesses of each option, you can make a well-informed decision that will enhance your customers’ shopping experience while optimizing your sales process.

How Security Measures Impact Your Choice of Payment Gateway

When it comes to choosing a payment gateway for your WooCommerce store, security should be at the forefront of your decision-making process. The right security measures not only protect your business but also instill confidence in your customers, making them more likely to complete their purchases. Here are some vital aspects to consider:

- Encryption Protocols: Look for gateways that utilize SSL (Secure Sockets Layer) and TLS (Transport Layer Security) protocols to encrypt sensitive data. This ensures that credit card and personal information are transmitted securely.

- PCI Compliance: Ensure the payment gateway is compliant with Payment Card Industry Data Security Standards (PCI DSS). This compliance indicates that the gateway has implemented stringent security measures to protect cardholder data.

- Fraud Detection Tools: Many payment gateways offer built-in fraud detection features such as address verification service (AVS) and card verification value (CVV) checks. These tools help minimize the risk of fraudulent transactions.

Moreover, it’s essential to consider the implications of the security measures on your overall customer experience. A gateway with overly complex security protocols can lead to cart abandonment, while a reputable gateway strikes a balance between security and usability. Here’s a quick table to highlight the relationship between security measures and user experience:

| Security Measure | Impact on User Experience |

|---|---|

| SSL Encryption | Enhances trust; users feel safe sharing information |

| 2-Factor Authentication | Improves security but may add steps to the checkout process |

| Fraud Alerts | Can prevent fraud, but excessive alerts may frustrate users |

Ultimately, the security measures implemented by a payment gateway can either bolster or hinder your sales. Choosing a gateway with robust security features not only protects your business from potential threats but also reassures customers that their transactions are safe. This peace of mind can be a decisive factor in their purchasing journey.

In addition, consider the reputation of the payment gateway provider. A proven track record in the industry can indicate reliability and the effectiveness of their security measures. Seeking user reviews and testimonials can provide insight into how well the payment gateway handles security issues and customer service.

Your choice of payment gateway can also influence your brand’s credibility. Customers are more likely to trust brands that prioritize security. By selecting a payment gateway known for its stringent security standards, you position your business as a trustworthy entity in a competitive marketplace.

The Role of Transaction Fees in Your Decision-Making

When choosing a payment gateway for your WooCommerce store, transaction fees can play a pivotal role in your overall decision-making process. These fees, which are typically charged per transaction, can significantly impact your profit margins. Understanding how these costs accumulate is essential for maintaining a healthy bottom line.

Here are some key aspects to consider regarding transaction fees:

- Fee Structure: Different gateways have varying fee structures – some charge a flat fee per transaction, while others take a percentage of the sale. Analyze these structures to determine which aligns best with your sales volume.

- Hidden Fees: Always read the fine print. Some gateways may advertise low transaction fees but might impose additional charges for services such as refunds, chargebacks, or international transactions.

- Volume Discounts: If you expect high sales volumes, seek gateways that offer tiered pricing. This can help lower costs as your business grows.

- Integration Costs: Consider any costs associated with integrating the payment gateway into your WooCommerce site, as these may also affect the overall financial picture.

To give you a clearer picture of how transaction fees can differ, here’s a simple comparison table featuring popular payment gateways:

| Payment Gateway | Transaction Fee | Monthly Fee |

|---|---|---|

| PayPal | 2.9% + $0.30 | $0 |

| Stripe | 2.9% + $0.30 | $0 |

| Square | 2.6% + $0.10 | $0 |

| Authorize.Net | 2.9% + $0.30 | $25 |

In addition to financial considerations, how transaction fees align with your business model is crucial. For instance, if you’re running a subscription-based service, a gateway that charges lower fees on recurring transactions can be more beneficial in the long run. Conversely, for businesses with occasional transactions, a gateway with no monthly fees might be more appropriate.

Ultimately, evaluating transaction fees alongside other features such as security, customer support, and ease of integration will empower you to make a more informed choice. Taking the time to analyze these factors can save you significant amounts over time, contributing to the sustainability and profitability of your WooCommerce store.

Integrating Your Chosen Payment Gateway with WooCommerce

Integrating a payment gateway into your WooCommerce store is a crucial step to ensuring smooth transactions and enhancing customer satisfaction. With various options available, it’s essential to choose one that aligns with your business goals. Once you’ve made your selection, the integration process can be straightforward, allowing you to focus on your sales.

To get started, first, you’ll need to install the payment gateway plugin. This can typically be done directly from your WordPress dashboard:

- Go to Plugins > Add New.

- Search for your preferred payment gateway.

- Click Install Now and then Activate.

After activating the plugin, you’ll need to configure its settings. Navigate to WooCommerce > Settings > Payments. Here, you will see a list of all available payment methods, including the one you just activated. Click on your chosen gateway to access its settings.

Key settings to consider include:

- API Credentials: Most gateways require you to input API keys or tokens, which you can obtain from the payment provider’s site.

- Transaction Settings: Decide whether to enable test mode for initial transactions or go live right away.

- Customer Notifications: Customize email notifications to keep customers informed about their transaction statuses.

Once you’ve completed the configuration, make sure to conduct a few test transactions. This step helps you identify any issues before going live, ensuring a seamless experience for your customers. Don’t forget to check the payment confirmation emails and any redirects to ensure they reflect the right information.

keep your gateway updated to benefit from improved security and new features. Regularly check the plugin’s settings and your payment provider’s dashboard to stay informed about any changes that might affect your transactions. This proactive approach not only enhances security but also builds customer trust.

| Payment Gateway | Transaction Fees | Supported Currencies |

|---|---|---|

| PayPal | 2.9% + $0.30 | Multiple |

| Stripe | 2.9% + $0.30 | Multiple |

| Square | 2.6% + $0.10 | USD |

Customer Support: Why It Matters When Choosing a Payment Gateway

When selecting a payment gateway for your WooCommerce store, customer support is a critical factor that can significantly influence your decision. Think about it: if something goes wrong during a transaction, the last thing you want is to feel stranded without assistance. A robust customer support system can be the difference between a smooth operation and a chaotic experience.

Choosing a payment gateway that offers 24/7 customer support ensures that help is available whenever you need it. Here are some key benefits of prioritizing customer support in your decision-making process:

- Quick Resolution: Issues can arise at any time, whether it’s a technical glitch or a customer inquiry. Reliable support ensures that problems are resolved quickly, minimizing downtime.

- Expert Guidance: Payment gateways often come with complex features. Having access to knowledgeable support can help you navigate these options and make the best choices for your business.

- Enhanced Customer Experience: If your customers encounter issues during checkout, responsive support can help manage their concerns, leading to higher satisfaction and retention rates.

Furthermore, evaluating the type of support available is essential. Some payment gateways offer a variety of support channels, such as:

- Email Support: Good for non-urgent issues, allowing for detailed explanations and documentation.

- Live Chat: Offers real-time assistance for immediate concerns, improving customer experience significantly.

- Phone Support: Ideal for complex issues needing in-depth discussions, ensuring clarity and understanding.

To help you visualize the importance of customer support, consider the following table that compares three popular payment gateways based on their customer support features:

| Payment Gateway | 24/7 Support | Live Chat | Phone Support |

|---|---|---|---|

| Gateway A | Yes | Yes | Yes |

| Gateway B | No | Yes | No |

| Gateway C | Yes | No | Yes |

As you can see, not all payment gateways provide the same level of support. It’s crucial to choose one that aligns with your business needs and offers comprehensive support options. With the right payment gateway, you’ll not only enhance your operational efficiency but also create a reassuring environment for your customers, fostering trust and loyalty.

Real-Life Success Stories: Businesses Thriving with the Right Payment Gateway

Many businesses are finding that the right payment gateway isn’t just a tool; it’s a game-changer. Take for instance ABC Clothing, a small online boutique that struggled with cart abandonment rates. After implementing a user-friendly payment gateway, they saw a remarkable 30% decrease in abandoned carts. Customers loved the seamless checkout experience, allowing them to complete their purchases quickly and easily.

Then there’s XYZ Electronics, a tech store that made a savvy switch to a payment gateway that offered multiple payment options, including digital wallets and cryptocurrencies. This strategic move attracted a younger, tech-savvy demographic, leading to a 50% increase in sales during the first quarter after the switch. The flexibility of payment options helped them cater to a broader audience, enhancing customer satisfaction and loyalty.

Consider the success story of Gourmet Delights, an online food delivery service. By integrating a payment gateway with robust fraud protection features, they not only safeguarded their revenue but also gained the trust of their customers. As a result, they experienced a 40% boost in returning customers who felt more secure shopping with them. Trust is a vital currency in e-commerce!

Moreover, FitLife Supplements leveraged a payment gateway that provided comprehensive analytics and reporting tools. This allowed them to track customer behavior and refine their marketing strategies accordingly. They reported a 20% increase in targeted sales campaigns, thanks to the insights gained from the payment gateway data.

| Business Name | Success Metric | Payment Gateway Used |

|---|---|---|

| ABC Clothing | 30% Decrease in Cart Abandonment | SimplePay |

| XYZ Electronics | 50% Increase in Sales | QuickWallet |

| Gourmet Delights | 40% Boost in Returning Customers | SecurePay |

| FitLife Supplements | 20% Increase in Targeted Sales | DataLite |

The examples above illustrate a clear trend: choosing the right payment gateway can significantly impact your bottom line. By focusing on user experience, security, and analytics, these businesses have not only survived but thrived in a competitive landscape. If you want your WooCommerce store to join their ranks, it’s time to evaluate your options and make the switch. Your business success story could be just around the corner!

Future-Proofing Your E-Commerce: Choosing a Gateway for Growth

When it comes to e-commerce, the right payment gateway can make all the difference in not just your revenue, but also your customer satisfaction and loyalty. A reliable gateway ensures smooth transactions, minimizes cart abandonment, and builds trust with your customers. So, what should you look for? Here are some crucial factors to consider:

- Security Features: Customers want to feel safe when making online purchases. Look for gateways that offer robust security measures, such as SSL encryption, PCI compliance, and fraud detection.

- Transaction Fees: Understand the fee structure of each gateway. Some charge flat rates, while others take a percentage of each transaction. Weigh these costs against your expected sales volume.

- Payment Options: Your gateway should support multiple payment methods, including credit/debit cards, digital wallets, and even cryptocurrency. This flexibility can enhance the shopping experience and broaden your customer base.

Another critical element is integration. Your chosen payment gateway should seamlessly integrate with WooCommerce to ensure a hassle-free setup and ongoing management. Look for solutions that offer:

- User-Friendly Setup: Choose gateways that provide easy-to-follow installation guides and excellent customer support.

- Customizable Solutions: As your business grows, you may need additional features or functionality. Opt for gateways that allow customization to meet your evolving needs.

- Reliable Performance: Downtime is not an option. Research the uptime history and performance metrics of potential gateways to ensure they can handle your traffic without hiccups.

It’s also important to consider the level of support you’ll receive. A responsive customer support team can be invaluable when issues arise. Here’s a quick comparison of popular payment gateways for WooCommerce:

| Gateway | Transaction Fees | Customer Support |

|---|---|---|

| Stripe | 2.9% + 30¢ per transaction | 24/7 online support |

| PayPal | 2.9% + 30¢ per transaction | 24/7 phone support |

| Square | 2.6% + 10¢ per transaction | Phone and email support |

Your payment gateway is not just a tool; it’s a partner in your e-commerce journey. By carefully evaluating your options through the lens of security, support, and scalability, you’ll be better equipped to choose a gateway that not only meets your current needs but also grows with you. Remember, the best payment gateway is the one that aligns with your business goals and enhances your customer experience.

Final Thoughts: Making an Informed Choice for Your WooCommerce Store

When it comes to choosing the right payment gateway for your WooCommerce store, it’s essential to evaluate your unique business needs and the preferences of your customers. With a plethora of options available, making an informed decision can significantly impact your sales, customer satisfaction, and overall store performance.

Consider the following key factors to guide your selection:

- Transaction Fees: Different gateways come with varying fee structures. Review these fees carefully to understand how they will affect your profit margins.

- Payment Methods: Ensure the gateway supports a range of payment options, such as credit cards, PayPal, and even cryptocurrency, to accommodate diverse customer preferences.

- Security Features: Look for gateways that prioritize security through features like PCI compliance and fraud detection to protect both your business and your customers.

- User Experience: A seamless checkout experience can enhance customer satisfaction and reduce cart abandonment rates. Choose a gateway with a user-friendly interface.

Another important aspect to consider is integration capabilities. Some payment gateways integrate natively with WooCommerce, while others may require additional plugins or configurations. Look for options that simplify the setup process, allowing you to focus more on growing your business rather than troubleshooting technical issues.

To help visualize the differences, here’s a quick comparison of a few popular payment gateways:

| Payment Gateway | Transaction Fees | Supported Payments | Integration Ease |

|---|---|---|---|

| PayPal | 2.9% + $0.30 | Credit Cards, PayPal | Easy |

| Stripe | 2.9% + $0.30 | Credit Cards, ACH, Wallets | Very Easy |

| Square | 2.6% + $0.10 | Credit Cards, Invoices | Moderate |

don’t underestimate the importance of customer support. Choose a gateway that offers reliable support, as issues may arise that require immediate attention. A responsive support team can make a world of difference in ensuring smooth operations.

Ultimately, your choice of payment gateway should align with your business goals and the expectations of your customers. By taking the time to compare options and reflect on the factors that matter most to you, you can make a decision that not only enhances your WooCommerce store but also fosters customer loyalty and drives growth.

Frequently Asked Questions (FAQ)

Q: What is a payment gateway?

A: Great question! A payment gateway is a technology that processes credit card payments for online and brick-and-mortar stores. It acts as a bridge between your customer’s bank and your WooCommerce store, ensuring that transactions are secure and seamless.

Q: Why do I need a payment gateway for my WooCommerce store?

A: If you want to sell online, a payment gateway is essential! It allows you to accept various payment methods—credit cards, debit cards, PayPal, and even digital wallets—making it easy for your customers to complete their purchases. Plus, a reliable payment gateway enhances your store’s credibility, which can boost customer trust and, ultimately, sales.

Q: What should I look for in a payment gateway?

A: When choosing a payment gateway for your WooCommerce store, consider factors like transaction fees, compatibility with WooCommerce, payment methods offered, and the level of security. You’ll also want to check if it supports various currencies if you plan to sell internationally. look for user-friendly features and excellent customer support.

Q: Are there any popular payment gateways for WooCommerce?

A: Absolutely! Some of the top contenders include PayPal, Stripe, Square, and Authorize.Net. Each has its unique features, so it’s worth taking the time to compare them based on your specific needs. For example, Stripe is known for its easy integration and customizable checkout experience, while PayPal is a household name that many consumers trust.

Q: Is there a payment gateway that’s best for small businesses?

A: For small businesses, I’d recommend looking into PayPal and Stripe. They both offer competitive transaction rates and easy setup without monthly fees, making them budget-friendly options. Plus, their widespread recognition can help build customer trust right off the bat!

Q: What about security? Should I be concerned?

A: Absolutely, security should be a top priority! Most reputable payment gateways, like Stripe and PayPal, offer robust security features, including PCI compliance and fraud detection tools. Make sure to choose a gateway that prioritizes customer data protection, as this not only safeguards your business but also builds trust with your customers.

Q: How do payment gateways affect my checkout process?

A: The right payment gateway can significantly enhance your checkout process. Some gateways offer seamless integration, allowing customers to complete their transactions without leaving your site, which can reduce cart abandonment rates. Look for gateways that provide a smooth, user-friendly experience to keep your customers happy!

Q: Can I use multiple payment gateways?

A: Yes, you can! Using multiple payment gateways can give your customers options, making it easier for them to pay in their preferred method. Just ensure that your WooCommerce store is set up to handle multiple gateways smoothly so that it doesn’t complicate the checkout process.

Q: What’s the final takeaway when choosing a payment gateway for WooCommerce?

A: The best payment gateway for your WooCommerce store ultimately depends on your specific business needs, customer preferences, and financial considerations. Take the time to research and compare different options, considering factors like fees, security, and ease of use. Making the right choice can lead to increased sales and a better overall customer experience. So, take the plunge and find the gateway that best suits your business!

Wrapping Up

out there, it can be overwhelming to find the perfect fit for your business needs. However, remember that the right gateway can not only streamline your checkout process but also enhance customer trust and ultimately boost your sales.

As you weigh the pros and cons of each option, think about what matters most to you and your customers—be it transaction fees, ease of integration, or the variety of payment methods offered. Investing a little time upfront to select the best payment gateway can pay off significantly in the long run.

So, take a moment to reflect on your priorities and do some research. You want a solution that aligns with your business goals while providing the best experience for your customers. Whether it’s PayPal, Stripe, or another provider, the right choice will empower your WooCommerce store to thrive.

Ready to take your online store to new heights? Let’s get to work on making that payment process seamless and secure for everyone involved. Your customers—and your bottom line—will thank you! Happy selling!